JPMorgan Chase chief executive Jamie Dimon isn’t fully convinced by the economic plan President Joe Biden is touting as a historic accomplishment.

“God, it’s a tough question to answer,” he replied.

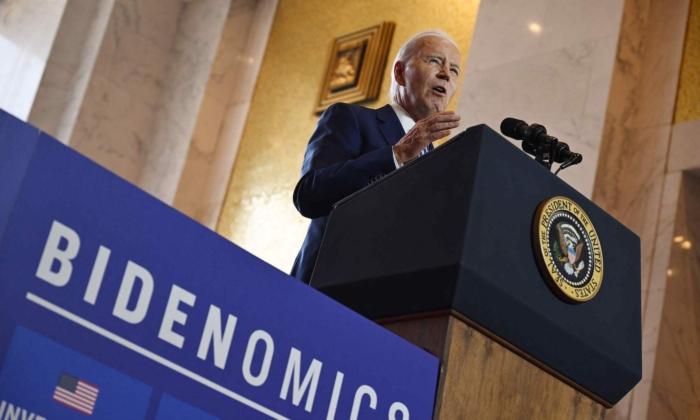

A new buzzword for Biden’s economic vision, “Bidenomics,” is deliberately designed to echo “Reaganomics,” although the Ronald Reagan era policies is characterized by reducing government spending and regulation and tightening money supply—a direct contrast to the Biden administration’s approach to the economy.

The banking executive said while he’s always rejected government intervention, he lately found himself becoming more favorable with some policies aimed to encourage or subsidize certain industries when it comes to matters of national security and American competitiveness.

“I’m in favor, for the first time in my life, of some industrial [policies] for security reasons and competitive reasons,” Mr. Dimon said. “It shouldn’t be political; it should be purely economic.”

“If it relates to supersonic missiles, I think we should do it,” he added at another point during the interview. “If it relates to holding down the Chinese people, I think we shouldn’t do it.”

While Mr. Dimon agreed that the government might be justified in playing a heavier role in certain areas, he warned that industrial policies have to be implemented with caution, reiterating that economic goals should not be mixed with a political agenda.

To that end, Mr. Dimon is not a fan of the Biden administration’s astronomical spending spree during the pandemic. Over the course of two years, Congress allocated more than $5 trillion via six separate pieces of legislation, including $1.9 trillion for stimulus checks, jobless benefits, health insurance subsidies, and more.

“The fiscal spending—$5 trillion of excess fiscal spending over two years,” he told Ms. Minton Beddoes. “Some [was meant] to counter COVID, but some was far more in excess that is causing inflation.”

Mr. Dimon also appeared to take issue with Mr. Biden’s proposal to cancel billions of dollars in federal student loans debt, a move many critics argue would primarily benefit colleges that offer low-quality, low-financial-value programs and end up making higher education even more expensive for future generations.

“We all agree we need to do a better job on our colleges—we should be making it cheaper, not more expensive,” the 67-year-old billionaire said. “Kids should know, if I graduate [with] this degree, I can [get] a job making $75,000 a year.”

“We should do a better job at that,” he continued. “Jobs lead to dignity, better outcomes, better social outcomes. I think in our society, we make fun of that burger flipping job, that first job—it’s the first one on the ladder.”

Dimon was also asked how “Dimonomics” would differ from “Bidenomics.” He replied that he is a “free enterprise person” who believes in the market and people’s ability to think and grow.

“I would have growth policies,” the banking veteran said. “We haven’t done a particularly good job in this country. We grew in the last 20 years, something like 1.7 percent a year. It should have been 3 percent—we should be criticizing ourselves. Why wasn’t it 3 percent?”

Mr. Dimon moved on to argue that the U.S. economy isn’t growing as well as it should be because governments in the past two decades had done “a terrible job” on issues like immigration, taxation, housing and healthcare.

“Three percent [growth per year] would mean the average American would have $15,000 more GDP per person this year,” he said. “That’s what we should’ve done, that would’ve paid for better safety nets, that would’ve paid for more military, it would’ve paid for more schooling.”

He added that if he got to create economic policies, he would expand the earned income tax credit, which he described as “a little form of industrial policy to negative income tax.”

“I think it would help society dramatically to get more hands in the lower paid, who would probably spend that money to take care of their families and their neighborhoods.”