Summary

- Long positions in euro-based assets looking increasingly risky.

- Central bank stance supports outlook for lower euro.

- Relative growth performance still favors US dollar.

The US dollar has been under pressure against most of its major counterparts for the first half of this month, and some of the clearest beneficiaries from these trends can be found in the euro and Japanese yen. Anti-dollar moves in currency markets tend to increase the focus placed on the euro as the second-most commonly traded currency and the central developed market counterpart to the U.S. economy. Many traders tend to look at the EUR/USD forex pair as the main gauge for performance trends in the euro but a better way of doing this is to watch the Guggenheim CurrencyShares Euro Trust (NYSEARCA:FXE), as this tracks the currency’s value against a basket of commonly-traded alternatives.

(click to enlarge) (Chart Source: Orbex)

(Chart Source: Orbex)

The EUR/USD has already traded near the 1.40 mark, and started to pull back. But when we look at the chart above, we can see that this year’s moves have been almost one-way in nature. Furthermore, the broader measure in FXE has posted gains of nearly 6% over the last year, so the generalize strength extends far beyond its performance relative to the U.S. dollar. For those looking for ways to gain exposure to currency markets through contrarian positions, it makes sense to start looking at the underlying fundamentals in the eurozone.

There are clear warning signals that suggest otherwise and recent statements from the European Central Bank (ECB) suggest that restrictive policy measures will need to be initiated if further gains are seen in the currency.

Draghi Statements

Recent comments from ECB President Mario Draghi shed some important light on the central bank’s policy stance, saying that continued strength in the euro exchange rate would require a reduction in interest rates. The ECB’s primary job requirement is to maintain price stability across the regional economy and the deflationary conditions that are present in most of the member countries could present obstacles GDP growth during the second half of this year.

Rising currency values make export products more expensive for foreign nations, hurting multi-national corporations that rely on those types of businesses. This extra drag makes it increasingly difficult for the ECB to make good on its commitment to reach its annual inflation target of 2%. In the chart above, we can see that average inflation levels in the eurozone currently stand at 0.5%, and in some of countries the numbers have actually turned negative.

Any continuation of the current trends will force voting members of the central bank to take action and implement policy changes that will stem the appreciation of the euro. The most direct way of doing this is to simply cut interest rates, as this reduces the incentive for investors to hold onto the currency for long periods of time.

Relative Growth

If the ECB is clearly intent on weakening the value of the euro, investors will need to look at which currency counterparts are best positioned to benefit from the potential declines. Most buy and sell transactions in the euro are conducted using the US dollar, so this would be the most obvious selection. This means it will be important for currency investors to watch activity in the PowerShares DB US Dollar Index Bullish ETF (NYSEARCA:UUP). In contrast, assets like the Guggenheim CurrencyShares British ETF (NYSEARCA:FXB) should be avoided, given the interconnected nature of the UK economy. This argument is supported by the fact that the pound and euro tend to move in conjunction with one another, and work off of the larger trends established in the dollar.

Furthermore, employment trends and the relative growth performance in the US far outweighs what is seen in the eurozone. The chart above shows eurozone GDP at 0.5% while the chart below shows much more encouraging trends in the US, where annual growth rates are seen at 2.6%.

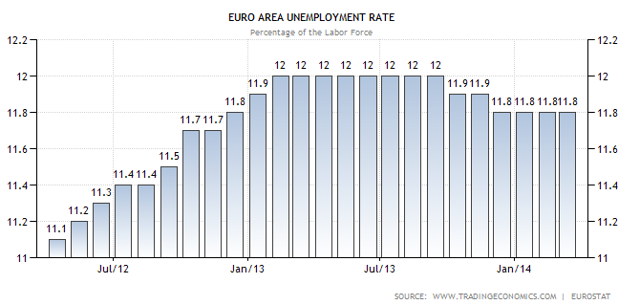

And when we look at the chronic trends of joblessness that are seen in the eurozone, there is little reason to believe these trends will end any time soon.

The chart above shows an unemployment rate that remains elevated at 11.9%, a clear indication that the systemic problems in the eurozone remain intact. All of these factors combined with the ECB’s stated policy stance suggest that further bullish moves in euro assets should be limited.