EPA to Roll Back Raft of Climate Regulations, Including EV Rule

Administrator Lee Zeldin says EPA will reconsider 31 regulations in what he calls the most consequential day of deregulation in American history.

Tara VanDerveer: A Legendary Figure in US Basketball History

The longtime Stanford coach tells how she transformed a struggling program into a national powerhouse.

US–Canada Trade War Hits Markets; Trump Threatens Historic Retaliation | Live With Josh

A trade war is kicking off between the United States and Canada.

Aston Hall: A Jacobean Prodigy House

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we visit a uniquely English country house.

A Concise, Thorough Study of an Overlooked Post-WWI War

‘The Rif War 1921–26’ is study of an uprising in Morocco that demonstrates the causes and results of such types of conflicts.

Dionysus: The Anomalous and Necessary God

Rational order and emotions require a balancing act, as it clear when we consider the ancient Greek gods Apollo and Dionysus.

Most Read

Top Stories

Schumer Says GOP Doesn’t Have the Votes to Pass Funding Bill as Shutdown Deadline Nears

Congress has until March 14 to avert a shutdown.

Stranded Astronauts Must Wait Longer as NASA Scrubs Launch

The decision came down after ground crews worked for nearly three hours to mend hydraulic issues with one of the clamps holding the rocket in place.

Beijing’s Bombing Threats Against Shen Yun Have Diplomatic Ramifications, Experts Say

The Chinese regime’s threat campaign against Shen Yun is part of unconventional warfare against America and will escalate if left unchecked, experts said.

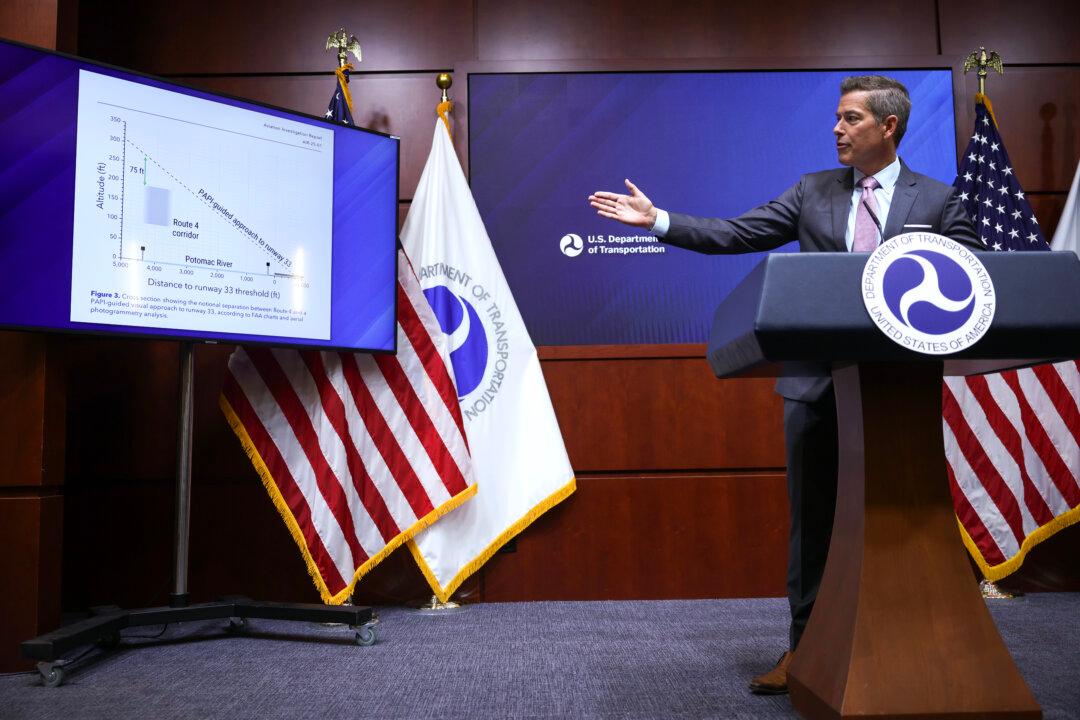

After Deadly Crashes, Long-Overdue Aviation Updates Accelerate

The Trump administration is moving to bolster air travel safety and efficiency. Experts say technology and staffing are the most crucial needs.

