Summary

- Dollar weakness has reached extreme levels.

- Changing Fed stance will positively influence supply and demand dynamics in the Dollar.

- Growth rates, inflation figures suggest the overbought Pound should be sold.

The early parts of this year have shown some very clear trends. In precious metals, we have seen gold bulls attempt to post recoveries in the SPDR Gold Trust ETF (NYSEARCA:GLD), and this has brought some relief to its silver counterpart in the iShares Silver Trust ETF (NYSEARCA:SLV). A large driver of these moves has been weakness in the U.S. Dollar, as investors have started to view the recovery in global economic data as a reason to start shunning safe haven assets. Most commodities have a strong inverse correlation with the greenback, so it is not entirely surprising to see moves like this given the current market environment.

But trending activity that is this one-sided can only last for so long, and it is time for traders to start looking for assets with the potential for a major reversal. The weakness in the PowerShares DB U.S. Dollar Index Bullish ETF (NYSEARCA:UUP) has started to pull away from the underlying economic fundamentals, and when we add in the changing policy stance at the U.S. Federal Reserve it is becoming increasingly likely that Dollar-based assets should start to see gains into the middle parts of this year.

Looking For Alternative Sell Positions

The best evidence for the above thesis can be seen in the improving U.S. labor market, rising inflation in consumer prices, and outperforming GDP growth when compared to the other major developed market economies. Said James Gordon, markets analyst at Orbex:

Consumer inflation for the month of March came in 1.5% higher than what was posted during the same period last year. This is not something that can be said for most of the developed world and this will lead to changing expectations for the next set of policy intentions at the U.S. Federal Reserve.

Because of this, we have to start looking at currency alternatives to start selling against the greenback. One of the biggest market movers of recent quarters can be seen in the British Pound, which has soundly outperformed most of its developed market counterparts. For forex traders, this means it is time to start looking for reversals in the GBP/USD. For those focused more on stocks and ETFs, this means we can start to identify potential positions in the Guggenheim CurrencyShares British ETF (NYSEARCA:FXB).

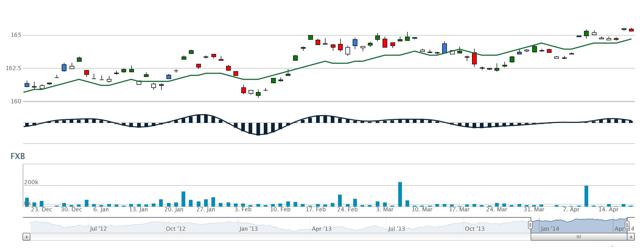

Technical Analysis: Guggenheim CurrencyShares British ETF

(chart source: OT Signals)

Trend studies in FXB remain constructive but momentum has started to stall and this could easily lead to profit taking if shorter term support levels start breaking. The real issue here is the available risk to reward ratio, which clearly favors the downside in Pound-related assets. From a technical analysis perspective, most of the bullish argument rests on the clearly defined uptrend channel that started in the middle of February. But prices are now hugging the support line there and without some major moves to the upside, these bullish arguments will soon become invalidated