The “One Belt, One Road” initiative is China’s signature project for building international clout as it seeks to establish global trade routes and set up investments that benefit its interests.

Across Southeast Asia and some South Pacific islands, China-financed OBOR infrastructure projects have recently come under scrutiny for burdening countries with enormous debts.

And so, China has set its sights on Europe. But as some European countries and the European Union grow increasingly wary of Chinese acquisitions in critical industries such as tech and auto manufacturing, China is pushing for economic ties with countries with a smaller footprint, such as Portugal and Spain.

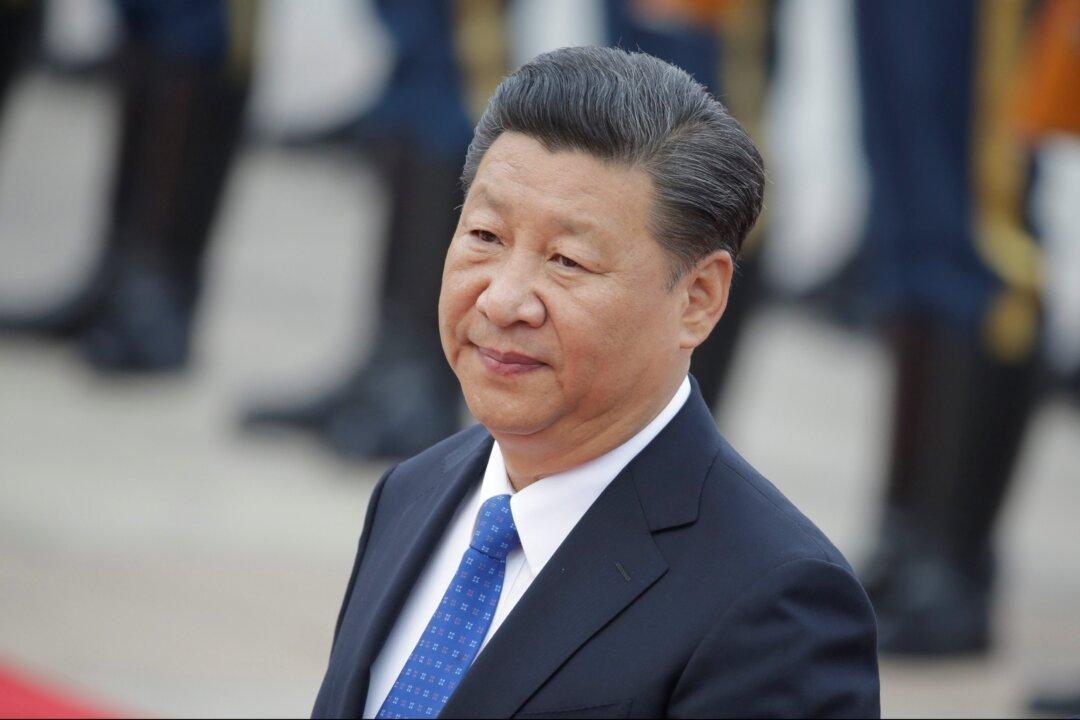

Chinese leader Xi Jinping will visit Spain on Nov. 27 to 29, and Portugal on Dec. 4 to 5, according to Chinese state-run media Xinhua.

In Spain, China will sign joint agreements aimed at exploring third-party markets, while in Portugal, China will “boost cooperation” in a variety of sectors such as science and tech, water conservancy, energy, infrastructure, and finance, Xinhua reported Nov. 24.

Observers anticipate that China will aggressively push for the two countries to sign onto OBOR. China’s investments are not only part of an agenda to target and gain access to sensitive technology developed by these countries’ private sectors, but also to use economic deals to win political support.

Portugal

In Portugal, China has made great strides. Amid a financial crisis in 2008, Portugal was desperate for foreign capital, and China swooped in. Direct foreign investment from China grew from zero before 2010, to 5.7 billion euros ($6.45 billion) in 2016, according to a December 2017 report by the European think tank Network on China, a consortium of research institutes in different European countries.

Today, Chinese firms own 25 percent of Portugal’s national grid, 27 percent of its largest listed bank, and all of its largest insurer and private hospitals operator, according to Reuters.

A number of major deals related to renewable energy technology, including Chinese state-owned hydropower giant China Three Gorges Corporation’s (CTG) acquisition of Energias de Portugal (EDP) in 2011, “granted CTG access to state-of-the-art knowledge and expertise in the field,” the report said.

CTG’s purchase of one of Portugal’s largest energy operators enabled the former to expand into global markets in Africa, South America, and the United States. For example, through the partnership with EDP, CTG acquired eight hydropower stations in Brazil, making it the second-largest private energy producer in Brazil.