For dividend investors, one of the biggest stories of 2015 has been the continued decline in Prospect Capital Corporation (NASDAQ:PSEC). The stock is trading 30% below its 52-week high and has fallen more than 10% since the end of April. Most of this bearish momentum has been generated by the uncertainty associated with Prospect’s decision to cut its dividend from $0.111 cents per share to $0.08333 cents per share. But many of the negative headlines that have come as a result of these declines have been unwarranted, as heightened share buying and plans to complete spin-offs in key areas of its business make it more than likely that the sell-off in PSEC has reached its exhaustion point.

If this turns out to be true, the combined effect of potential capital appreciation and elevated dividend yields could easily generate returns upwards of 40%. Projections like this might seem unrealistic. But when we view the stock in terms of its massive NAV discount and it’s market-leading dividend, these projections actually start to look a bit conservative if investors are willing to ride out this period of volatility.

Strategic Criticisms

Over the last few weeks, many pundits have mistakenly identified Prospect’s weak stock performance as weakness in the company’s strategic approach. To be sure, last year’s decision to reduce dividend payouts did spook investors. But it should be understood that this was a necessary reduction enacted to reduce portfolio risk and protect against the possibility of lower investment income.

When we look at the latest earnings report, it appears Prospect made the right choice: Q1 earnings came in at $0.24 per share in NII, which was enough to cover its substantial 13% dividend. There was a minor decline in NAV ($0.05), but the company still managed to post quarterly returns of 7.7% for the period. Clearly, there is underlying stability here. But if we were to look at the stock performance itself, it might be easy to draw a completely different conclusion about the company.

NAV Discounts

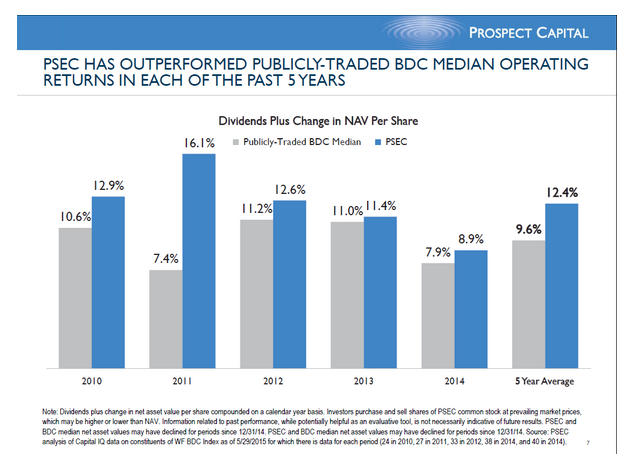

With all of the recent declines, PSEC now trades at a book value discount of roughly 26%. This should be viewed as extreme and excessively cheap given the fact that most business development companies trade at NAV discounts of around 5-6%. With this in mind, it is helpful to view PSEC in terms of its comparative performance in the space. In the chart below, we can see that Prospect Capital has constantly outperformed its competitor business development companies in each of the last five years:

With the recent moves, it might look as though these trends might be changing. When stocks are trading at a significant discount to NAV, it is usually an indication that investors are skeptical of the company’s strategic approach or are even questioning the actual book value of its assets. But it is important to remember that PSEC has consistently managed to close its NAV discount after periods of heightened volatility.

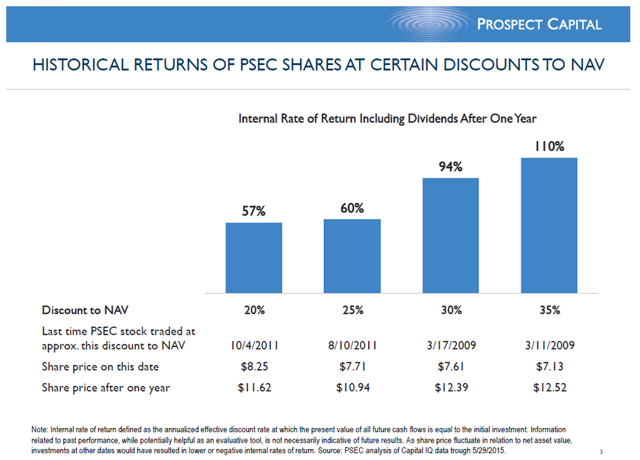

Consider the chart below, which shows historical returns in PSEC after NAV discounts have reached extreme levels:

If nothing else, this chart shows Prospect’s consistent ability to bounce back after periods of elevated selling in the market. It should be noted that the large gains posted the last time PSEC traded at a 30% NAV discount were aided by the 2009 bull rally -- and these types of gains are unlikely given the fact that the broader stock market is now trading near record highs.

But when we look at underlying strategic factors like Prospect’s plans to divest some of its pure-play businesses (certain real estate operations and CLOs), it is clear that there is strong potential for revenue growth going forward. Prospect is working off of the assumption that these businesses will command a higher multiple in environments outside of the BDC structure. So these moves should provide a nice tailwind for PSEC once its plans are finished.

Share Buying

Recently, some have argued that the potential for higher interest rates will damage the outlook for PSEC later this year. But factors like this are more of an issue for entities like mREITS, which take out short-term loans to fund longer-term loans. Performance potential in PSEC is more closely tied to credit risk than it is to interest rate risk, and the increased likelihood of higher interest rates suggests that the economy itself is growing. This growth is a positive for the companies in the PSEC portfolio, so concerns in these areas have created another false reason to sell the stock.

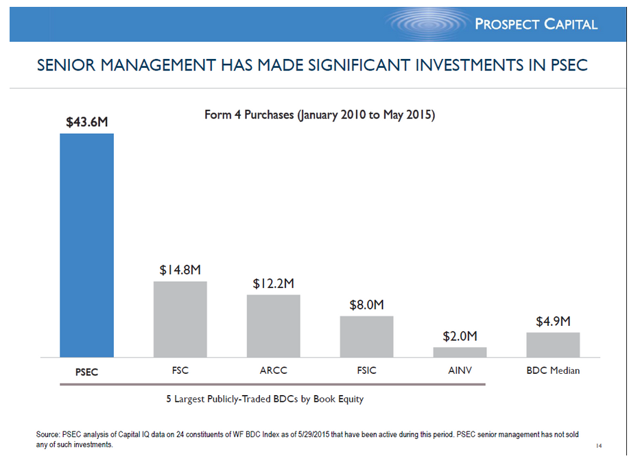

The management team at PSEC is well aware of these factors and this could, in part, explain why we have seen elevated share buying in the stock. The chart above shows the comparative value of share buying in the five largest publicly-traded BDCs. Activity in PSEC is nearly three-times what is seen in the second place position at Fifth Street Finance Corp. (NASDAQ:FSC).

Clearly, senior management at Prospect is not showing the same level of concern as the rest of the market with respect to the falling stock price. For value investors, all of this points to excellent long-term opportunity given the protectively massive book value discount, elevated dividend yield (13%), and proactive managerial strategy at the company. Potential negatives could be seen if non-performing loans start to increase or if further de-risking leads to more dividend cuts. But with the relative strength we have seen in recent earnings numbers, the current dividend looks safe for at least the next year. So, if you are an investor that is willing to look past the negative headlines and position for a longer-term outlook, PSEC still holds its place as one of the best dividend plays in the market.