DOJ Charges CBP Official for Allegedly Defrauding FEMA

The woman is accused of fraud after she allegedly collected money on claims that her home was unlivable from flood damage.

Trump Says Education Secretary McMahon Made Decisions on Mass Layoffs

The Department of Education fired more than 1,300 workers.

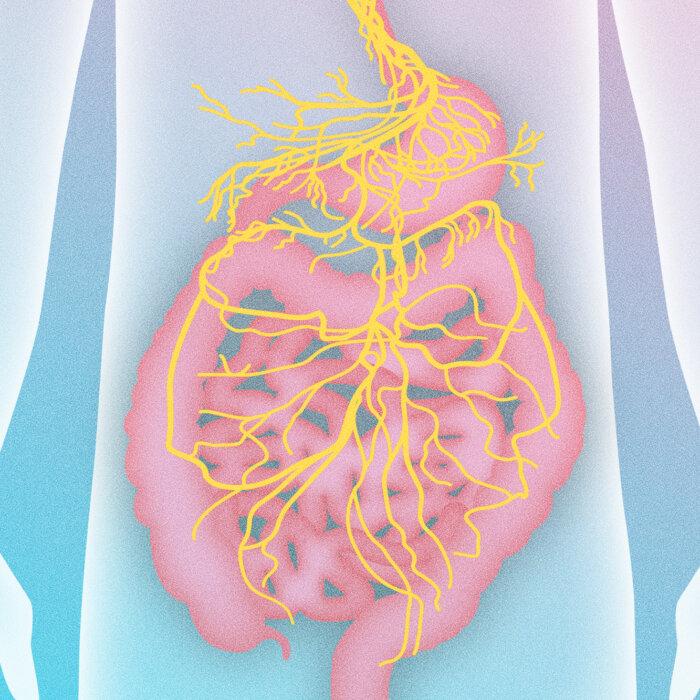

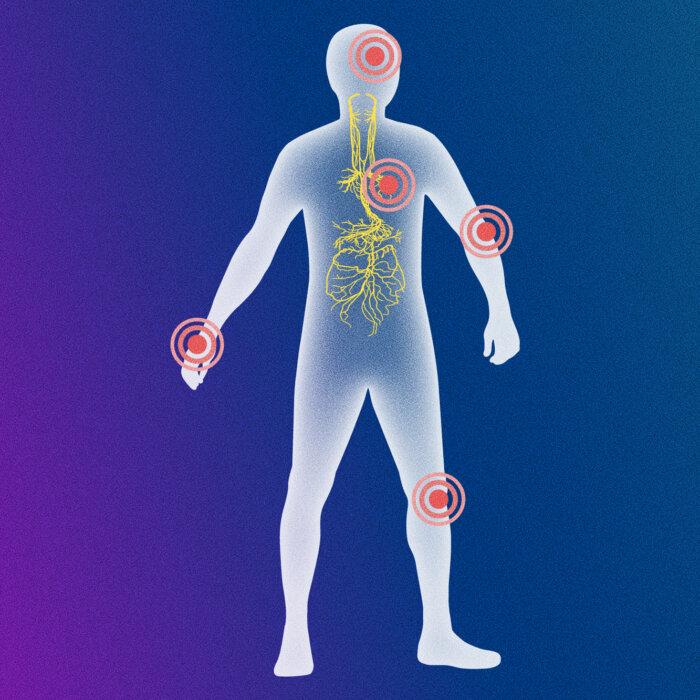

12 Ways to Activate Your Vagus Nerve–and How to Practice Them

Stimulating the vagus nerve can promote relaxation and stress reduction, paving the path to healing our bodies and minds.

EPA Administration Says $20 Billion Grants to Climate Groups Are Now Terminated

The move was announced in a post on Tuesday.

Exclusive

X Takes Down Network of Chinese Accounts Amplifying NYT Attacks on Shen Yun

An Epoch Times investigation exposed thousands of fake and malicious accounts that spread CCP propaganda, including via Western media.

Day in Photos: Protests in Argentina, Hostages on Train in Pakistan, and Сherry Blossoms in Japan

A look into the world through the lens of photography.

▶Phoenix Audience Travel to Ancient China Through ‘Fantastic’ Shen Yun

Shen Yun Performing Arts enchanted the audience at the Symphony Hall in Phoenix, Arizona, on March 8, taking them to the world of ancient China.

