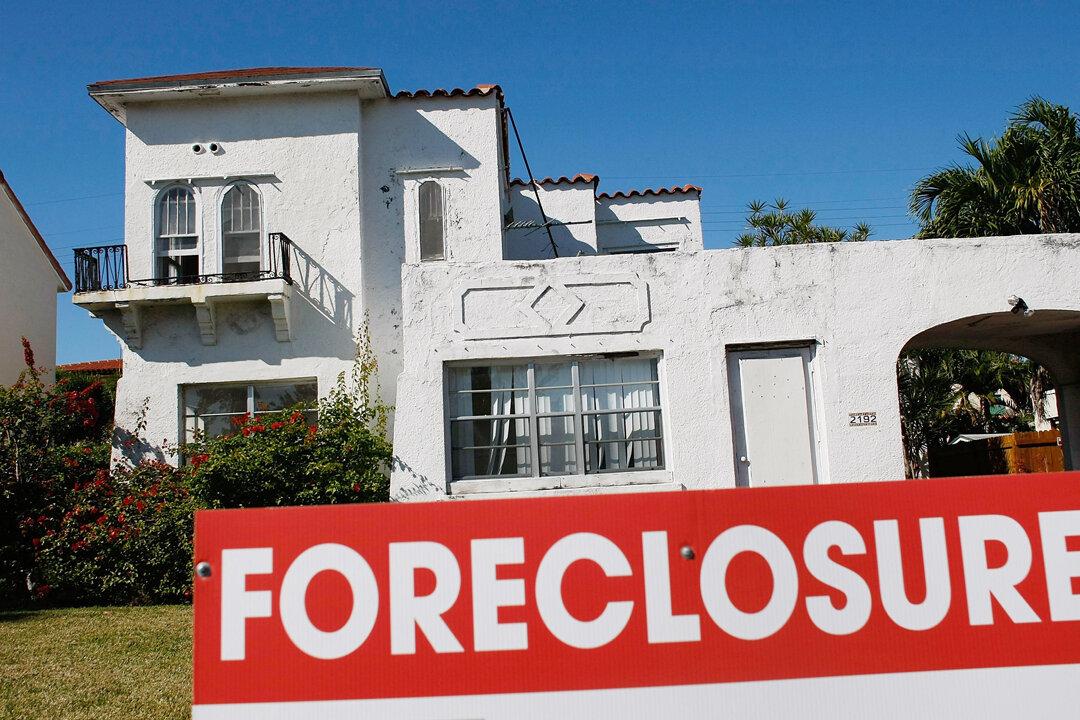

Loan servicers and banks are expecting a wave of foreclosures to inbound. The foreclosures over the past two years have built up due to the foreclosure and eviction moratorium.

Data from the Mortgage Bankers Association conclude that when there is a spike in defaults, typically there also is an increase in foreclosures; but in 2020 to 2021, as defaults increased, the number of foreclosures continued to trend downward.