●LIVE ARTICLE UPDATES

Live

Trump to Address Congress Amid Trade Tensions

The president’s speech to Congress comes as his administration imposed 25 percent tariffs on Canada, Mexico prompting retaliatory actions from both countries.

Fallout From Zelenskyy Meeting; Europe Faces Defense Crisis | Live With Josh

Plans for a peace deal between Russia and Ukraine are now paused, and Trump said Zelenskyy can come back when he’s ready for peace.

premiere

[PREMIERING 9PM ET] Why Paraguay Can Lead the Way in Latin America: Foreign Minister Rubén Ramírez Lezcano

Paraguay’s Foreign Minister, Rubén Ramírez Lezcano, shares his thoughts about the U.S.–Latin America relationship.

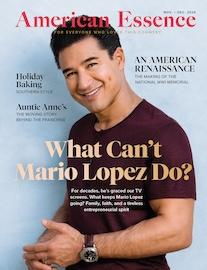

Adam Carolla’s Comedy and Conversations

The popular comedian and podcast pioneer discusses his career origins and the challenge of living in California.

‘Do Not Cry’: A Holocaust Memoir

Renee Salt tells her story of faith and survival during the time she spent in the ghettos and concentration camps of World War II.

Oscar Night’s Most Captivating Dresses

A look at the most glamorous dresses from the 2025 Academy Awards ceremony.

Most Read

Top Stories

Lutnick Says Trump Will Meet Mexico, Canada in the Middle on Tariffs

In addition to Mexico and Canada, Trump increased China tariffs to 20 percent over its role in the fentanyl crisis.

Zelenskyy Says White House Clash ‘Regrettable,’ Ready for Peace Talks

The Ukrainian president delivered his first public remarks since the Trump administration paused military aid on March 3.

Opinion: The Media’s Shen Yun Blind Spot

How critical reports miss the real story—with grave consequences.