Detained Palestinian Activist Must Be Allowed Private Calls With Lawyers: Judge

Mahmoud Khalil is in detention in Louisiana.

Global Trade Expected to Grow Despite US Tariffs: Report

Despite U.S. trade policy shifts, global trade is forecast to grow at 3.1 percent annually over the next five years, a new DHL and NYU Stern report reveals.

Witkoff Heading to Russia This Week to Discuss Ukraine Cease-Fire Deal

Officials are optimistic a cease-fire agreement could be days away from completion.

Canadians Visiting US Face New Registration, Fingerprint Requirements for Longer Stays

The Trump administration is tightening border rules, requiring Canadians to register and provide biometric data for stays of more than 30 days.

Housing Supply Gap Reaches Nearly 4 Million in 2024: Report

Real estate developers are facing high material costs, labor shortage, credit issues, and other headwinds.

Transportation Secretary Calls for Total Overhaul of US Air Traffic Control System

‘We’re gonna start the work of building a brand-new air traffic control system that will be the envy of the world,’ Duffy said.

USDA Freezes Funding for University of Maine Pending Civil Rights Review

USDA says it is weighing whether to take further steps to address the school’s potential violations of Title IX.

Tracking Trump’s High Level Appointments, Senate Confirmations

The Senate is undertaking the confirmation process for the president’s new administration.

‘The World Will Tremble’: The Horror of Concentration Camps

Two prisoners at the Chelmno death camp risk everything to expose the extermination of Jews during WWII.

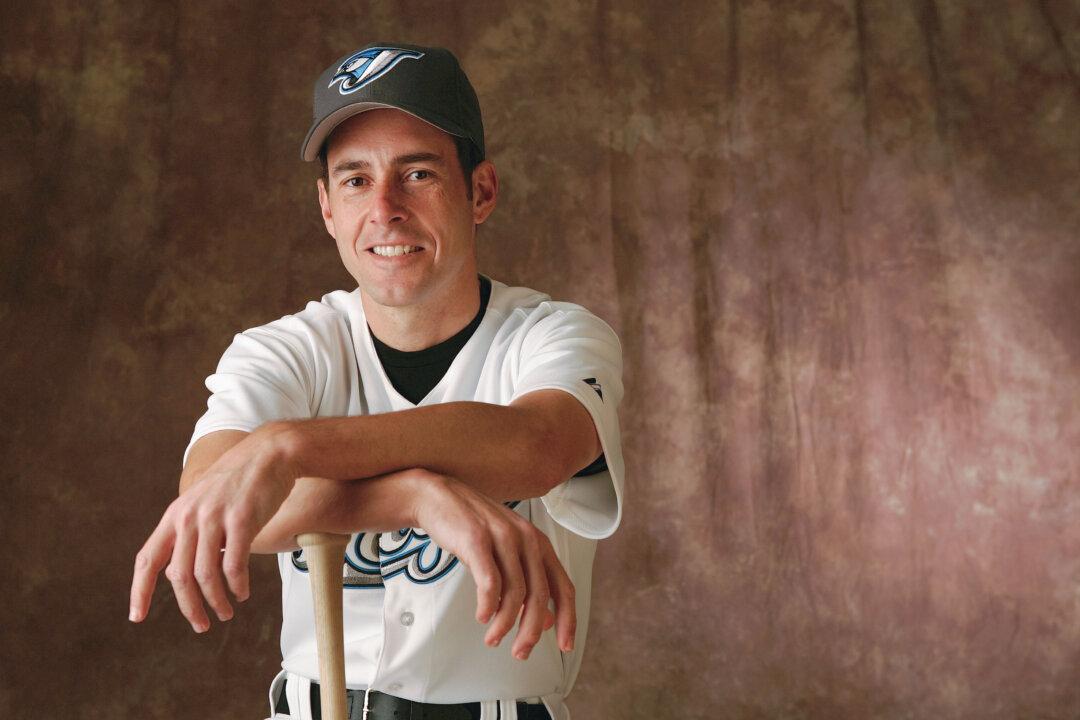

Verducci’s ‘Love of the Game’ Has MLB Network Insider in Demand

From writing for Sports Illustrated, to reporting for FOX Sports and MLB Network, Tom Verducci’s baseball insights are in constant demand.

