Everyone needs a budget.

There, I’ve said it. Normally, I don’t give advice just suggestions but this is real actual sensible advice. Everyone needs a budget and a budget must be written down.

A budget isn’t about deprivation, it’s you giving yourself permission to spend.

You decide what you do with your money every month.

There are plenty of people with tiny incomes who save and put money aside for when they need it and plenty of people who earn a lot of money and spend it all so have no savings. It’s up to all of us to decide which one they want to be.

We made big financial mistakes in the past and spent everything we earned and then borrowed for projects such as buying a car or house renovations. It took a written budget to get us out of debt and a written budget to get us where we are today. We didn’t always do this and thought we could just spend what we had each month as our bills were paid. It didn’t have any long term planning built in and it got us into financial difficulties. Now, we’re debt and mortgage free I can see that we lived in a very haphazard way in the past.

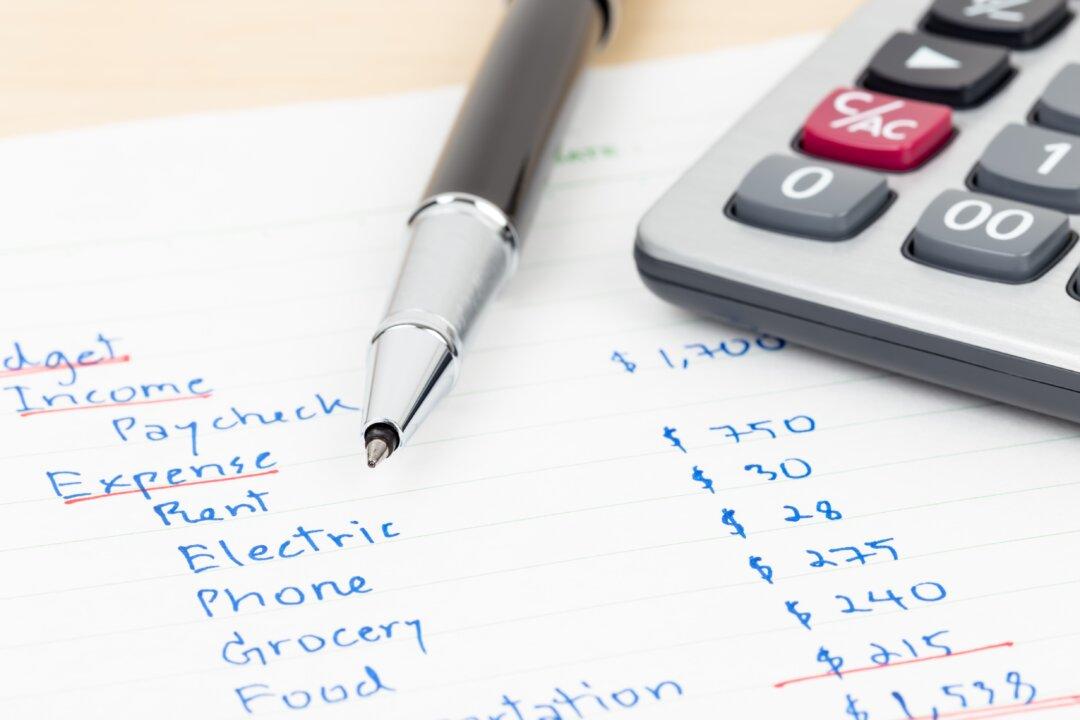

This blog post isn’t about saving money or shaving off pennies or pounds to save money but just simply how to write a budget and what it should look like.

A budget isn’t fixed either and you won’t get it right straight away. It will take about three months to get right as there will be things you will leave off or forget. There might be things that you don’t think of now as it’s winter or wouldn’t think of because it’s summer.

A budget gets written and readjusted every month. You will need to keep every receipt you get an account for every penny you spend. My budget folder has places to store those receipts and you know exactly how much you are spending and on how much.

Now we live off one less than average wage and have no choice but to budget and save for everything that we need. Previously, we used spreadsheets for budgeting but this year we’ve gone back to a paper budget. It doesn’t matter if you use an app, a note pad, a snazzy budget book or a spreadsheet, what matters is that it’s written down and followed.

Where Do You Start?

If you want to live below your means, you need to know what your means are. We have one income so that’s simple. You might have two or more and a pension, such as an armed forces pension or an occupational pension that you took early. All this is income. The figure you need is the after tax and deductions income. The final figure each month. If you have a variable income, like I do as I am paid by the hour and months are different in lengths, then you have to base your budget on your worst month or lowest pay amount for the year. The average doesn’t work as on your lowest month, your budget won’t work so always work on the lowest amount.

So, you have figure number 1: the money coming in.

That’s the easiest part, the next is tricky and might take a while as you have to know where all your money is going. You will need to log on to your online banking and look at every direct debit and know what it is, every transaction and know where it went. It’s best to go through three months statements to see the patterns of what you spend and where you spend it.

Your categories will look something like this or a bit different depending which country you live in, as we’re in France, health insurance is something we have and ours includes dental and optical. Ours doesn’t have debt or mortgage categories but yours might so I have included them and you need to know exactly how much you’re paying for that.

