White House Says Deportation Flights Didn’t Defy Judge’s Order

White House press secretary Karoline Leavitt says the court’s order lacked legal basis and was issued after the flights left U.S. territory.

Peter St Onge: Will Trump and DOGE Succeed in Gutting the Regulatory State?

In this episode, we dive into President Donald Trump’s multi-pronged strategy to revitalize America’s economy.

How to Cope with Survivor’s Guilt: Eric Lionheart on Supporting Veterans

Many of the brave men and women who return from war often experience PTSD and other challenges like survivor’s guilt.

Three Great Irish Poems to Celebrate St. Patrick’s Day

Make merry on St. Patrick’s Day this year with these three poems written by accomplished Irish poets.

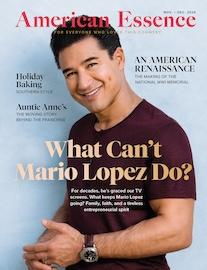

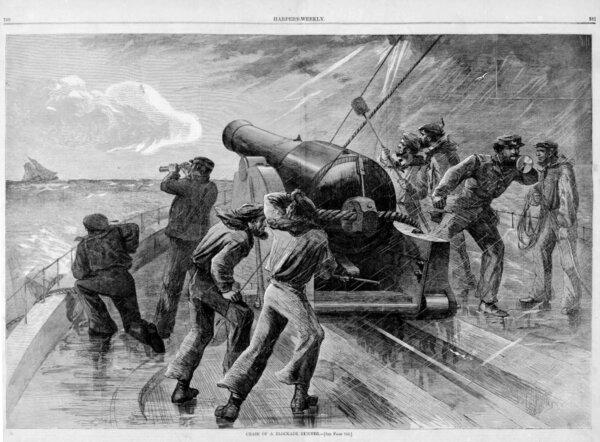

How a Teen Archeologist Discovered a Sunken Confederate Warship

In ‘This Week in History,’ the most powerful Confederate cruiser was sunk off the coast of Charleston and discovered exactly 102 years later.

New and Upcoming Releases for Children’s Spring Reading

Books on human connections, animal stories, historical facts, and faith will surely put a spring in your children’s steps.

Most Read

Top Stories

Massive Storm Leaves at Least 39 Dead as US Hit by Tornadoes, Wildfires, Blinding Dust

Tornadoes claimed at least a dozen lives in Missouri, decimating homes and businesses in hard-hit Wayne County.

Why the Egg Industry Is Pushing for a Bird Flu Vaccine

The U.S. Department of Agriculture is putting $100 million toward researching a vaccine that could help stop the massive cullings due to avian influenza.

Day in Photos: Tren de Aragua Deported, Astronauts Exchange, and a Wife-Carrying Race

A look into the world through the lens of photography.

7-Mile Border Wall Expansion Begins in Arizona

Arizona shares an approximately 370-mile border with Mexico.

Sen. Lankford Sees New ‘Wild Card’ Role as Chance to Speed Up Senate

A former minister who prefers a private life, the soft-spoken Oklahoman now serves as a spokesman and vice chairman for the Senate Republican Conference.

▶Peter St Onge: Will Trump and DOGE Succeed in Gutting the Regulatory State?

In this episode, we dive into President Donald Trump’s multi-pronged strategy to revitalize America’s economy.

Epoch Times Honored for Work Exposing Chinese Regime’s Human Rights Abuses

Reports on how the Chinese Communist Party takes organs from people imprisoned for spiritual beliefs win annual award for secular media coverage of religion.

US Strikes on Iran-Backed Houthis in Yemen Killed Multiple Leaders: Waltz

The Houthis say the strikes led to 31 deaths; the United States has not yet released death toll estimates.

New Study Finds Payment Security Affects Travel Purchase Decisions

Organized fraud rings target the travel industry due to its high transaction values and international nature, according to an Outpayce study.

Dismantling of Education Department Is Underway, Drawing Legal Challenges

The Trump administration is on track for sweeping changes to public education within the first 100 days of its second term, but legal challenges await.

Tracking Trump’s High Level Appointments, Senate Confirmations

The Senate is undertaking the confirmation process for the president’s new administration.

Doctors, Detransitioners Allege Medical Malpractice in Treating Gender Dysphoria

Gender transition procedures did not solve underlying psychological problems that were ignored, detransitioners say during a Capitol Hill forum.

FDA Issues Warning on Laughing Gas After Increase in Adverse Events

The FDA warned that usage of such products can lead to possible serious side effects, including death.

▶Pamploma Audience Captivated by Beauty of Ancient China in Shen Yun

On March 9, audience members in Pamplona, Spain, welcomed Shen Yun Performing Arts with a heartfelt applause.

DOJ Files Emergency Motion After Judge Blocks Trump From Invoking Alien Enemies Act

U.S. Attorney General Pam Bondi and other Justice Department officials say that a federal judge exceeded his authority with his decision.

Used Vehicle Sales Jump 16 Percent in February: Report

The supply of lower-priced used cars has become tighter, affecting people looking for affordable options.

Trump’s Choice to Lead Hostage Negotiations Withdraws Nomination

Adam Boehler will continue to work as a special government employee in the administration.

More Than 250 Tren de Aragua Gang Members Deported to El Salvador Prison: Rubio

The United States has designated the Venezuelan Tren de Aragua gang as a terrorist organization.

NASA’s Starliner Astronauts Welcome New Crew to Space Station

‘It was a wonderful day. Great to see our friends arrive,’ Williams told Mission Control.

ICE Arrests 214 Criminal Illegal Immigrants in Virginia

Apprehended individuals include those with a murder conviction and ‘indecent liberties with a minor’ convictions.

Nightclub Fire in North Macedonia Leaves 59 Dead, 155 Injured

In videos displaying the chaos, musicians pleaded with spectators to flee as quickly as possible while people ran through the smoke.

The Milky Way and Its Myths: Sacred Stars and Starry Nights

These myths illustrate the paramount importance of the night sky.

Special Coverage

Special Coverage

![[LIVE Q&A 03/17 at 10:30AM ET] Trump Declares Gangs as Alien Enemies; Federal Judge Blocks Move | Live With Josh](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F03%2F17%2Fid5826644-031725_REC-600x338.jpg&w=1200&q=75)