Classical Indian art has been and continues to be greatly undervalued compared to other classical Asian arts. However, in recent years, the market prices have risen due to new collectors in the field as well as the difficulty specialists have in sourcing good-quality works with exceptional provenance.

How stable is Asian art as an investment?

Asian art as an investment is a wonderful complement to a well-diversified portfolio of investments. I suggest that one purchase works from a well-respected specialist in their field of choice, judging the artwork both on importance and beauty. As I say, buy what you love and you shall never regret the purchase.

Given our gallery’s experience over the last 37 years operating in New York, we have seen prices rise steadily, whereas certain other sectors have seen “speculators or investors” artificially inflate the pricing structure; and consequently when the financial markets tumble, these speculators are the first to abandon this portion of their portfolio and at times cause a drop in the respective market.

How do you vet items?

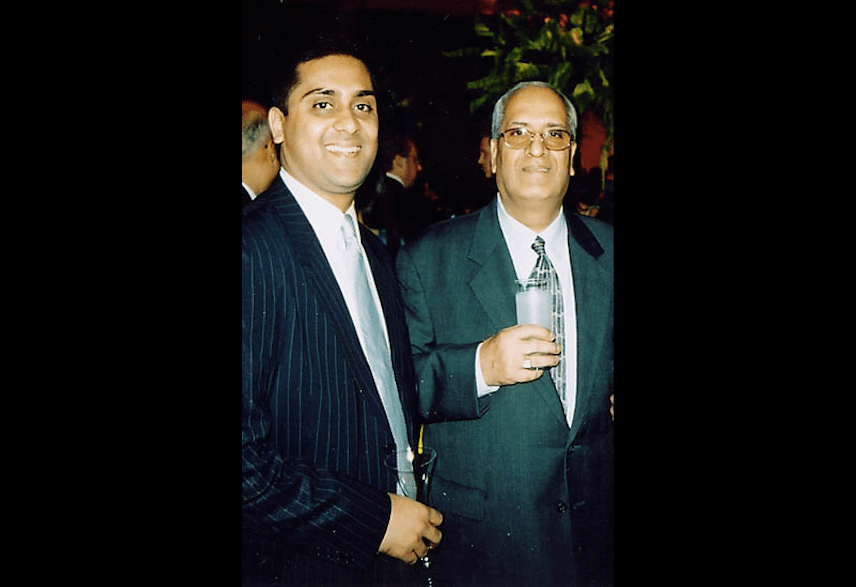

We rely on our experience. Kapoor Galleries Inc., founded by Ramesh Kapoor, who is still actively involved in each work, has been a leader in the field of Indian art for over 50 years, having operated a gallery in New Delhi from the mid 1960s until 1975 when he emigrated to New York and founded Kapoor Galleries in March 1975.

Based on these invaluable years of experience, we vet items based on their quality of work, rarity of subject matter, condition, and overall aesthetic beauty.

What are the pitfalls for new investors to watch out for?

New or young collectors need to be mindful that they are dealing with reputable and knowledgeable specialists, who have developed their expertise and can help them build a collection which represents their taste.

What’s new and exciting?

It has been a very exciting year for Indian miniatures, specifically the Reitberg/Metropolitan shows, along with some landmark sales of distinguished private collections, such as the Stuart Cary Welch collection last May.

These grand exhibitions, in coordination with exquisite material available to the collecting community after such a long time has heightened interest from seasoned collectors, museums, specialists, and intrigued new collectors to the field of Indian painting as well.

Where do you see the market going in the next five years?

A focus on higher quality works continues to be the trend, and I see this only developing further in the future. “Younger” collectors continue to develop their eye, focusing on more important and rare works.

Has the Asian buyer had an impact—coming into the market to buy?

In our field, both the Chinese and Indian affluent collector has had an impact. As our field caters to both realms, via the focus on Indian and Himalayan arts, we have seen collectors, curators, and dealers from China and India in New York for the last five to six years.

The Chinese have been very aggressively buying works of Imperial manufacture, as well as important Himalayan bronzes from both private galleries and auction salesrooms.

The Indian collecting community has focused primarily on modern and contemporary art from South Asia; however, there has been a steady “crossover” to classical Indian art, both painted and sculptural works from a small select group of discerning collectors.