Verducci’s ‘Love of the Game’ Has MLB Network Insider in Demand

From writing for Sports Illustrated, to reporting for FOX Sports and MLB Network, Tom Verducci’s baseball insights are in constant demand.

Billy Joel Postpones Tour Dates After Undergoing Surgery: ‘My Health Must Come First’

The 75-year-old singer-songwriter was diagnosed with an undisclosed medical condition.

Billy Joel Postpones Tour Dates After Undergoing Surgery: ‘My Health Must Come First’

The 75-year-old singer-songwriter was diagnosed with an undisclosed medical condition.

Microplastics in the Environment May Fuel Antibiotic Resistance

Among the plastics tested, polystyrene promoted the highest level of antibiotic resistance.

Microplastics in the Environment May Fuel Antibiotic Resistance

Among the plastics tested, polystyrene promoted the highest level of antibiotic resistance.

‘The Knitted Collar’: Virtue in Sickness and in Health

Mary Anne Hoare’s short story of a little girl who makes a tough choice inspires us all to do the same.

‘Until Forever’: Endless Devotion in the Wake of Loss

Based on a true story, a young man faces his terminal illness that affects everyone around him.

‘Black Bag’: Cool, Quietly Hilarious 4-star Spy-Thriller

With its suits, eyewear, and interior design giving off a 1960s’ retro vibe, Soderbergh has crafted an exceptionally taut-yet-funny, stylish spook thriller.

Ureli Corelli Hill: Founder of the New York Philharmonic

In this installment of ‘Profiles in History,’ we meet a brilliant violinist whose European trip resulted in founding America’s greatest symphony orchestra.

‘The Knitted Collar’: Virtue in Sickness and in Health

Mary Anne Hoare’s short story of a little girl who makes a tough choice inspires us all to do the same.

This ‘Perfect’ French Toast Casserole Is the Best Thing to Make This Weekend

The best part of this French toast casserole is that it’s as versatile as you need it to be.

California ‘Hidden Gem’ Is No. 1 Beach in the US, New Report Says. Here’s Where to Find It

Situated in a sheltered cove on California’s Central Coast, Avila Beach is a gem of a destination.

How to Plan a Spring Break Trip Without Breaking the Bank

Being proactive and flexible with your destination can lead you to find both affordable and adventurous options.

