Missouri Judge Finds CCP Liable for $24 Billion for Hoarding COVID-19 Protective Equipment

The judgement found that the Chinese Communist Party was liable for $24 billion in damages related to its hoarding of medical supplies during the pandemic.

Fallout From Zelenskyy Meeting; Europe Faces Defense Crisis | Live With Josh

Plans for a peace deal between Russia and Ukraine are now paused, and Trump said Zelenskyy can come back when he’s ready for peace.

Lucas Miles on the Surprising Religious Origins of the ‘Woke’ Movement

Wokeism has permeated a lot of the current culture and politics.

An Absorbing Account of the Pacific War’s Most Famous Battle

Insightful and highly readable, Mark Stille’s ‘Midway’ is a detailed analysis of the naval battle and is certain to become an authoritative work.

‘Meeting With Pol Pot’: The Danger of Talking With a Dictator

A film about a journalist’s disappearance is a thinly disguised documentary of Pol Pot’s genocide of the Cambodian people.

‘True-Blue Grasser’: Remembering Dierks Bentley’s ‘Up on the Ridge’

With his surprise bluegrass album, the country artist honored those who made Nashville feel like home.

Most Read

Top Stories

It’s Time to ‘Spring Forward’—What to Know About the Debate Around Daylight Savings

The debate between Standard and Daylight Saving Time rages as experts weigh the health threats.

Social Security Reinstating 100 Percent Monthly Recovery Rate for Overpayments

The SSA said its chief actuary estimates the change will save about $7 billion over the next decade.

Exclusive

X Takes Down Network of Chinese Accounts Amplifying NYT Attacks on Shen Yun

An Epoch Times investigation exposed thousands of fake and malicious accounts that spread CCP propaganda, including via Western media.

5 Takeaways From FDA Nominee Marty Makary’s Hearing

Lawmakers from both sides of the aisle peppered the nominee with questions about flu vaccines, mifepristone, and other issues.

Strong Support for Trump’s Economic Agenda, With Inflation a Top Concern: Epoch Readers’ Poll

A survey of more than 24,300 readers provides insight into public perception; and while optimism is high, many acknowledge short-term challenges.

Mexican Businesses, Regional Leaders Respond to New US Tariffs

Latin Americans speak up about the new levies assigned to Mexico’s U.S. bound exports and the possibility of more to come.

Federal Judge Denies Request to Block DOGE From Accessing Treasury Data

A Washington judge has found no evidence of potential harm or data misuse.

Judge Declines to Block Policy That Lets Agents Arrest Illegal Immigrants at Schools

Denver Public Schools sued over the policy which it said was in contravention of federal law.

Canada Open to Early Talks on Trade Pact With US, Discuss Ending China Dumping: Finance Minister

Canadian finance minister also said his government would prefer to hash out all details on trade in one broad negotiation instead of sector by sector.

US Warns Foreigners of Visa Ban for Backing Terrorist Groups

This move comes as part of a crackdown on anti-Semitism on U.S. college campuses after the Hamas terrorist attack on Israel on Oct. 7, 2023.

▶Business Owner Touched by Shen Yun’s ‘Beautiful Dancing of Divine Beings’

Shen Yun Performing Arts received a warm welcome in Ludwigsburg, Germany, on March 2, captivating theatergoers there with a journey through ancient China.

Trump Admin Will Explore Ways to Acquire Bitcoin for Strategic Reserve

The president said he’s ending Biden’s ‘Operation Choke Point 2.0,’ referring to efforts to cut off banking services to crypto companies.

Opinion: The Media’s Shen Yun Blind Spot

How critical reports miss the real story—with grave consequences.

Trump Restricts Student Loan Forgiveness for Certain Nonprofit Workers

The new rules will exclude those employed by nonprofits engaged in improper or illegal activities from receiving loan forgiveness.

CDC Alerted of Hantavirus That Killed Betsy Arakawa, Considered ‘Notifiable Disease’

It is unlikely the canine died as a result of the same disease that killed Arakawa, New Mexico State Veterinarian Erin Phipps says.

Private Moon Lander Declared Dead After Landing Sideways in Crater

Intuitive Machines’ first mission ended with its lander Odysseus also landing on its side after one of the lander’s legs collapsed.

Judge Should Dismiss Eric Adams Case, Court-Appointed Lawyer Says

Former Solicitor General Paul Clement was appointed amicus curiae, or friend of the court, by Judge Dale Ho to present arguments regarding the DOJ’s motion.

Tracking Trump’s High Level Appointments, Senate Confirmations

The Senate is undertaking the confirmation process for the president’s new administration.

Day in Photos: Police Disperse Rally in Bangladesh, Cyclone in Australia, US Space Force Test Flight Lands

A look into the world through the lens of photography.

Trump Forms White House Task Force for FIFA World Cup 2026, Taps Vance as Deputy

The president has signed an executive order creating the White House Task Force on the FIFA World Cup 2026, with himself to serve as chief overseer.

Mexico to Review China Tariffs

President Claudia Sheinbaum blamed Chinese imports for the collapse of Mexico’s textile and shoe industries.

The Spiritual Anthem ‘Rise Again’ as a New Single

The latest rendition honors the song’s legacy and gives its message renewed life.

Scruggs Brings Information Hungry Attitude to MLB Network Radio’s The Leadoff Spot

Having played professional baseball in South Korea, Mexico, and in the MLB, Xavier Scruggs Brings a wealth of knowledge to The Leadoff Spot.

