Judge Blocks Trump’s Efforts to Deport Gang Members Under 1798 Alien Enemies Act

The ACLU and Democracy Forward filed a lawsuit challenging Trump’s invocation of the Alien Enemies Act to speed along deportations of Venezuelan nationals.

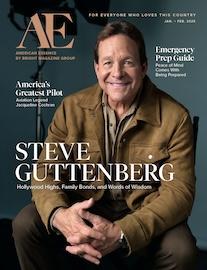

Peter St Onge: Will Trump and DOGE Succeed in Gutting the Regulatory State?

In this episode, we dive into President Donald Trump’s multi-pronged strategy to revitalize America’s economy.

How to Cope with Survivor’s Guilt: Eric Lionheart on Supporting Veterans

Many of the brave men and women who return from war often experience PTSD and other challenges like survivor’s guilt.

New and Upcoming Releases for Children’s Spring Reading

Books on human connections, animal stories, historical facts, and faith will surely put a spring in your children’s steps.

The Triumphant Trompe L’oeil ‘The Goldfinch’

The small painting became a worldwide sensation after a Pulitzer Prize winning book used its title.

Ioloni Palace, Hawaii: America’s Only Royal Residence

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we visit the only example of American Florentine architecture.

Most Read

Top Stories

At Least 32 Dead as Extreme Weather Sweeps Across Several States

The hazardous weather is predicted to continue moving east through the weekend into March 17, according to the National Weather Service.

Trump Orders Military Strikes on Houthi Terrorists

The strikes occurred on the same day U.S.-led joint forces killed a deputy leader of ISIS, Abdallah Maki Mosleh al-Rifai.

▶Peter St Onge: Will Trump and DOGE Succeed in Gutting the Regulatory State?

In this episode, we dive into President Donald Trump’s multi-pronged strategy to revitalize America’s economy.

Epoch Times Honored for Work Exposing Chinese Regime’s Human Rights Abuses

Reports on how the Chinese Communist Party takes organs from people imprisoned for spiritual beliefs win annual award for secular media coverage of religion.