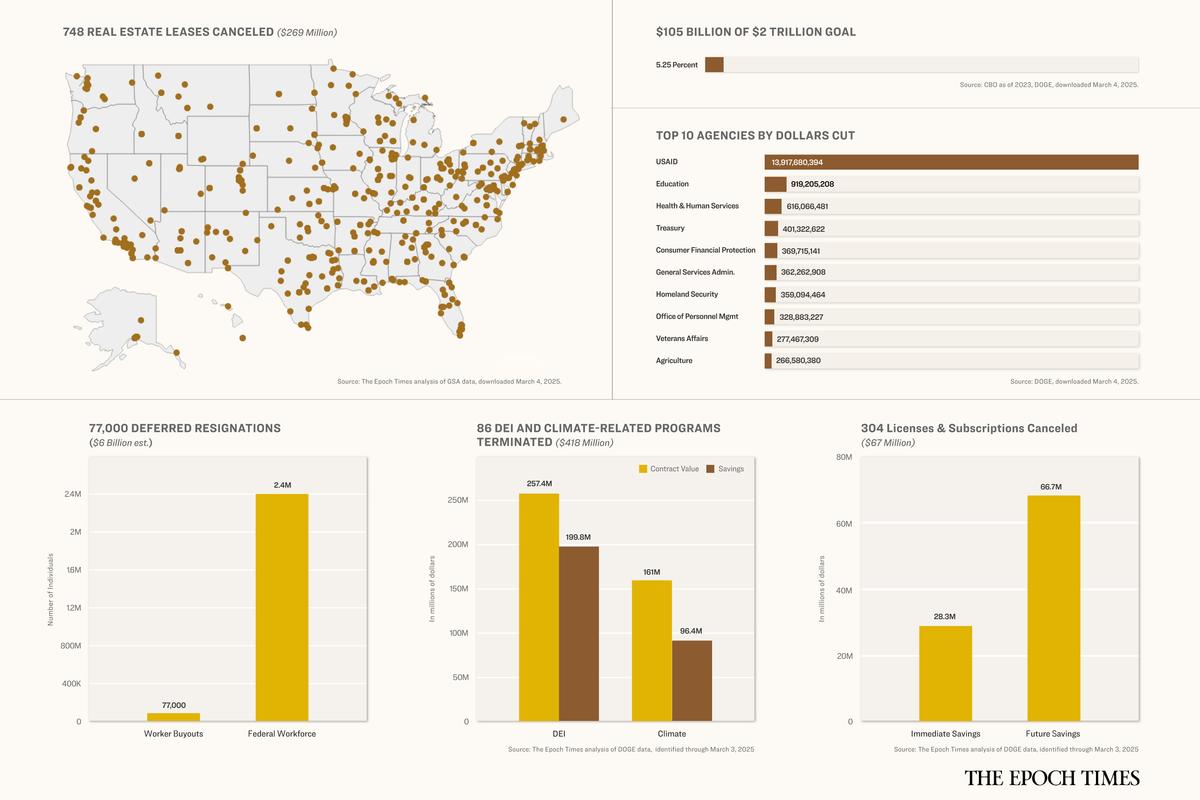

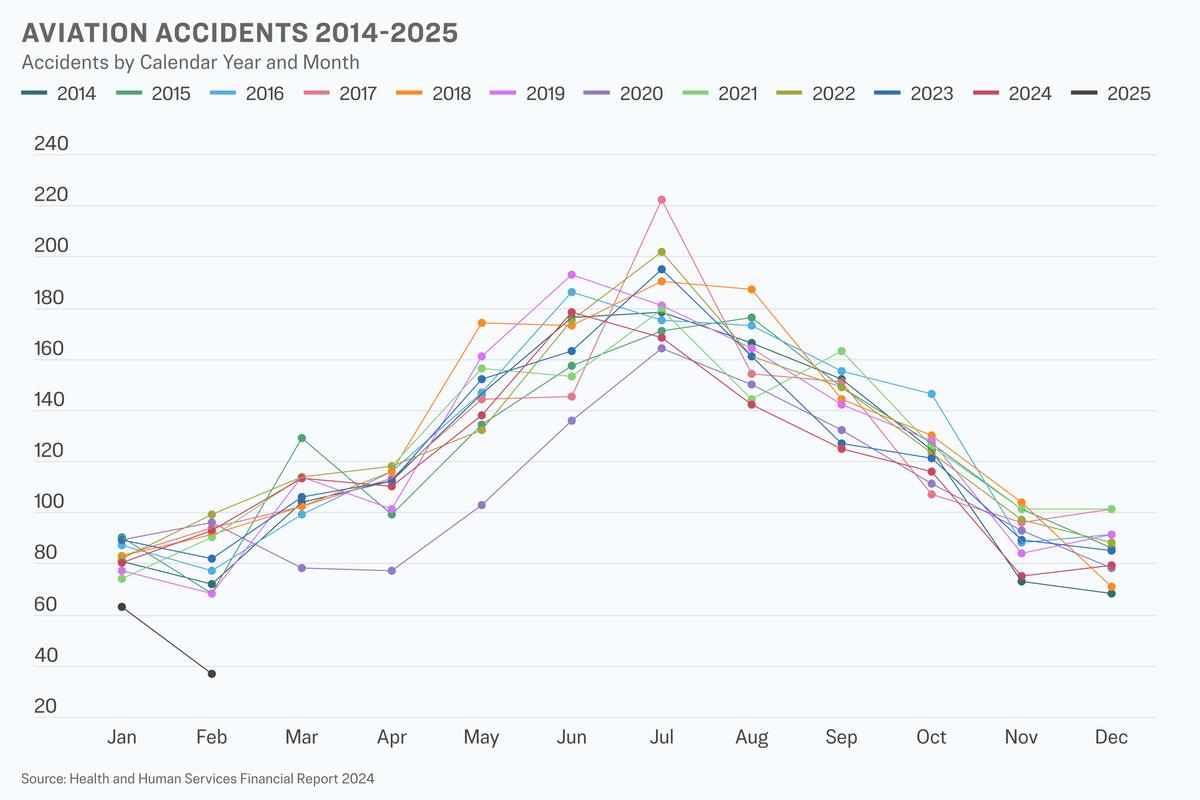

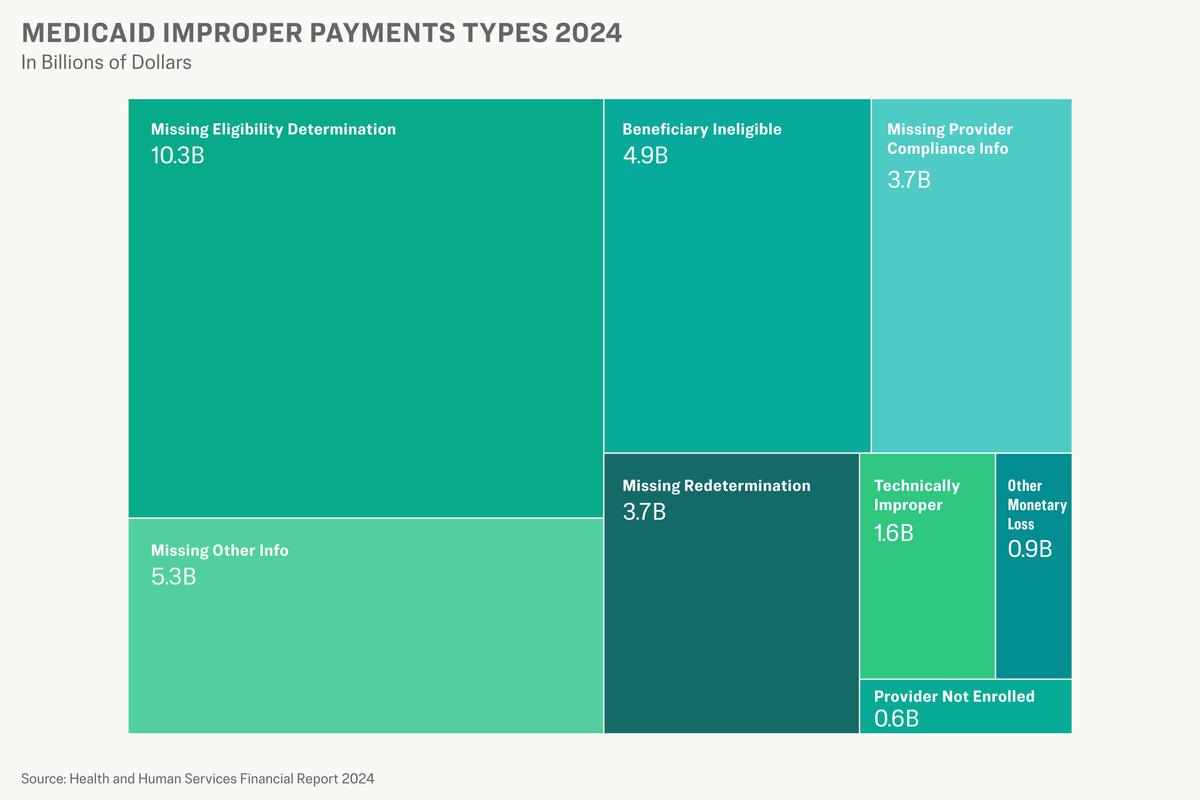

6 Charts That Explain DOGE-Related Cuts So Far

The agency has targeted $105 billion in federal spending in six weeks.

China Acknowledges ‘Sporadic’ Human Bird Flu Cases

An expert called it ‘very irresponsible’ that Beijing hasn’t provided details on the severity and location of the cases.

