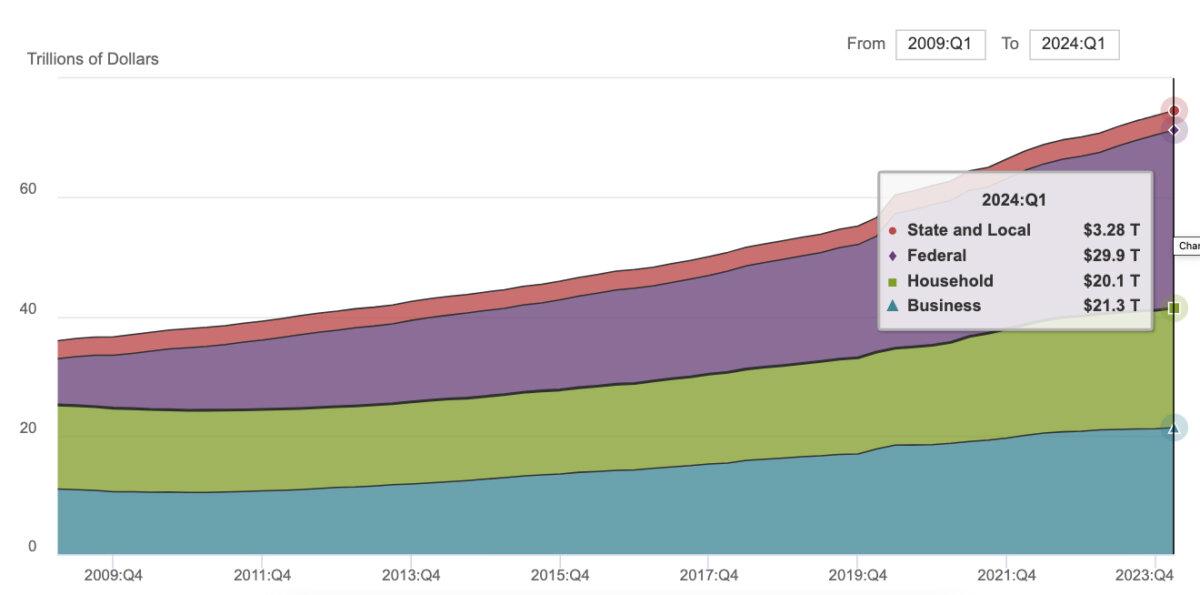

America is awash in debt. U.S. national debt has surpassed $35 trillion. This translates to approximately $93,500 per American. National debt today is at levels comparable to those seen during World War II. In the United States, the federal debt has reached or surpassed WWII levels, sitting at around 104 percent of GDP when excluding intragovernmental holdings, and about 128 percent of GDP when including them. This is the highest it has been since shortly after World War II, begging the question: What would become of our currency if we would once again be plunged into world war?

Source: Board of Governors of the Federal Reserve System