Oil Prices Likely to Remain Low

In 2015, we have not seen as much attention focused on the commodities space or on oil in particular. There is good reason for this, as equity markets are now closing out a historic bull run that has unfolded over the last six years and investors are still deciding whether or not it makes much sense to start buying stocks are their current (and highly elevated) levels. But it must be remembered that there are other opportunities to be found elsewhere in the market, and the commodities space should not be left out. If anything, commodities markets are currently giving traders more opportunities to play things from the short side, so it you are looking to implemented PUT options, there are plenty of places available to express that bearish view.

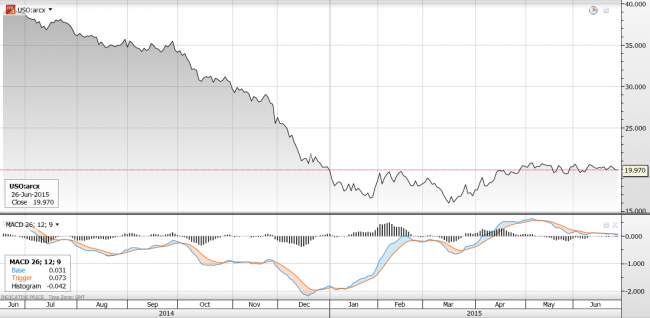

Chart Perspective: United States Oil Fund LP ETF (NYSE: USO)

Source: CornerTrader

USO is one of the most commonly traded instruments that is used to express a market view in the underlying price of oil. In the chart above we can see that it came under major pressure as we headed into the final weeks of last year. The ETF has made a very weak attempt at a recovery since then, but most of the market has been largely unimpressed. The chart activity this year can only be described as sideways or lackluster, so there is growing scope that we will start to see some additional downside in the stock assets that are tied to the value of oil.

Specifically, the lack of upside momentum is pushing things dangerously close to negative territory on the daily MACD reading, and if this occurs we can start to expect forceful breaks of support to the downside as there will essentially be no momentum left to push prices higher. The first level to watch on the downside now comes in at 15.60, so this will be a critical line in the sand that will need to hold in order to keep the oil price from collapsing.

This broad view is largely supported by the fact that the US Federal Reserve has already made its intentions clear and we will soon start to see interest rate increases for the US economy. This will put more downside pressure on the price of oil because there will be less fuel and energy needed to complete major building projects and manufacturing companies will likely suffer as well. All of this points to a lower price in the weeks and months ahead.