Mortgage/rent - we have none but I had to include that category.

Food - what ever you think you’re spending, it’s usually more. Go through your statements over three months to see exactly what you’re spending.

Council tax/ taxe fonciere/ d’habitation/ ordures menageres (the last is the annual charge we pay for refuse collection and recycling) We lump all of that together as we pay annually but still have to budget monthly for this and put the money in an account.

Debt repayment - we have none but it you have debts, this must come first.

If you are debt free, the top of your priorities after paying for the roof over your head and eating is savings. Again, I don’t normally advise but today.

Savings funds payments. We have three and pay into.

Big purchase sinking fund - The time to start saving for a new car is when you’ve just bought one, this savings fund could be for anything big and could be called a long term savings fund.

Overlooked sinking fund - This is for everything that people seem to not budget for: clothes, haircuts, This fund is for things that we might need, in this is birthdays and Christmas and any holidays we might want to take. All this needs saving for and people seem to overlook this and suddenly wonder where the money is.

Unexpected sinking fund - This is a bigger saving amount and for us that’s incase anything breaks down, needs replacing or the dogs need medical treatment, it’s for car repairs,annual care service, tyres. It says unexpected but hings will break down, things will need repairing and things well need replacing and we all need to budget for that.

Health insurance - you won’t need this if you’re in the UK, but in France we have to have top up insurance so we are fully covered. We have what we need to be legally covered and no more so we have full hospital cover.

Dental insurance - this is all in with our health insurance but you might want an amount to pay each month for this.

Water - we pay two bills a year and know what we’ve paid year on year. We divide that amount by 12 and set it aside each month.

Gas - we have no gas here.

Electricity

Service plans - these include boiler insurance and annual boiler servicing. We paid this in the UK, we have no boiler now.

Logs - our house is only heated with wood. We buy it once a year but budget all year and put money aside.

Phone/TV/Internet - here that’s an all in one package with one payment. We only have the minimum service. What ever you pay, you need to have it in your budget and that could be three separate figures each month.

Mobile phones - we have sim only payments each month and buy our phones outright but you need the figure for each mobile phone each month. We make sure we don’t use data so we don’t go over our budget plans.

Car insurance

Home insurance

Life Insurance

Car fuel

Bank Charges - we have several accounts and they are not free in France.

Children

I’ve included this below as people need to factor in the over all costs for children and spread the payments monthly. If you have children, you’ve got to have a sinking fund for that. There’s no surprises, they will grow, need new shoes, clothes, school uniforms, school trips and you need to put money aside every month. None of these are unexpected as they all will happen. You know how much you spend on the children for their Christmas or birthday presents so you divide that by 12 and set aside that amount each month. You need to work out your monthly costs for all of these and add them together.

Childcare

School fees

Children school meals

Children bus passes

Children clothes/ school uniforms

Children clubs and subscriptions

Christmas and birthdays for the children

Holiday childcare for the children

School trips for the children

Clothes - we don’t have a monthly budget for this as we buy new clothes every other year or even longer. You might want to allocate an amount for this each month.

Hair and Beauty - we don’t have a monthly amount for this as we don’t have regular hair cuts but just when we want them. This might be an essential for some people and needs a monthly figure. Go through your statements, how much did you spend on brows, nails, tanning, waxing, hair colouring over the last three months or over the year is even better. Divide that by 12 and that’s the monthly amount you need to set aside.

Pet care - this might be pet insurance, costs of dog grooming or pet sitting or kennels if and when you go on holiday or go to work. You need an annual amount and divide that by 12 then of course set that amount aside each month.

Entertainment - you need to set a regular amount for this. It might include the cinema once a month/week, or bowling or the amount you spend on day trips.

Eating out - you need to set an agreed amount. This includes any takeaways you might want to buy.

Media subscriptions - so any film streaming services, anything like Netflix, you need to have it all written down. You might include Amazon Prime in this if you use it for films too.

Not necessary spending - you might have enough money or want to set aside money each month, that’s maybe like pocket money. This might be what you buy coffee with or just have to spend on what ever you want. You need an agreed amount that you allow yourself to spend. My category for this says ‘charity shop’ as we like to go to one of the charity shops once a month.

This lists isn’t exhaustive and mine might have left off a lot of things that you have instead. We work on a ZERO BALANCE budget so every centime we have is accounted for, has a job, a purpose and somewhere to go. So, everything we buy or spend is done so mindfully.

This removes any on the spot or spontaneous decisions as we’ve planned where all our money goes.

The worst situation is if these figures do not balance and if they don’t then you have to go through your list and stop spending on the things that you don’t need first. I’ll address how to have a savings budget and not simply a spendings budget at sometime in the future.

But for now, for your well being, your stability, your family and your future, get your budget written down and know how much money you have and where it’s going.

It’s simple sum, MONEY COMING IN MINUS BUDGETED MONEY GOING OUT, INCLUDING TO SAVINGS, EQUALS ZERO.

It’s your budget.

This article was originally published by Frugal Queen in France.