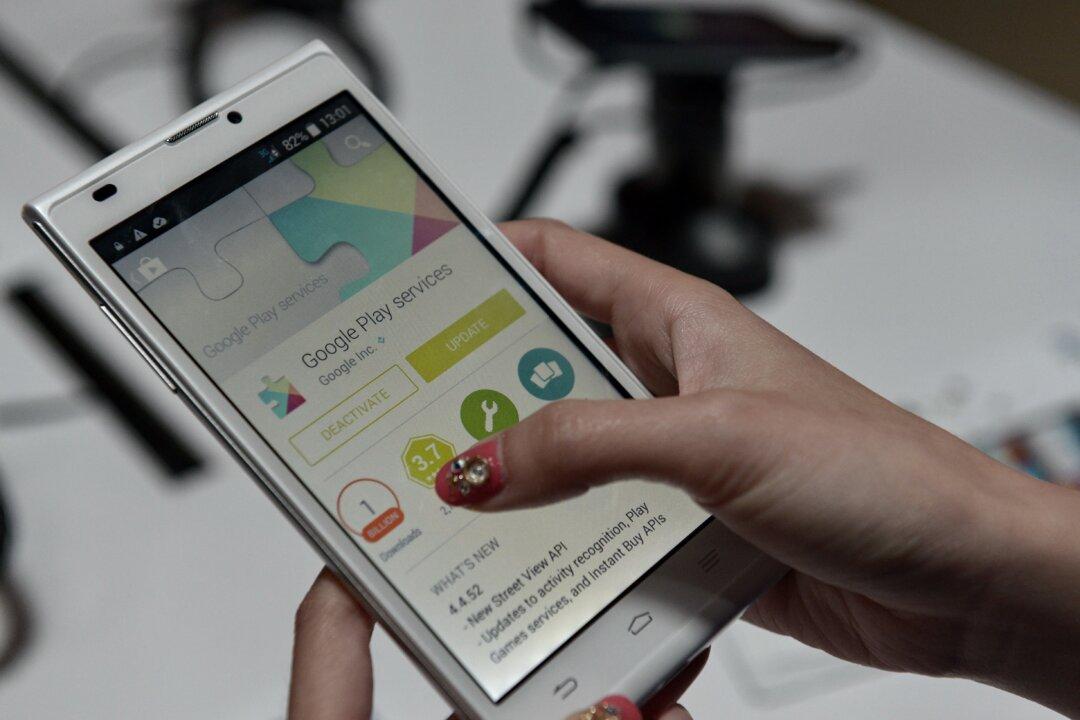

After the United States said it would ban American companies from supplying tech parts and software to the Chinese smartphone maker ZTE, a document circulating on the Chinese internet has elucidated just how troubling the situation would be for China’s second-largest telecoms company.

The U.S. Department of Commerce announced the decision on April 16 after discovering that ZTE had failed to comply with the terms of a prior court agreement following the company’s sanctions violation.