A West Virginia-based nonprofit fundraiser has filed a civil rights lawsuit against Connecticut over that state’s unusually burdensome rules that require him to tell state officials what he’s planning to say to prospective donors a full 20 days in advance of donor contact.

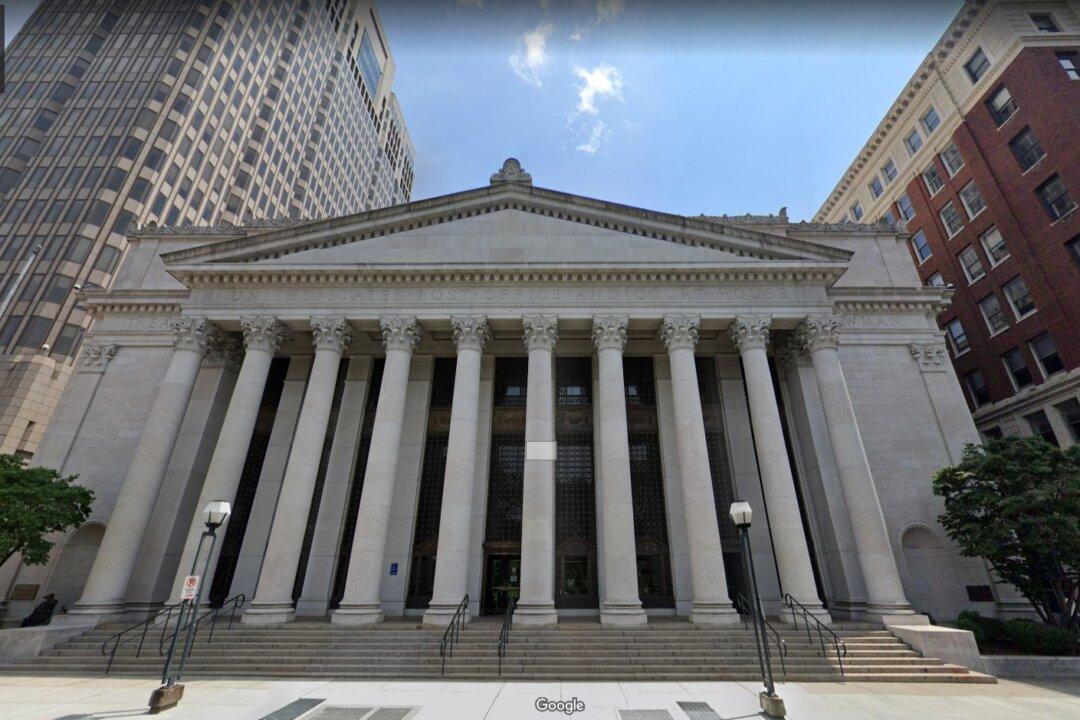

The lawsuit, Kissel v. Seagull, was filed on Jan. 31 in federal court in Connecticut.