The Supreme Court ruled unanimously on April 12 that a federal appeals court should not have dismissed a delivery driver’s proposed class action lawsuit over compulsory arbitration.

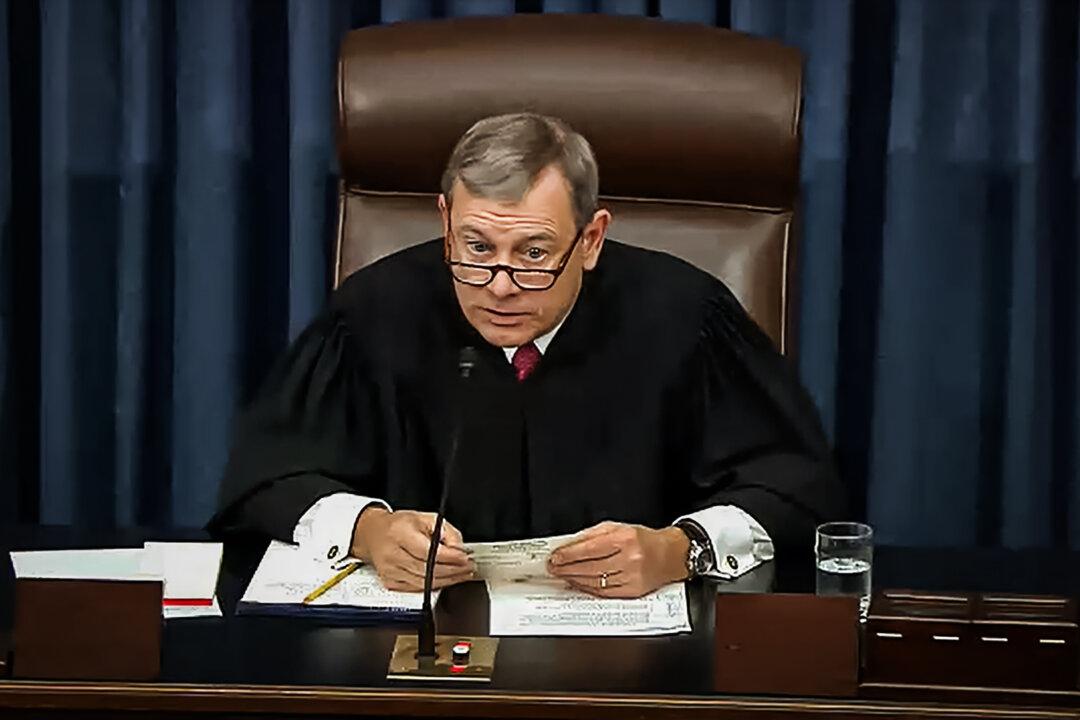

The 9–0 opinion (pdf) in Bissonnette v. LePage Bakeries Park St. LLC, written by Chief Justice John Roberts, rejected a decision of the U.S. Court of Appeals for the 2nd Circuit that threw out the proposed class action. Drivers claimed they were deprived of wages because they were treated as independent contractors instead of employees.