Exclusive

Lawmakers Reintroduce Falun Gong Protection Act to Combat CCP’s Forced Organ Harvesting

‘It’s long past time to dismantle the CCP’s state-sponsored organ harvesting industry,’ Sen. Ted Cruz (R-Texas) told The Epoch Times.

Judge Extends Block on Executive Order That Defunds Gender Change Procedures on Minors

Plaintiffs argue that the Trump administration is exceeding its authority by withholding funds already allocated by Congress.

Pentagon Announces $80 Million in Savings From First DOGE Review

Press secretary Sean Parnell said that DEI and climate change programs are ‘not a core function of our military’ and constitute ‘a distraction.’

Day in Photos: Chaos in the Serbian Parliament, Trump’s Tariffs Take Effect, and Pancake Race in London

A look into the world through the lens of photography.

4 Takeaways From Top Pentagon Nominee’s Confirmation Hearing

Elbridge Colby has called for a shift in U.S. priorities on the world stage, including taking steps to deter communist China.

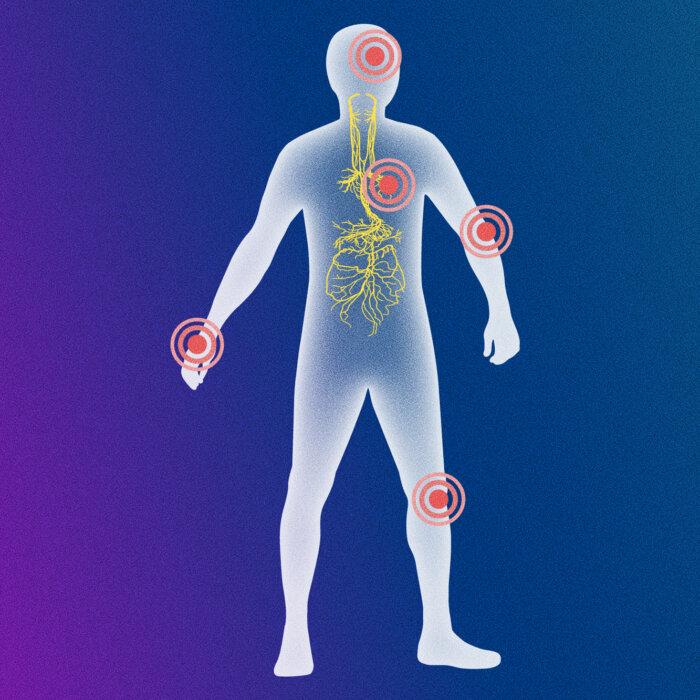

The Drug Warnings You May Never See—Until It’s Too Late

With more than 400 black box warnings, it’s hard for many physicians to keep track.

▶Shen Yun Mesmerizes Las Vegas Audience: ‘It’s Magic For The Eyes’

Shen Yun Performing Arts graced the stage at the Smith Center for the Performing Arts in Las Vegas, Nevada, on Feb. 27.

Navy Reservist Charged With Bribery to Help Chinese Nationals Obtain Unauthorized Military IDs

Two Chinese nationals allegedly paid $3,500 for two IDs, according to prosecutors.

Tracking Trump’s High Level Appointments, Senate Confirmations

The Senate is undertaking the confirmation process for the president’s new administration.

Air Force Recruitment Soars to 15-Year High, Officials Say

Defense Secretary Pete Hegseth suggested the resurgence of interest in military service is fueled by a renewed emphasis on combat readiness and discipline.

CDC Says It’s on the Ground Responding to Texas Measles Outbreak

Texas officials say 159 cases of the virus have been confirmed as of Tuesday, with one death reported.

Momentum for European Army Grows Amid Concerns Over US Disengagement

European forces have traditionally worked together, but that’s ‘completely different’ from a war fighting army, according to a defense expert.

Judge Reverses Trump’s Firing of Federal Appeals Board Chairwoman

The judge, based in Washington, ruled that the firing was unlawful.

