Summary

- Prior forecasts proving to be highly accurate.

- Little reason to expect rallies in the precious metals ETFs.

- Strong labor markets suggest that the Fed will continue with stimulus reductions.

The pain continues for investors still long the SPDR Gold Trust ETF (NYSEARCA:GLD) as one of the most commonly watched precious metals instruments is now trading at its lowest levels in four months. But for those of us closely watching the fundamentals (rather than simply holding long positions and hoping prices will turn around), these negative trends are not at all surprising. I have written bearish projections in GLD for most of the last year, in articles like this one from last October, which sent warning signals and encouraged precious metals investors to sell GLD before the best shorting opportunities disappeared.

This was when GLD was trading just below $132, roughly 10% higher than the price levels currently seen and within striking distance of the $115 valuation target I originally laid out for GLD. Taking the bearish stance on GLD tends to attract a lot of negative criticism, largely because majority trade positioning in precious metals tends to become overly emotional and detached from the fundamental factors that drive supply and demand in the broader market. These tendencies spill over into silver markets as well, so it is not surprising to see similar outcomes in assets like the iShares Silver Trust ETF (NYSEARCA:SLV), which is now back in negative territory for the year.

Geopolitical Factors are Non-Factors

For those hoping 2014 would correct the massive declines seen in 2013, situations like the geopolitical tensions in Ukraine offered small reasons for hope. But anyone who established new positions on what would inevitably be a market event with transitory influence was making a big mistake, as the real story could have been assessed when watching the growing outflow numbers in instruments like GLD. The Ukraine story generated no real momentum in the underlying price of precious metals, and this was why I advised investors to use any news-fueled pop in GLD as a selling opportunity (or at least as a chance to exit some long positions). I expect no changes in these tendencies, and the true driver of GLD and the precious metals space as a whole will continue to be interest rates - not geopolitical influences or safe haven buying.

Interest Rates, Labor Markets

My bearish projections were relatively easy to construct, and it is no real surprise that these markets have shown almost no ability to generate consistent bullish momentum. Supportive earnings have sent the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) to record highs and improving macro data have pushed the PowerShares DB US Dollar Index Bullish ETF (NYSEARCA:UUP) higher relative to Euro-denominated assets. Most precious metals positions are long term in nature, and those bullish GLD will only face sustained obstacles in the changing monetary policy stance at the Federal Reserve. Both the S&P 500 and the US dollar tend to move in opposing directions (albeit for different reasons), so as long as these trends continue there is little reason to establish new long positions in GLD.

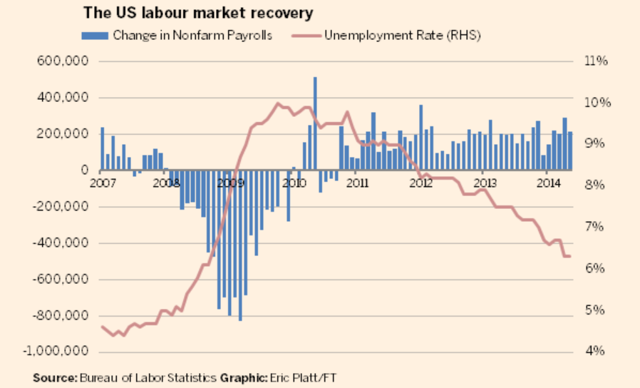

A rising interest rate environment is not one that is supportive for precious metals ETFs, and continued strength in labor markets suggests that the Fed will continue to remove QE stimulus and establish its policy to normalize interest rates sometime next year. Monthly jobs numbers have shown consistent gains (above 200,000 additions for the last four reports), and total employment data in the US has now surpassed the peak seen just before the financial turmoil of 2008.

The Fed is still expected to cut its monthly asset purchases to $35 billion at its next meeting, and there is essentially nothing in the labor market data to suggest that there will be any deviations from this plan. None of this is positive for GLD, so remain long at your own peril.

Chart Perspective: GLD

(Chart Source: CornerTrader)

Momentum in GLD is clearly centered on the downside, with the next resistance coming in at $123. This is a prior demand level, so there should be some difficulties here if prices manage to rally that far. Next downside target rests at $115.