Finding extra cash in your coat or pants pocket is always a delight, but there are other hiding places where the rewards are higher. Many Americans are unaware of lost or forgotten assets. These assets could be anything from an old insurance policy to a refund or a lost paycheck. Finding and cashing in on these assets isn’t difficult, but may take some detective work to find.

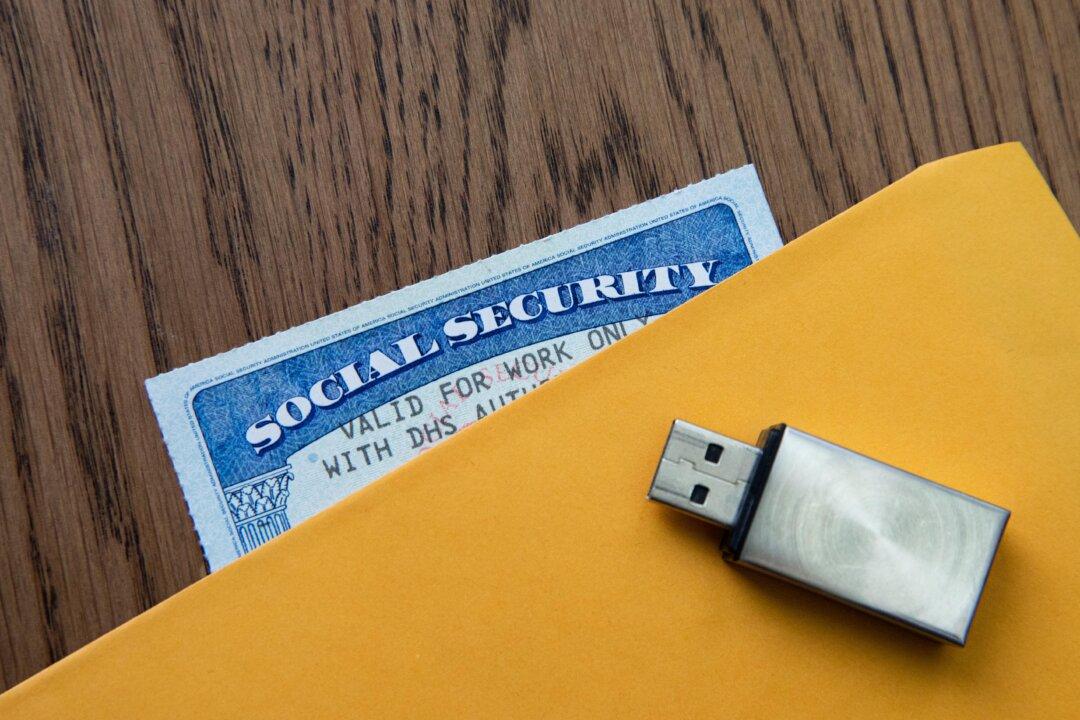

A social security card and a USB device in New York, on Feb. 14, 2021. Chung I Ho/The Epoch Times

|Updated:

Anne Johnson was a commercial property and casualty insurance agent for nine years. She was also licensed in health and life insurance. She went on to own an advertising agency, where she worked with businesses. She has been writing about personal finance for 10 years.

Author’s Selected Articles