Scruggs Brings Information Hungry Attitude to MLB Network Radio’s The Leadoff Spot

Having played professional baseball in South Korea, Mexico, and in the MLB, Xavier Scruggs Brings a wealth of knowledge to The Leadoff Spot.

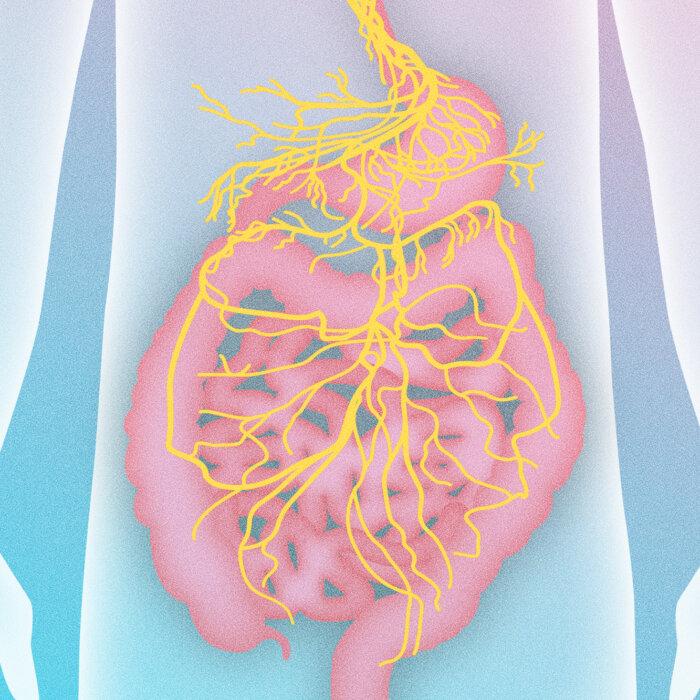

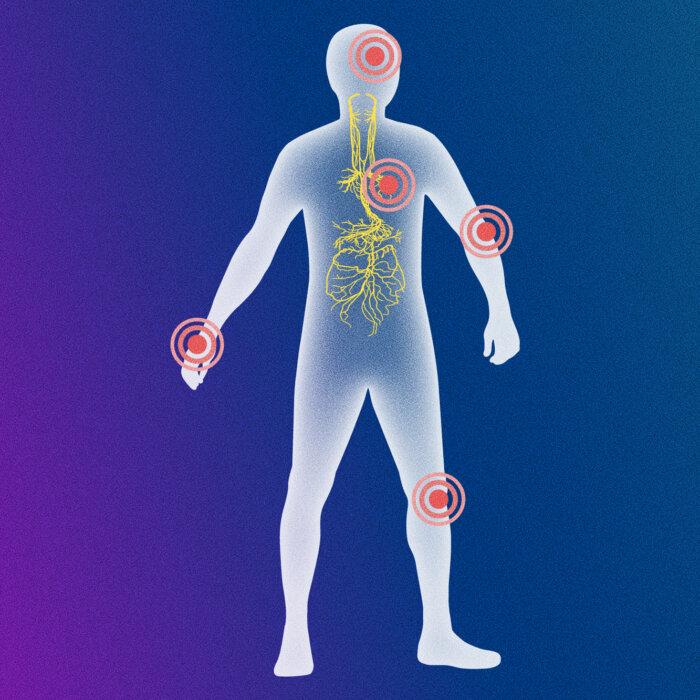

Exercises for Limber Hips and 7 Reasons Why You'll Want to Do Them

Hip exercises require little space and can be done in the comfort of your own home.

Exercises for Limber Hips and 7 Reasons Why You'll Want to Do Them

Hip exercises require little space and can be done in the comfort of your own home.

Founding Father’s Early Life Shaped in an Unlikely Place

Alexander Hamilton’s boyhood island of St. Croix was a place of challenge, intellectual curiosity, and possibility.

‘Soldier of Fortune': Crossing Borders, Capturing Hearts

Clark Gable stars in a romance-drama set in 1950s’ Hong Kong.

Smoky: War Hero and World’s First Therapy Dog

A dog saves the day in wartime and after the war brings comfort to those who suffered.

Founding Father’s Early Life Shaped in an Unlikely Place

Alexander Hamilton’s boyhood island of St. Croix was a place of challenge, intellectual curiosity, and possibility.

Plant-Based Pitfalls: When Can the Vegan Diet Go Wrong?

People who follow a vegan diet are at risk for vitamin deficiencies, because some nutrients come mainly from animal sources.

Should You Order Foreign Currency Before You Travel?

Understanding how to get foreign currency affordably can help you maximize your travel budget.

Puerto Vallarta: Mayhem and Magic on the Malecon

The Malecon is a 1-mile delight in so many different ways as to make any number of hours pass quickly.

Should You Order Foreign Currency Before You Travel?

Understanding how to get foreign currency affordably can help you maximize your travel budget.

He Traded His Dental Mirror for Hollywood Spotlights

A place in Hollywood is rarely guaranteed for latecomers, but Edgar Buchanan, age 36, was the curious exception to that rule.

The Ellicott Family and Their Gift to America

They were called ‘dreamers and half-hearted fools’ at the time, but yet they changed the course of American history.

Special Coverage

Special Coverage

![[PREMIERING 9PM ET] Mike Rowe: Why Are 7.2 Million Able-Bodied Men Not Looking for Work?](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F03%2F08%2Fid5822179-250307-ATL_Mike-Rowe_HD_TN-600x338.jpg&w=1200&q=75)