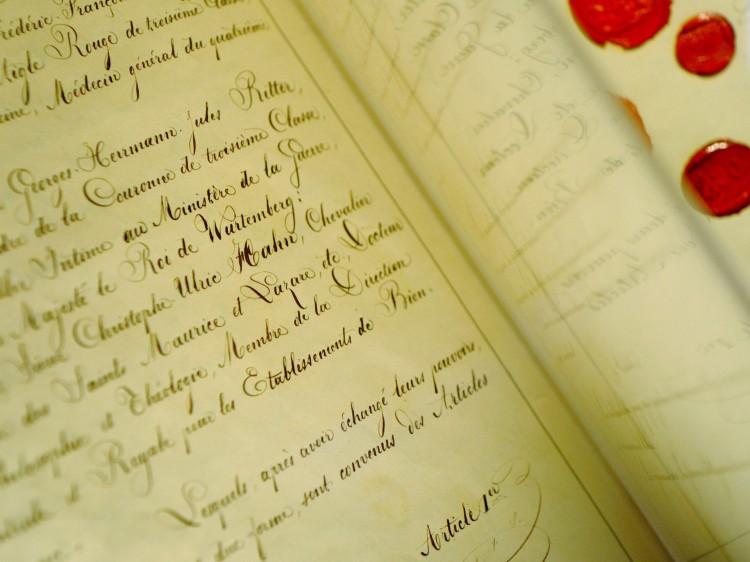

After completing your estate planning documents and letters of instruction, you may realize that these are very important legal documents that need to be stored in a safe place.

Your estate planning documents may include a will, a living trust or ongoing trust, a durable power of attorney and other personal documents like deeds or business ownership papers.

When pondering where to store these important documents, don’t forget to let the person who will be administering your estate know where to find them.

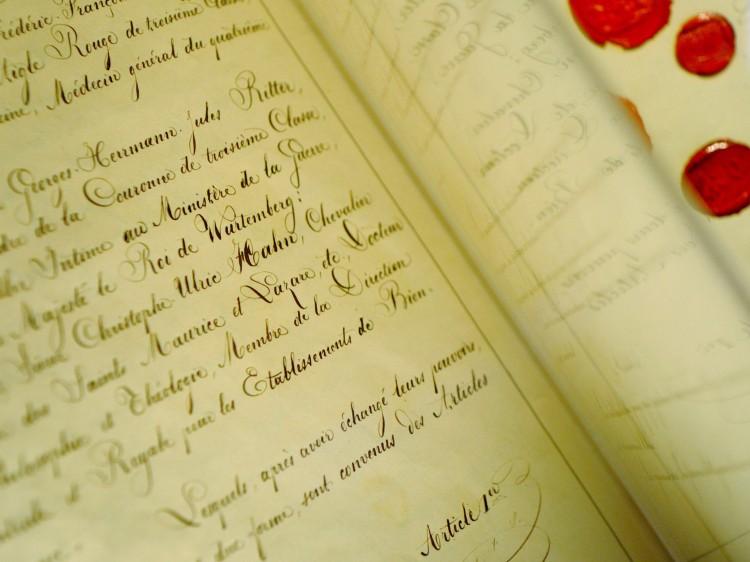

Any secure place can be used, like a safe in your house or office, a locked file cabinet or desk drawer, even a safety deposit box at the bank. Remember to share the combination to a lock, provide an extra key, or put the potential administrator’s name on the safety deposit box to ensure easy access later on.

If you want to keep the documents private while you live, check with your bank to find out what needs to be done to gain access to your safety deposit box after you die. In some instances, the box will be sealed, depending on your state laws.

It is easier to get access to a safety deposit box if more than one name is on it, which will save the administrator from going through a prolonged legal process to get permission.

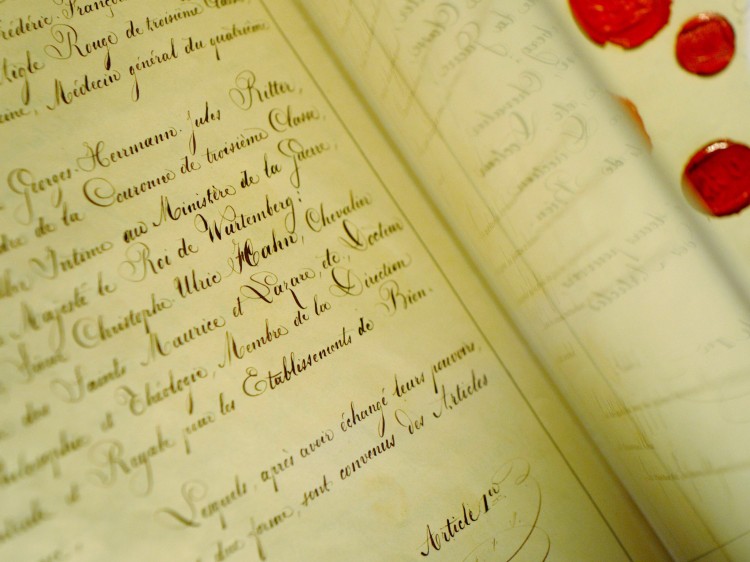

Another alternative is to make copies of some of your documents, like the durable power of attorney and living trust. These kinds of documents can provide funeral and burial instructions, which should be immediately available.

Don’t worry about giving copies of certain documents to trusted family, friends, or financial institutions because these copies are not legal originals. Even though a copy of your signature may be on the documents, it does not replace the orginal that you have locked up for safe keeping.

In case you want to change any of your documents, you will not have to worry about causing any confusion. The new or updated original document takes precedence over any prior original or copies. Remember to distribute new copies if you choose to make any changes.

If for some reason your signature becomes illegible on a copy, do not write an original signature over top of it. Having more than one document with an original signature can create problems in the future if the signed copy is viewed as a “duplicate original”. More importantly, if you decide to amend or revoke the original document, you will have to do the same to each copy that you put an original signature on.

To further avoid future trouble, you should write “copy” in ink on each page of the copied documents or don’t make any copies at all. That way you can just entrust a key, a combination, or a shared safety deposit box to the one person you have chosen to handle your affairs when you are no longer able to.

Information contained in this article is not intended to be legal advice nor applicable to all situations. For legal assistance, contact an attorney in your state of residence. You can visit Arleen’s website at arleenrichards-law.info.

The Epoch Times publishes in 35 countries and in 20 languages. Subscribe to our e-newsletter.