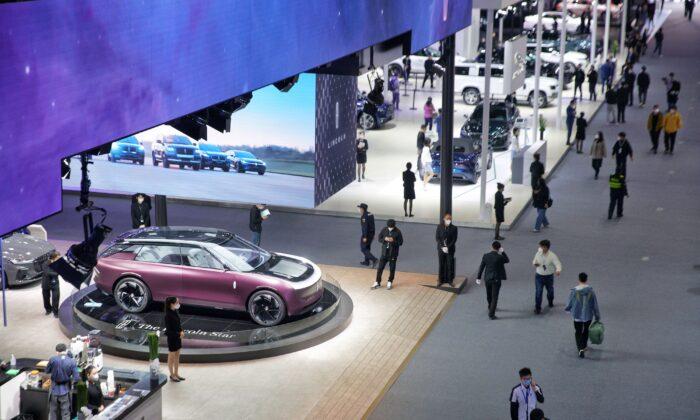

A low-price auto campaign initiated by Chinese car companies and local governments has been sweeping throughout China since the start of March, but auto sales continue to fall. Experts indicate that middle-class Chinese citizens, the mainstay of consumption, face heavy debts as they lose confidence in the economy.

On March 6, Dongfeng Motor Corporation, in cooperation with the Hubei provincial authorities, launched a car-buying season campaign with the most significant price reduction. A major discount was offered for the Dongfeng Citroen C6, usually priced at 216,800 yuan (about $31,700), with a combined government and corporate subsidy of 90,000 yuan (about $13,000) per vehicle.

Discounted Sales Can’t Help Weak Auto Market

This wave of domestic auto price cuts comes after Tesla, which took the lead on Jan. 6, dropped prices on some of its models by up to 48,000 yuan (about $7,000).But a low-price strategy can’t help the sales of domestic-made cars as auto sales across China are dropping. A source from a joint venture told Chinese news portal Sina: “At the beginning of the year, we had thought the impact of the epidemic would recede, and car consumption would recover. Thus, many car companies set a high sales target, but we didn’t expect to fall short.”

“This reflects that the entire auto industry and market in China are fragile, and the Chinese economy is in recession,” Xie said.

Xie disagrees with the CAAM and said that if the market is depressed and fewer people are buying cars, it would make sense for car companies to compete by cutting prices.

Debts Weigh Down on Consumption

Many Chinese auto industry insiders believe that several car dealers are being forced to reduce prices to clear their inventories that may not meet the China VI-B emissions standard, which goes into effect starting July 1 this year.According to Lu Tianming, a U.S.-based political and economic analyst, the low-price promotion is only a superficial reason for the wave of auto price cuts.

“The low-price promotion competition is actually due to an absence of consumer power, and the whole consumption is shrinking,” Lu told the Chinese language edition of The Epoch Times on March 25.

“The shrinking consumption is caused by insufficient spending money, and consumers who have the money are afraid to spend.”

Lu said the ordinary Chinese people have no money because their debts have reached a new high, with housing mortgage accounting for the highest percentage.

“The real estate sector is a binding constraint on China’s economy,” he said.

“The communist regime’s land finance policy pushed high land prices, coupled with collusion between business and government, which has led to high housing prices.

“The disposable income of Chinese residents is so low that they become overly indebted after buying a home, and their mortgage payments account for too much of their income, resulting in a significant reduction in their ability to spend on other products.”

Lu also pointed out that the Chinese fear spending money “because they lack confidence in the future. Since the Chinese Communist Party’s three-year zero-COVID policy, the people’s income is generally declining, and they are worried about their future.”

Official data shows that people’s savings are growing, and total deposits have reached a record high. In Lu’s view, this is not because people are earning more money, but because their income has been reduced, so they want to keep their money in the bank.

“They [Chinese consumers] are cutting back on food and clothing and saving money to prepare for the uncertainty of the future.

Consumer Confidence Diminishes

“Such record-breaking numbers or increased savings signal a decline in spending,” said Xie, adding that people are afraid or reluctant to spend money, and they are worried about losing their jobs tomorrow. “If this sentiment arose, people would save more, and saving would reduce the consumption rate,” he said.

Lu shared a similar opinion that Chinese middle-class income is lessening. “City lockdowns and the emigration of industrial chains have impacted the Chinese economy, resulting in a sharp drop in the income of the middle class. Even car prices have dropped sharply, but sales are still down because the middle class can’t afford to spend or dare not spend.”

Xie said that most middle-class citizens don’t have more savings, citing that “the average citizen is overwhelmed by mortgages, car loans, and other expenses.” Furthermore, there are many cases of loan suspensions and mortgage cuts, he said.

He noted, “We only see the total amount of deposits increasing, but whose deposits are increasing?

“If the total amount of savings is increasing, we should look at the vested interests of the upper echelons of communist rulers and see if they have more cash in their hands.”