BlackRock to Buy Panama Canal Ports from Hong Kong Firm

The timing aligns with Washington’s growing scrutiny of Chinese-controlled infrastructure along global trade routes.

Terrorism, Nuclear Threats Top US Foreign Policy Concerns: Poll

Poll shows Americans prioritize counterterrorism, nuclear nonproliferation, and energy security, while support for democracy-building abroad remains low.

‘Brothers After War’: Soldiers Adapt to Civilian Life

Alternately harrowing and hopeful, this documentary about brave soldiers and their families is a tough but much necessary watch.

Orlando Magic Receive Difficult News: Jalen Suggs Out for the Season

After successful surgery on his left knee, the Magic guard is ‘expected to make a full recovery,’ the team says.

Orlando Magic Receive Difficult News: Jalen Suggs Out for the Season

After successful surgery on his left knee, the Magic guard is ‘expected to make a full recovery,’ the team says.

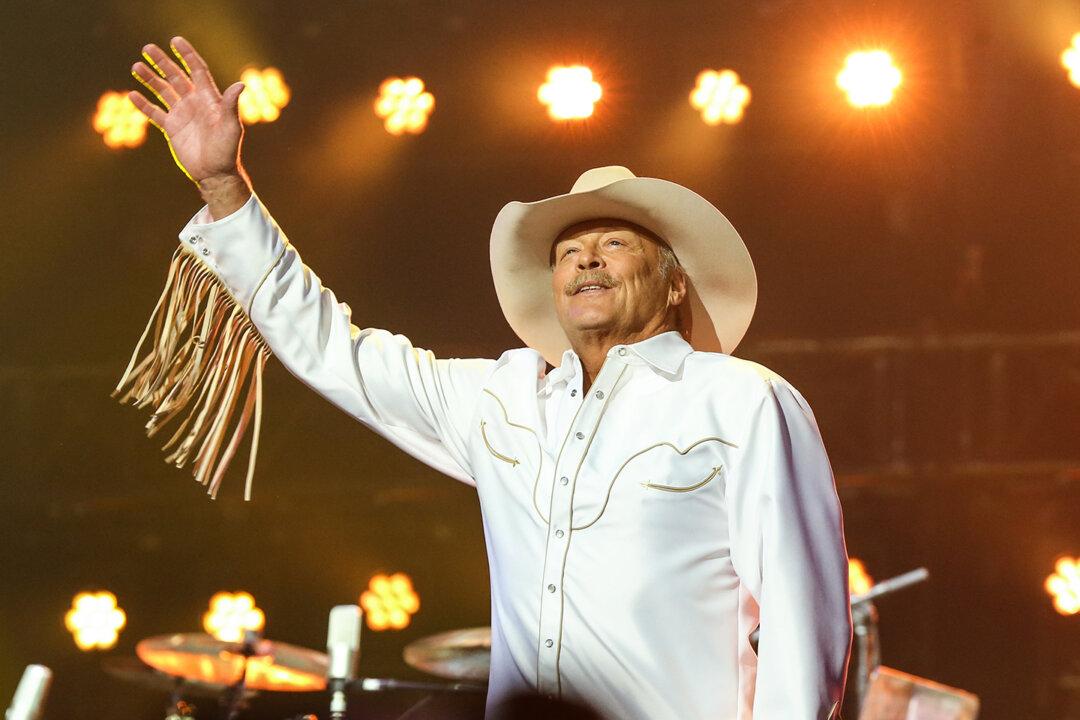

Country Star Alan Jackson Prepares to Close Out His Farewell Tour in May

The singer and songwriter, 66, is battling a degenerative nerve disease. ‘It’s getting more and more obvious and I know I’m stumbling around on stage,’ he said.

Country Star Alan Jackson Prepares to Close Out His Farewell Tour in May

The singer and songwriter, 66, is battling a degenerative nerve disease. ‘It’s getting more and more obvious and I know I’m stumbling around on stage,’ he said.

