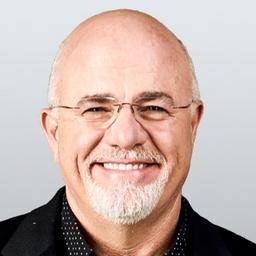

Dear Dave,

I’m single, and I make $35,000 a year. Next year, my salary and bonuses should be around $50,000. I have a little over $30,000 in debt right now, including student loans, and I’m not sure how I’ll be able to keep up with bills and everything else right now if I have to save $1,000 for a starter emergency fund like you recommend. Can I get by with a starter emergency fund of $500?