All over the world, there are people just like us who have a different income one month to the next. The self employed, sales people, people who have on target earnings, people working on zero hours contracts, and month to month, there are good times and bad times. So, how do we budget for that?

You may have set up your own business, you may have had to take any job, even if it’s insecure, just because that’s all there was at the time.

I’ll give you the scenario first.

Each month, we do our work and we invoice for that. We get the money in the next month.

We earn money in January, we get that money into our accounts in February and we have to live off that money, and save what we can in March.

Also, we only get paid when we work so if we are sick or take time off, then we have no income. We do get sick and we do take time off so we have to build that in.

Anyone running a business where you invoice, get paid later, then work out what’s yours after taxes and social charges will understand that.

There’s plenty of advice out there such as living on an average. However, on a lean month, we’re way below average so we can’t spend what we don’t have.

Here’s how cope.

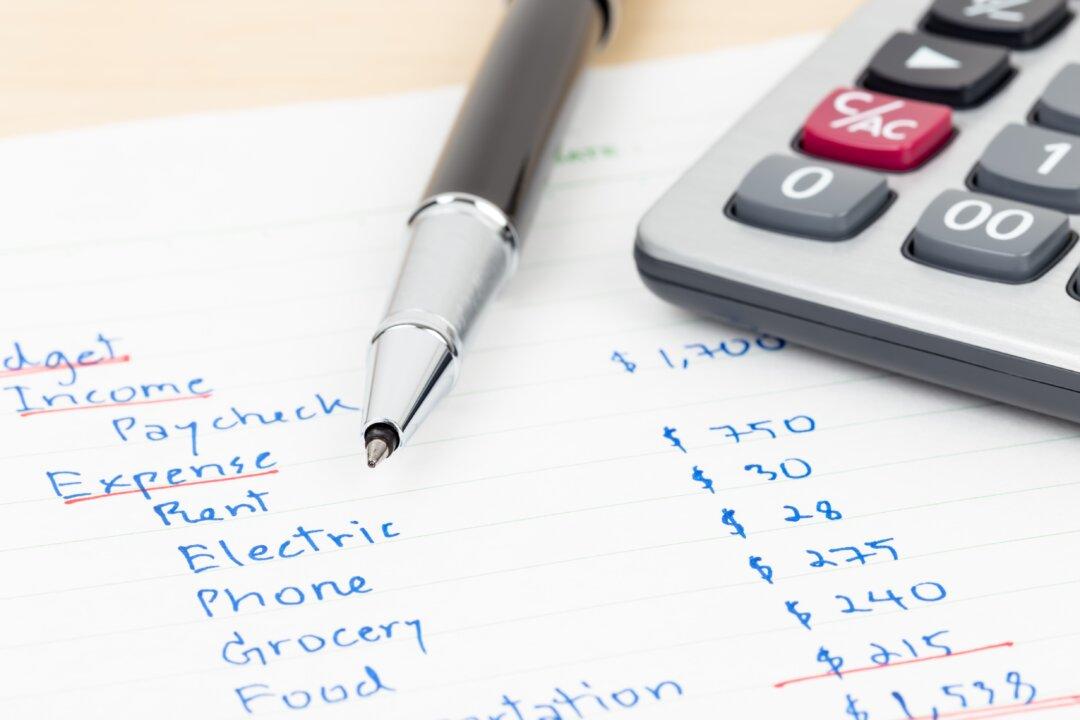

Know your barebones budget

Every month, there’s a bare bones budget and we know, if that’s all we have, that we can at least live.

Our bare bones budget are our absolute essentials: food, fuel for the car, utilities, insurances, water, gas, the minimum amount we have to save each month and that’s the basis of our budget. Some months, that’s all there is and we make it work.