Most investors haven’t heard of life settlements, and those who are aware of this opportunity usually do not have a full and fair understanding of the pros and cons. It is relatively easy, with no specialized knowledge or experience required, but there are a few unattractive aspects.

The process is simple. An agent will arrange the deal for you and get you all of the information and documents that you need. Best of all, the debt is paid by a regulated “A”-rated insurance company, which is about as secure as you can get.

Investors buy a life insurance policy from a “life settlement” company that buys life insurance policies from people who do not want the life insurance policy any longer. The insured person is selling the policy because he or she wants to “cash out” for a price that is higher than the “cash value” that the life insurance company would pay, and less than the full death benefit that will be paid out upon settlement of the life insurance policy.

The policy holder must be at least 65 years of age, and the insurance policy must be aged beyond the time for any challenge by the insurance company, so the investor acquires a contractual right to be paid by an “A”-rated life insurance company upon the death of the insured. Investors buy the policies at attractive discounts to the eventual payoff value, so the profit is determined and locked in when the investment is made.

Everyone has heard the old saying about “buying low and selling high.” Here is an opportunity to buy a rock-solid future payment for a deep discount. No research, no economic predictions, no market fluctuations. The only questions is when will the policy pay off, and can you trust the life settlement company that structures the transaction?

Summary Points:

- No Specialized Knowledge: Just call a life settlement company

- Reasonable Capital Requirement: $10,000 and up

- Scalability: Yes. There is large supply for investors.

- Poor Liquidity: There is no set time period for payoff of this investment. Resale is possible but typically at a discount.

- Barriers to Entry: Investors must be qualified with income and assets.

Why Would a Policy Holder Sell a Life Insurance Policy?

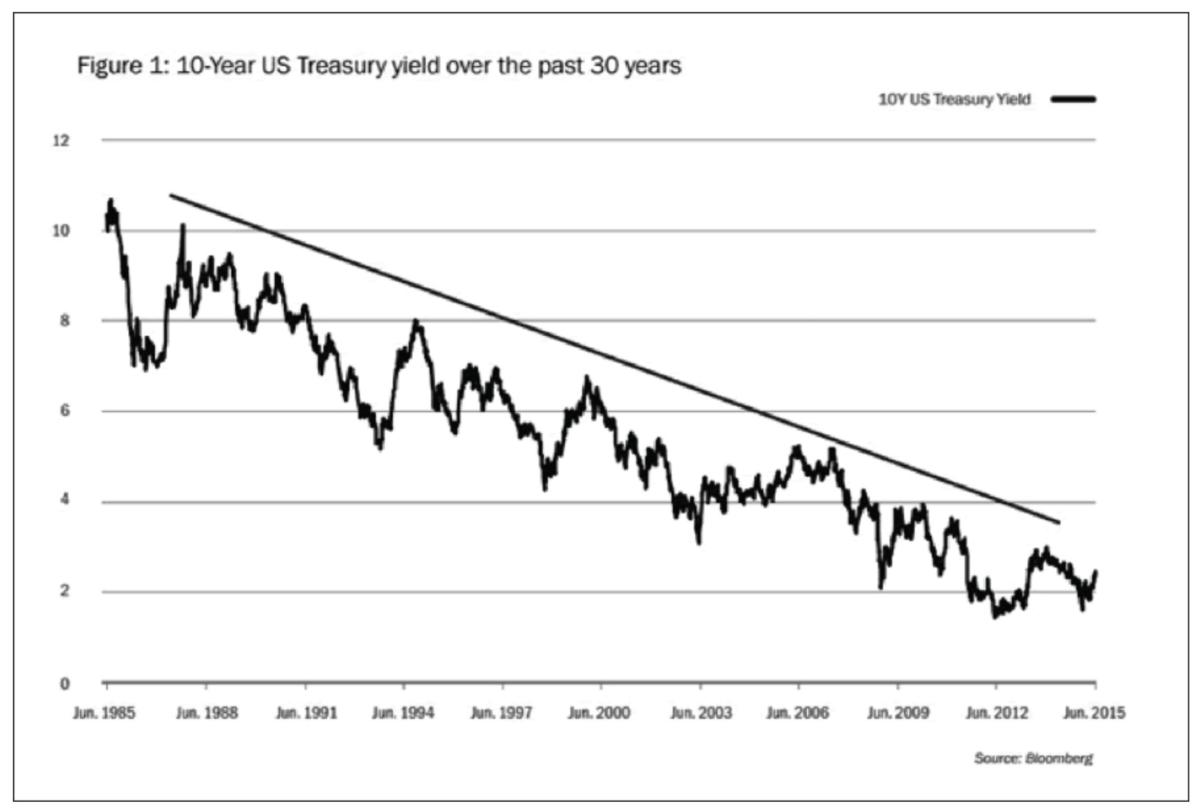

People buy life insurance for many reasons, and over the course of their life, circumstances change, making the policy unnecessary. Many people buy a life insurance policy when they land their first job or get married. Years later, if they are widowed with no children or close heirs, they have no reason to maintain the policy. Others simply can’t afford the annual premiums or need cash. Many people retire with what seems to be sufficient savings and a well-planned budget, only to see their financial stability destroyed by the volatility of the stock market and artificially depressed interest rates. Anyone who retired a few years ago planning to earn interest of 4–5 percent on bank savings was in for a nasty surprise as bank interest rates have plummeted to under 1 percent. The chart above illustrates how treasury bond yields have plummeted in recent years, leaving fixed-income investors in a financial squeeze.

Current interest rates make it very difficult to survive on most retirement budgets. Many retirees are faced with tough financial decisions, and they find the idea of selling a life insurance policy to be more appealing than alternatives such as selling their home.

Some common reasons for a policy holder to sell a life insurance policy include: