Money. It’s an aspect of life everyone must manage. For many, the stresses that come along with personal finances affect their relationships, their health, and their overall well-being.

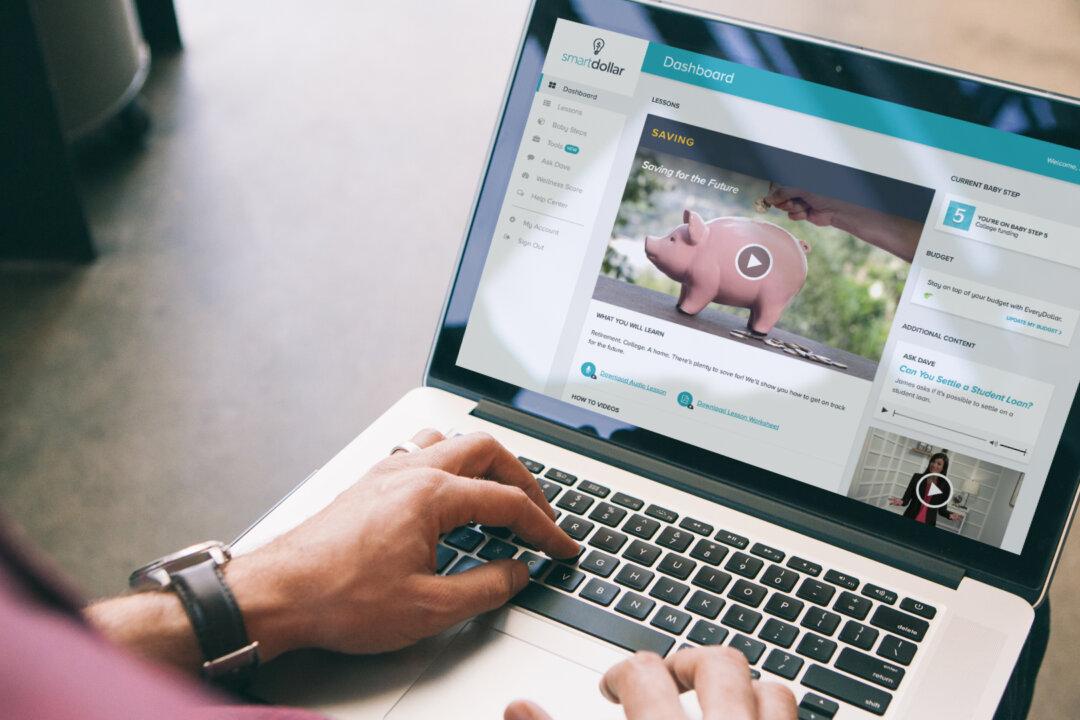

I spoke to Brian Hamilton, the vice president of SmartDollar, a new program for employers being offered by Ramsey Solutions. SmartDollar aims to offer a way for employers to help their employees tackle their money issues.