The Magic of Music: Healing, Memory, and Connection

Music has been used for millennia to heal the body, mind, and spirit. Recent research offers insights into its therapeutic potential.

The Magic of Music: Healing, Memory, and Connection

Music has been used for millennia to heal the body, mind, and spirit. Recent research offers insights into its therapeutic potential.

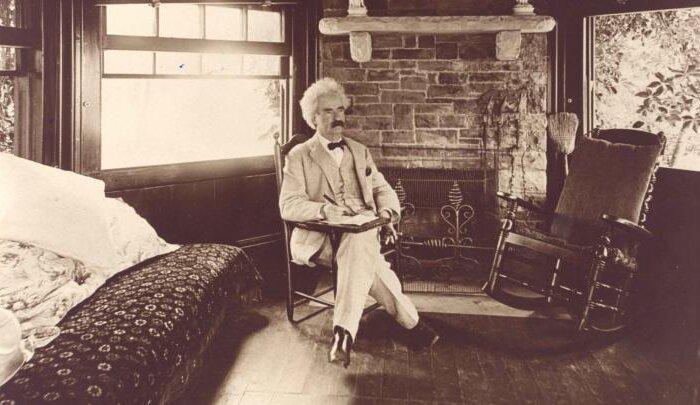

Thomas Hobbes on the Importance of History

Why did the ’most radical political philosophers’ start out as a lover of ancient works?

The Grimm Brothers’ Fairytale, ‘Cat and Mouse in Partnership’

In this fable published by the Grimm Brothers, a mouse learns a difficult lesson after trusting someone it thought was a friend.

‘Celtics City’: The NBA’s Most Successful Franchise

This nine-hour documentary series is exhaustive, thorough, and borders on overkill.

Emma Abbott: The People’s Prima Donna

The opera singer never forgot her humble beginnings and made opera accessible to average Americans.

Thomas Hobbes on the Importance of History

Why did the ’most radical political philosophers’ start out as a lover of ancient works?

The Agony and Ecstasy of Getting Out of Debt

When there is debt, use logic and grit to get through it.

Here’s Why Airline Seat Belts Are Different From Those in Your Car

While there’s an argument to be made that life would be simpler if all seat belts, whether in a car or an airplane, worked the same way, that will never happen.

Discover Elegance, History, Even a Secret or Two in Vibrant Buenos Aires

The dining and cultural experiences of Buenos Aires are both indulgent.

Times Square Is Now a Dining Destination. Here’s Why and Where to Eat

You'll never have trouble finding a great restaurant at Times Square.

Here’s Why Airline Seat Belts Are Different From Those in Your Car

While there’s an argument to be made that life would be simpler if all seat belts, whether in a car or an airplane, worked the same way, that will never happen.

Why I Love America: The Freedoms That Make America Exceptional

Reader Brian Lund reflects on why America’s guaranteed freedoms make her a country worth protecting and loving.

A Life ‘Simply Lived and Lived Simply’: Reader Pays Tribute to Immigrant Grandfather’s Legacy

James Park learns valuable lessons from the humble life his grandfather led.

Kenny Chesney and ‘The Joy Of Being Unabashedly Alive’

Revealing entertaining stories that shaped his career, the country musician’s memoir may be a new fan favorite.

Special Coverage

Special Coverage

![[LIVE Q&A 03/05 at 10:30AM ET] DOJ Recovers Epstein Files; Ukraine Ready for Peace | Live With Josh](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F03%2F04%2Fid5820071-030525_REC-600x338.jpg&w=1200&q=75)

![[PREMIERING 9PM ET] Why Paraguay Can Lead the Way in Latin America: Foreign Minister Rubén Ramírez Lezcano](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F03%2F04%2Fid5819743-ruben-600x338.jpg&w=1200&q=75)