Tariffs on China Reach 145 Percent After Latest Increase, White House Clarifies

A White House official confirmed that the new tariff rate on Chinese products now totals 145 percent, not 125 percent as the president suggested earlier.

premiere

[PREMIERING 9PM ET] Inside China’s Stranglehold on the Global Medicine Supply Chain: Rosemary Gibson

Rosemary Gibson is a national authority on health care policy and patient safety, and the author of ‘China Rx’.

John Adams’s Integrity and the Boston Massacre

In this new installment of ‘When Character Counted,’ attorney John Adams risked the loss of his reputation and livelihood in his passion for justice.

250 Years Ago, Part 4: The Salem Gunpowder Raid and Leslie’s Retreat

On the road to the Revolutionary War, defiant Patriots give the British a prelude of battles to come.

The Importance of Myth and Why We Should Understand It

Myth is not the opposite of truth; it’s a way of getting at deeper truths.

Most Read

Top Stories

Breaking

Supreme Court Upholds Order to Return Man Mistakenly Deported to El Salvador Prison

The high court ruled that the man should be given due process of law upon return.

Six Dead After Helicopter Crashes Into Hudson River Near Manhattan

Videos posted to social media showed the helicopter mostly submerged while appearing upside down in the water.

House Passes Budget Plan to Advance Trump’s Agenda

The House approved a revised blueprint to unlock a bill for Trump’s tax cut, border, and energy measures.

Tariffs: The Big Picture

An overview of how tariffs work, their benefits and the challenges they present.

How Chinese Imports Are Leveraged in Cyberattacks

Chinese-made devices have been repeatedly exploited as part of a Beijing-backed effort to undermine and destabilize the United States.

US May Use Law Firms Striking Deals With Trump to Work on Trade Negotiations

The president said ‘a lot of countries’ want to make deals ’that are proper for the United States’ and the firms can help negotiate those trade agreements.

European Union in Talks to End Tariffs on Chinese Electric Vehicles

The moves come as the Trump administration increases tariffs across the world with a growing focus on China.

House Democrats Warn Elon Musk Must Leave Government Role After 130 Days

The Democrats say that Musk cannot stay in his special government employee role after May 30.

New Data Reveal Significant Increase in Oil and Gas Reserves Discovered in Gulf of America: Interior Department

The department will no longer require an environmental impact statement for approximately 3,244 oil and gas leases in seven Western states.

Day in Photos: Forest Fire in Scotland, Dust Storm in Iraq, and High-Security Prison

A look into the world through the lens of photography.

Swiss Drugmaker Novartis to Invest $23 Billion to Expand US Manufacturing, Operations

The company plans to build or expand 10 facilities and bring 100 percent of its key medicines’ production inside the United States over five years.

▶Shen Yun’s Performance Is ‘Incredible,’ Says Representative of New York State Senator

On April 4 and April 5, Shen Yun Performing Arts was met with a full house again at the David H. Koch Theater at Lincoln Center in New York City.

Tracking Trump’s High Level Appointments, Senate Confirmations

The Senate is undertaking the confirmation process for the president’s new administration.

Consumer Spending Holds Firm Amid Tariff Pressures, Bank of America Finds

Spending stayed resilient last month as American consumers—especially wealthier households—continued to buy.

RFK Jr. Says US Is Launching Massive Effort to Pinpoint Cause of Spiking Autism Rates

‘By September, we will know what has caused the autism epidemic, and we’ll be able to eliminate those exposures,' the health secretary said.

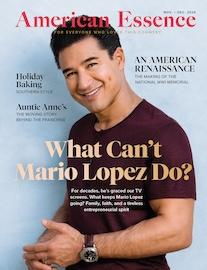

OpenAI Countersues Musk Over Alleged Harassment

Musk had sued OpenAI alleging anti-competitive conduct and violation of its charitable mission.

Retail Egg Prices Continued to Rise in March, Data Show

Prices reached a record high of $6.23 per dozen in March, according to the government’s inflation data.

Senate Confirms Paul Atkins as New SEC Chair

A longtime adviser to crypto currency firms, Atkins is expected to take a friendly approach to crypto regulation.

Erdogan Meets Pro-Kurdish Politicians in Bid to End Decades of Violence

The Turkish president met two parliamentary deputies from the Ankara Parliament supportive of the ethnic group at his presidential palace in Ankara.

USPS Seeks to Raise Stamp Price to 78 Cents to Achieve Financial Stability

A proposed 5-cent increase would mark a 56 percent rise in stamp prices since 2019, as USPS continues its push for long-term financial stability.

A Difficult Pardon: A Tortured POW and the Choice to Forgive

Tortured WWII veteran Eric Lomax spent much of his adult life imagining ways to kill his captors; he never dreamed forgiveness would be in the cards.

Special Coverage

Special Coverage

![[PREMIERING 9PM ET] Inside China’s Stranglehold on the Global Medicine Supply Chain: Rosemary Gibson](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F04%2F10%2Fid5839860-250410-ATL_Rosemary-Gibson_HD_TN_Final-600x338.jpg&w=1200&q=75)

![[LIVE Q&A 04/11 at 10:30AM ET] Inflation Goes Down Amid Trade War; Trump Fires Back at CCP | Live With Josh](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F04%2F10%2Fid5840055-041125_REC-600x338.jpg&w=1200&q=75)