What do an at-home water testing kit company, a luxury watchmaker, and an online farmland real estate investment platform have in common?

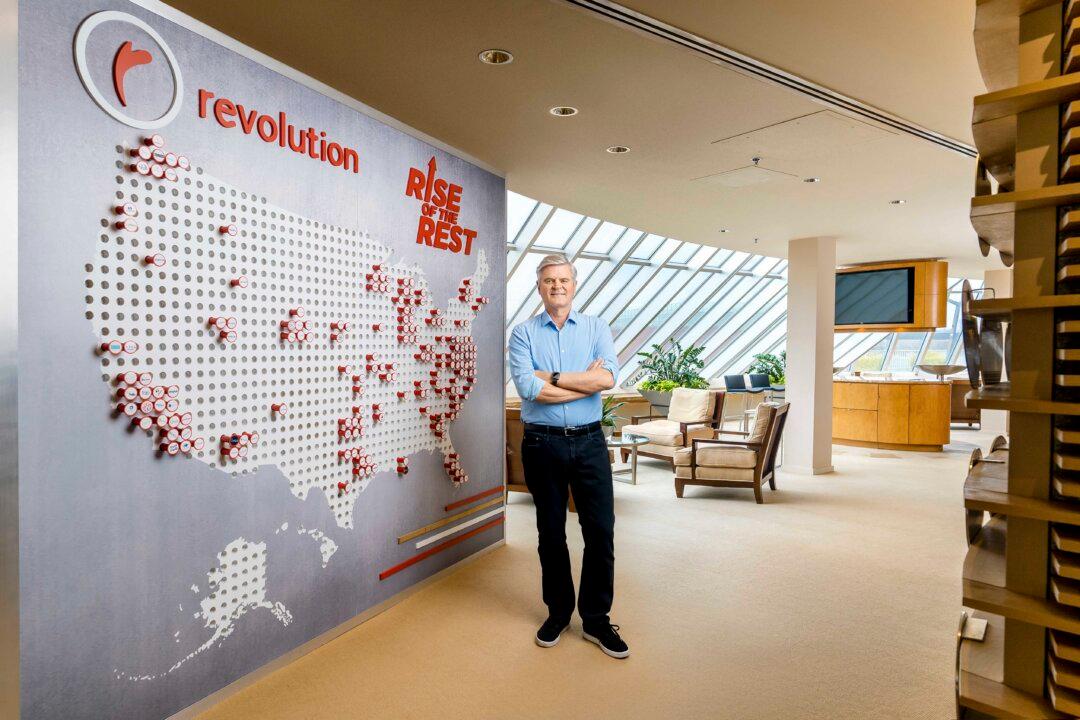

First, they were started in America’s heartland—Zionsville, Indiana; Detroit, Michigan; and Fayetteville, Arkansas, respectively—far from the usual, bicoastal venture capital hubs. Second, their initial potential was spotted and funded by AOL co-founder Steve Case and his team of investors, as part of his Rise of the Rest Seed Fund’s efforts to find and invest in the most innovative startups outside of Silicon Valley. The watchmaker, Shinola, is one of the more familiar names, but hundreds of start-ups have flourished so far under Case’s initiative.