Most people know that as they approach age 65, they need to learn about Medicare. Enrollment is the seven-month period that begins three months prior to the month of your 65th birthday, and coverage starts on that birthday.

A person drawing Social Security is automatically enrolled in Parts A and B (you could decline B), but only that spouse who is drawing Social Security. The premium is automatically deducted from Social Security. Failure to enroll is a very costly mistake, increasing rates lifelong. Its cost is a function of your income, and the rates and system itself is almost sure to be overhauled in the next four years.

One can—must—learn details at www.Medicare.gov. But here are the basics: Part A covers hospital costs.

Part A is free if you paid taxes for the prior ten years, but if not, you can buy in and late enrollment has a lifelong penalty of ten extra percentage points per year of delay.

Part B covers professional services and supplies. You might have post-retirement benefits for what Part B covers, or privately purchased insurance. That creates a serious potential for a money trap: If you fail to enroll for Part B, your premium when you eventually enroll increases ten percentage points for every year of delay; big dollars and this is lifelong!

Veterans easily assume, incorrectly, that they will automatically transition from VA health benefits to Medicare, but this is not so and they often suffer the Part B surcharge.

Part C is called “Advantage” and can be viewed as an HMO or as an insurer that negotiates fee-for-service arrangements to try to bring the efficiency of private enterprise to Medicare. Part C includes A and B and more; it may be all you need, even covering drugs. But do evaluate this with an agent, because low- and zero-premium versions have high deductibles and you may need a supplement. You can enroll in Advantage, an ongoing experiment that appears to be helping slow the rise of provider prices, without proof of insurability if you enroll during open enrollment or a qualifying event such as a significant change in your health coverage. If you don’t get Advantage, you will need Part D and a Medigap policy of your choice.

Part D is drug coverage and, like Part B, is optional. There’s a lifelong penalty, one percentage point per month for procrastinating enrollment in Part D.

A person in poor health or expecting some treatment should use open enrollment for Medigap and Medicare to buy the coverage that minimizes out-of-pocket costs.

My comment, for what it is worth, is that the only way to rein in expenses is to create a huge database that consumers can access, with incentive rewards for the consumer finding savings in the market for equivalent treatments and products. This would be difficult for consumers to judge, so such a new system would create companies that have talent to make these comparisons accurately and efficiently; this would stop the current phenomenon of consumers getting whatever a provider prescribes without knowing whether the price and quality are competitive. I offer this opinion in this book in order to spread the idea. Perhaps some version of my suggestion will help both retirees and the nation as a whole. Medicare may be inefficient, but the biggest problem is the lack of transparency in the costs of medical care itself.

Don’t miss the enrollment period! Note that not all providers accept Medicare reimbursements because Medicare typically falls behind actual costs; the system continues to spring leaks. Many people will fail to budget for the cost of a supplement (aka Medigap), assuming incorrectly that Medicare covers all medical services they will need, and that what is not covered will cost them approximately what their old employer plan had as an out-of-pocket expense. Dangerous assumption. You must budget for Medicare and for a Medigap policy. There are, depending upon system changes in any given year, a dozen nearly standardized Medigap plans that pay enough to make that incorrect assumption become closer to truth.

For planning purposes, use different rates of inflation for different types of expenses. Studies are constantly updated, but planning software now typically includes researched inflation rates. Note that Medicare premiums and supplemental coverage premiums will likely inflate faster than other consumer items.

As for long-term care, whether in-home, in a community setting, or institutionalized, add one percentage point to general medical cost inflation if the software incorrectly lumps it into medical expenses.

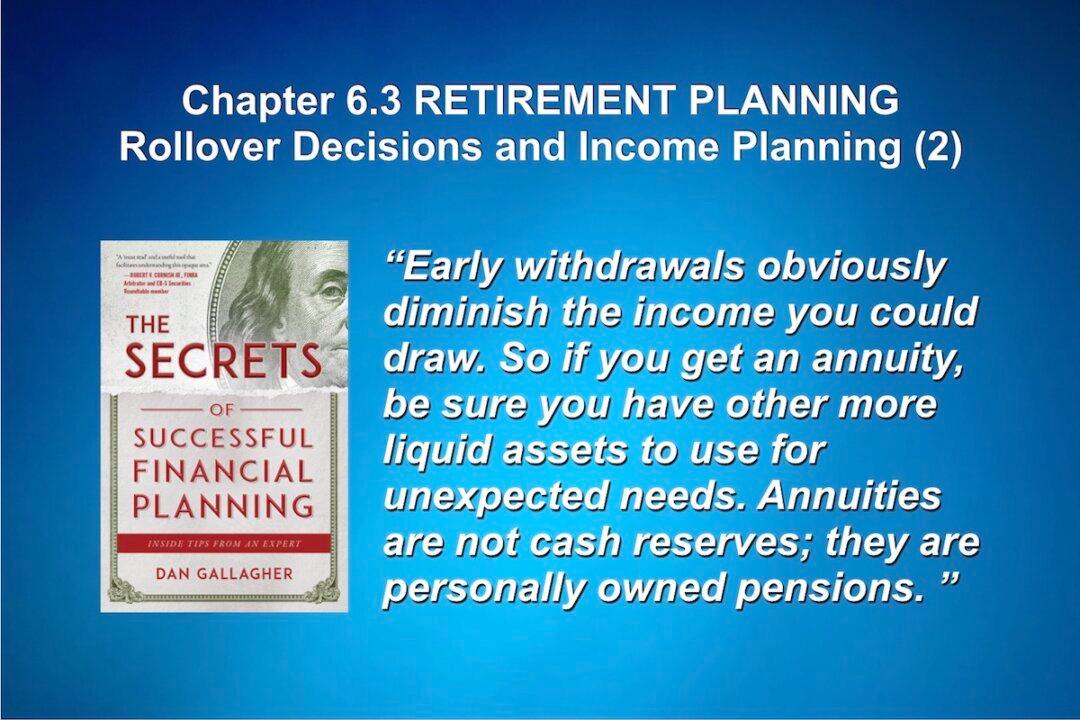

This excerpt is taken from “The Secrets of Successful Financial Planning: Inside Tips From an Expert,” by Dan Gallagher. To read other articles of this book, click here. To buy this book, click here.

The Epoch Times Copyright © 2023 The views and opinions expressed are those of the authors. They are meant for general informational purposes only and should not be construed or interpreted as a recommendation or solicitation. The Epoch Times does not provide investment, tax, legal, financial planning, estate planning, or any other personal finance advice. The Epoch Times holds no liability for the accuracy or timeliness of the information provided.