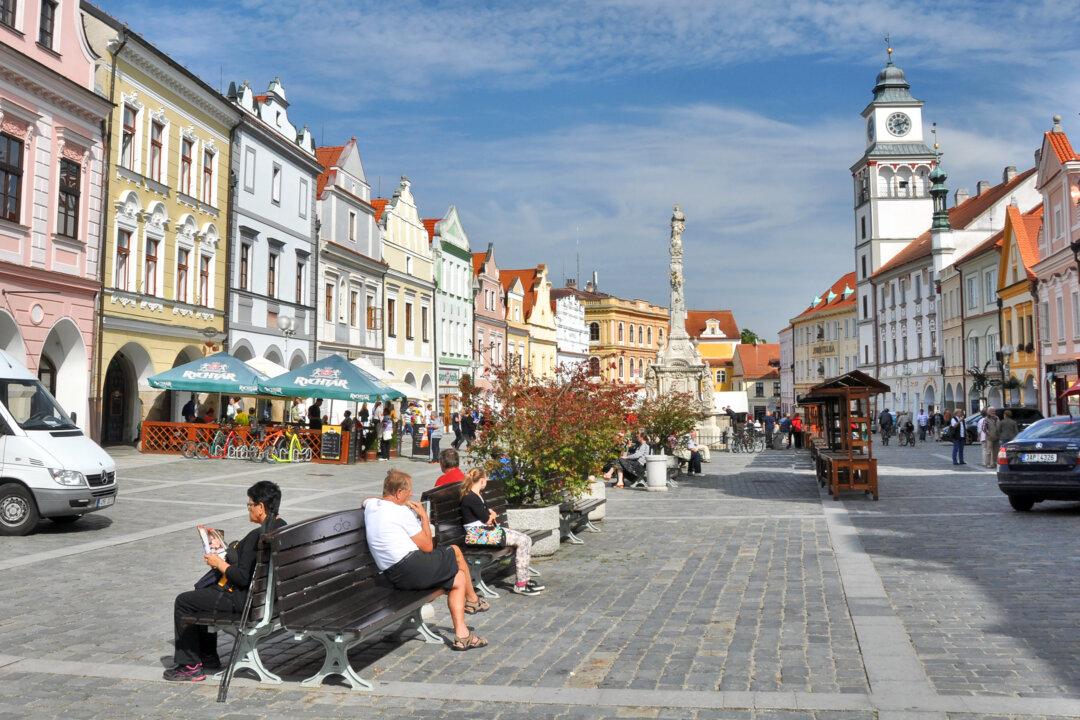

Rick Steves’ Europe: Třeboň and Třebíč, Two Gems of the Czech Countryside

History is alive in these two Czech countryside towns.

California ‘Hidden Gem’ Is No. 1 Beach in the US, New Report Says. Here’s Where to Find It

Situated in a sheltered cove on California’s Central Coast, Avila Beach is a gem of a destination.

How to Master the Art of First Impressions, According to an Etiquette Expert

5 tips for making a great first impression, according to etiquette expert Bethany Friske.

6 Best Getaways for a Digital Detox

Whether you’re seeking tranquility or adventure, here are six beautiful destinations for a digital detox.

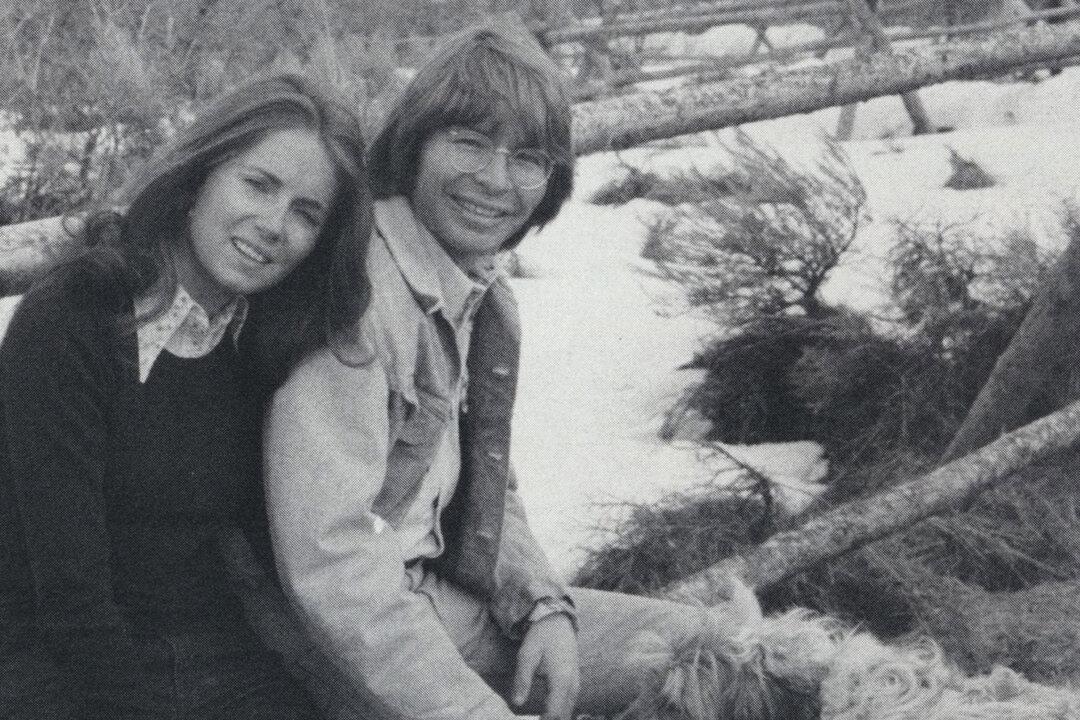

Love and Nature: ‘Annie’s Song’

John Denver’s loving ode to his wife is the epitome of his songwriting mastery.

Special Coverage

Special Coverage

![[LIVE Q&A 03/13 at 10:30AM ET] Attacks on Tesla Labeled as Domestic Terrorism | Live With Josh](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F03%2F12%2Fid5824513-031325_REC-600x338.jpg&w=1200&q=75)