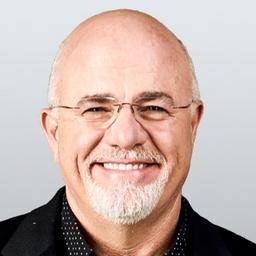

Dear Dave,

My husband recently opened his own commercial painting company. We know he will have three months or so every year when he’s making very little, if any, income. We also started following your plan recently, too, and have $1,000 set aside for our starter emergency fund. We were ready to begin paying off all our debt except our home in Baby Step 2, but now he wants to skip that, and move to Baby Step 3 to build a fully funded emergency fund of three to six months of expenses. I think I know why he feels this way, but would you give me your thoughts?