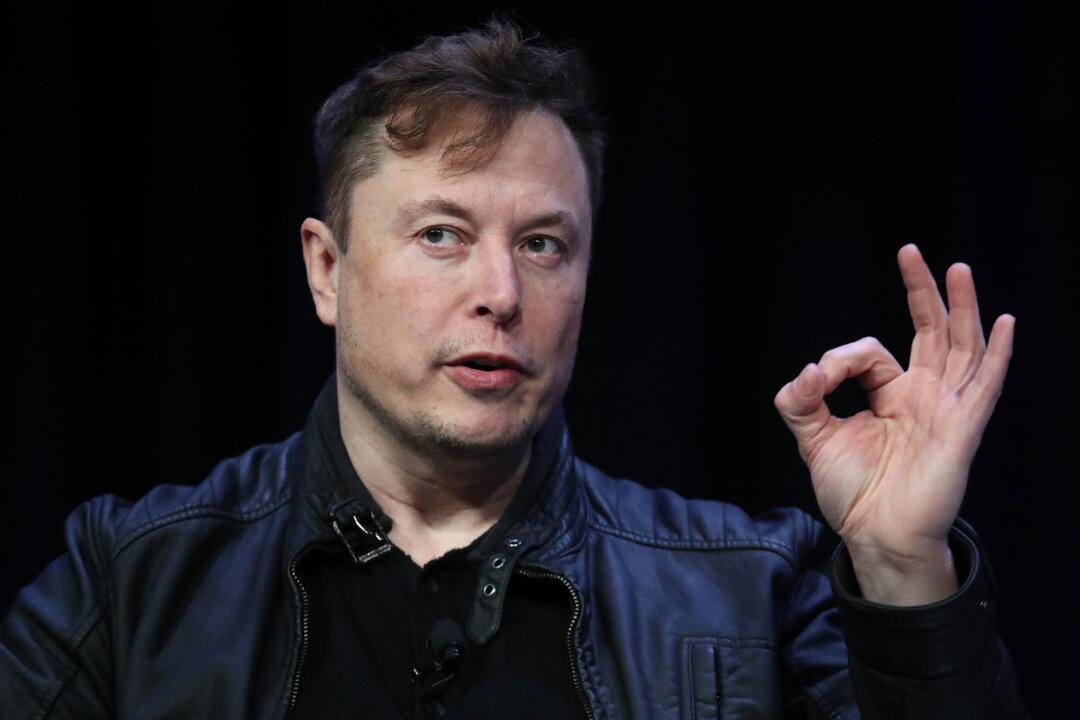

Elon Musk disclosed in a filing on April 21 that he has received commitments for $46.5 million in debt financing to buy Twitter, Inc.. The announcement came a week after he launched his hostile takeover bid, and the social media platform reacted with the adoption of a poison pill.

In a week’s time, how did Musk manage to rally the bankers around him?