By Sandra Block and Anne Kates Smith

From Kiplinger’s Personal Finance

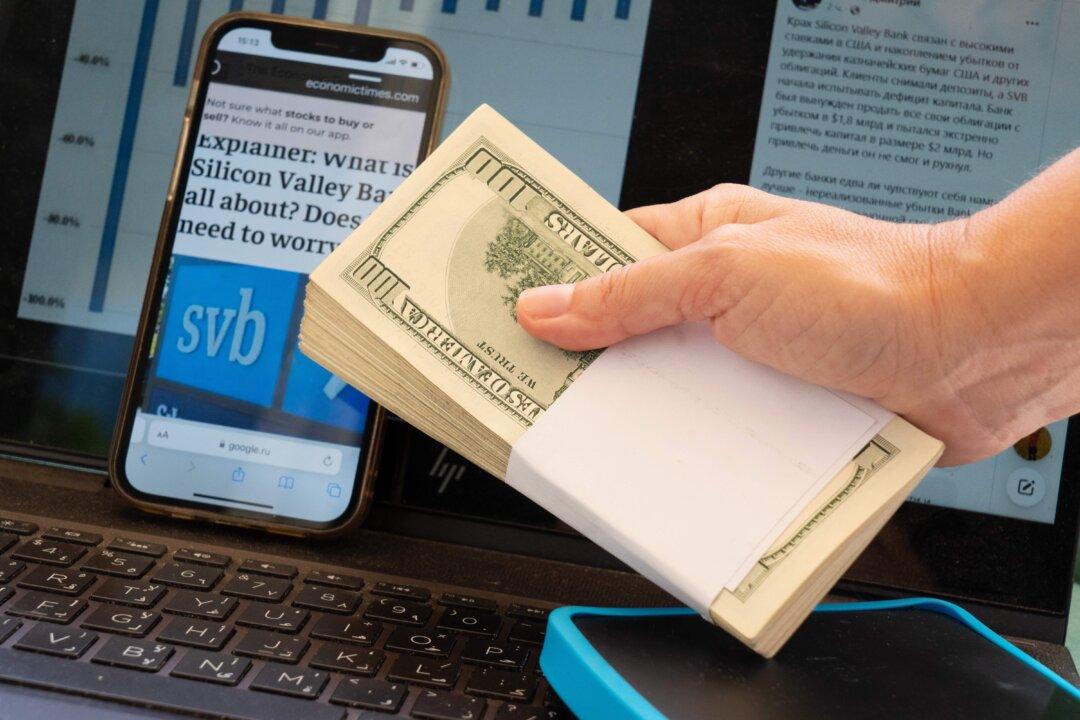

Since the Federal Deposit Insurance Corporation (FDIC) was created in 1933, no bank customer has lost a penny in insured deposits, even during the darkest days of the 2008-09 financial crisis.