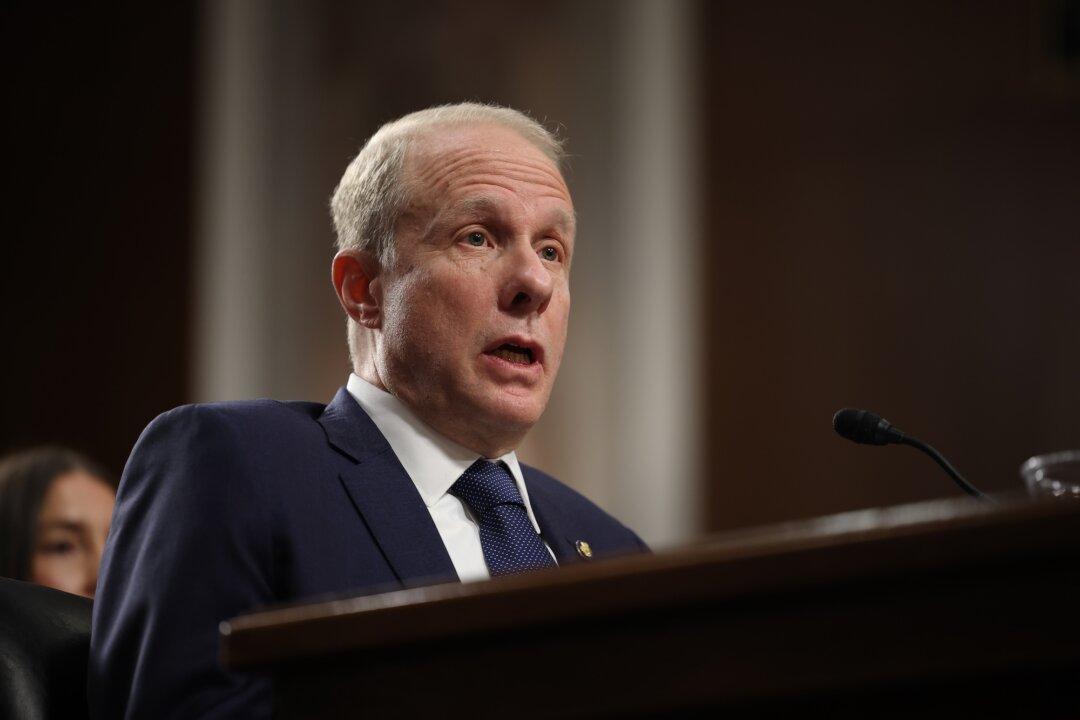

Sen. Lankford Sees New ‘Wild Card’ Role as Chance to Speed Up Senate

A former minister who prefers a private life, the soft-spoken Oklahoman now serves as a spokesman and vice chairman for the Senate Republican Conference.

Review of Greenhouse Gas Rule May Assure Coal Survival, but Not Revival

Revising emission regulations could sustain declining industry, but expansion unlikely in ’the golden age of natural gas.’

EU Temporarily Bans Huawei Lobbyists Amid Corruption Probe

The ban followed arrests during a police investigation into alleged bribery that is said to have benefited Huawei.

DOGE Says 239 ‘Wasteful’ Government Contracts Canceled, Saving $400 Million

The Elon Musk-led advisory body gives update on the federal government’s cost-cutting progress.

Tracking Trump’s High Level Appointments, Senate Confirmations

The Senate is undertaking the confirmation process for the president’s new administration.

US Foreclosure Filings Jump 5 Percent in February

Delaware had the highest foreclosure rate in the country, followed by Illinois and Nevada.

House Lawmakers Propose Bills to Counter Beijing’s Transnational Repression in the US

The measures would dedicate personnel, training, and resources to monitor transnational repression from authoritarian regimes and protect target groups.

▶Dance Instructor Touched by the ‘Power’ and ‘Delicacy' of Shen Yun

Shen Yun Performing Arts took audiences in Pamplona, Spain, on a journey through ancient China on March 8.

Day in Photos: Protests in Serbia, Missouri Tornado Aftermath, and Counting Monkeys in Sri Lanka

A look into the world through the lens of photography.

US Stocks End Another Volatile Week, Cyclical Stocks and Big Tech Hit Hardest

Both the S&P 500 and Nasdaq officially fell into correction territory amid tariff and recession fears.

US to Pay El Salvador $6 Million to Imprison 300 Illegal Immigrant Gang Members for a Year

Trump also signed a proclamation invoking an 18th-century law called the Alien Enemies Act to further target the Tren de Aragua gang.

Senate Confirms Stephen Feinberg as Deputy Defense Secretary

Feinberg has suggested opening defense manufacturing opportunities like Ford and General Motors to boost the overall defense industrial base.

Residents Left Devastated as High Winds Fuel More Than 130 Wildfires Across Oklahoma

The National Weather Service has issued a fire weather watch through Tuesday. A dangerous storm system fanned 130 fires in 44 Oklahoma counties.

Colorado Man Arrested in Connection With Vandalism of Tesla Dealership

Another suspect connected to the attack on the same dealership is facing federal prosecution.

Trump Revokes 19 Biden-Era Executive Actions in 2nd Round of Roll Backs

The president on his first day of office rescinded nearly 80 executive orders and memoranda issued by President Joe Biden.

Judge Blocks Deportation of 5 Venezuelans With Suspected Ties to Tren de Aragua Gang

A court has granted an emergency order blocking the potential deportation of Venezuelan detainees under the wartime Alien Enemies Act.

Trump Signs Order to Dismantle 8 Federal Agencies, Including VOA Parent Entity

VOA nominee Kari Lake told staff on Saturday to check their emails ‘immediately.’

How a Teen Archeologist Discovered a Sunken Confederate Warship

In ‘This Week in History,’ the most powerful Confederate cruiser was sunk off the coast of Charleston and discovered exactly 102 years later.

Special Coverage

Special Coverage