Focus

austerity

LATEST

Former Central Bank Governor Warns Canada Faces More Austere Future

Canadians at every level of society will be facing financial challenges and making sacrifices, says David Dodge, former governor of the Bank of Canada.

|

Gradual Belt-Tightening Favoured Over Austerity in Fixing Canada’s Finances

Canada’s federal debt is surging toward $1 trillion.

|

Africa’s Ticking Time Bomb: $35 Billion Worth of Eurobond Debt

Between 2010–2015 a dozen Sub-Saharan countries issued sovereign bonds in excess of $19.5 billion. Many of these Eurobonds will mature between 2021–2025.

|

Socialists Rain on Spain

The Socialists’ habit of running from the left and governing from the center is not a formula that will work anymore in Spain.

|

Irish Shillelagh Austerity

Whatever credibility austerity had is now lost on much of Europe.

|

Judgment Day for Austerity in Irish Election

A coalition of leftists and independents may come out on top in the Irish election.

|

Greece Approves New Austerity Bill Changing Loan Rules

Greek lawmakers on Tuesday approved legislation granting the right to sell bad business loans from local banks to overseas funds as part of a new austerity bill demanded by bailout lenders from the rest of the eurozone.

|

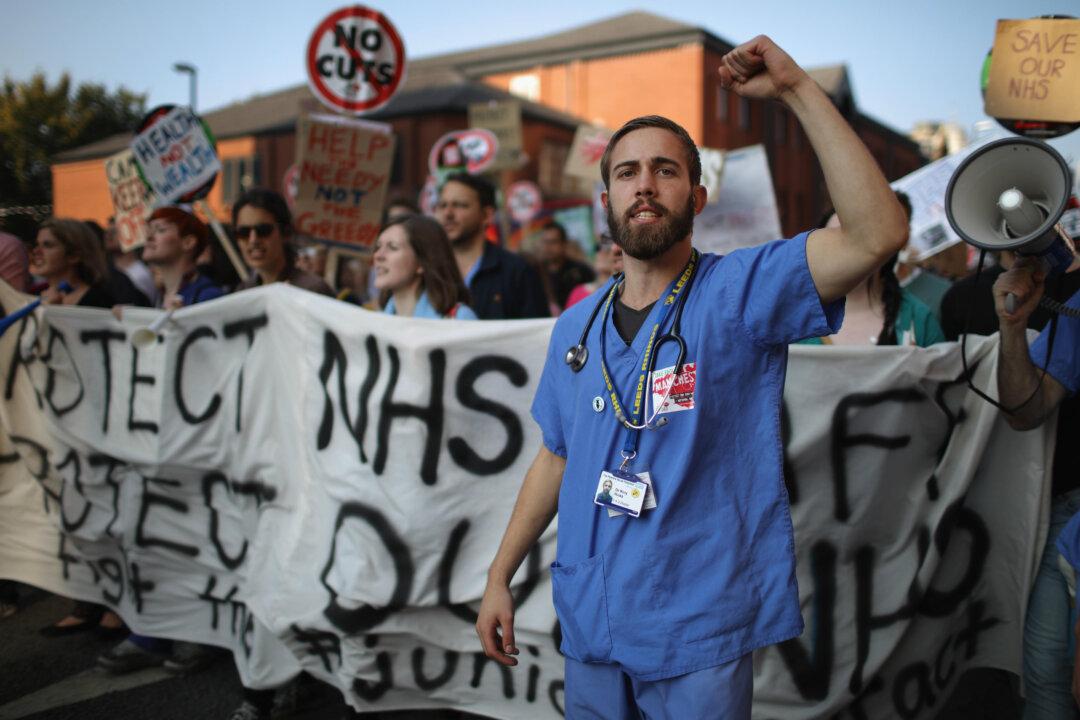

Angry Doctors Are Just the Latest Victims of Globalization

The current threat of a doctors’ strike is just the latest example of the unhappiness of U.K. National Health Service staff.

|

Austerity: Portugal Is on a Different Path to Greece and Spain—Here’s Why

There is an air of calm in Portugal. Like Greece and Spain, Portugal was bailed out by international creditors and underwent austerity measures that included tax hikes and salary cuts across the public sector. But the political effect of this has been starkly different.

|

Is Portugal a Poster Child for Austerity?

Austerity works. That’s the message of Pedro Passos Coelho, the Portuguese prime minister, to voters.

|

Why Leaving the Euro Is Back on the Agenda in the Greek Election

While the allure is there, a Greek exit from the European Union is unmistakably a bad idea.

|

IMF to the Aid of Ukraine: Well-Intended, but Misguided

Ukraine, battling separatists and demands for autonomy in its eastern regions, confronts a debt crisis. The International Monetary Fund approved $17.5 billion over four years and also called for another debt operation. After five months of negotiations, Ukraine received another $15.3 billion, including a 20 percent “haircut” in the $18 billion of bonds held by the private creditors. More than three quarters of the country’s 2015 external debt is privately held “Agreement may have been reached but that should not mask the fact that, like much of the IMF program, the ‘debt operation’ is misguided, a short-term fix that will prove to be costly over the longer term,” argues David R. Cameron, professor of political science and the director of Yale’s Program in European Union Studies. The structure of the deal could delay structural reforms and discourage investors. Cameron expresses doubt that Ukraine’s economy will grow at rates as predicted by the IMF and anticipates additional bailouts will be needed. He points out that the United States and the European Union have a strong geopolitical interest in Ukraine.

|

Europe’s New Economic Divide

Europe still wrestles over how to resolve the debt crisis in Greece. The managing director of the International Monetary Fund warned this month that Greece’s debt remains unsustainable, and she urged the country’s European partners to prepare to provide significant relief. “Few voters anywhere in Europe are excited about bailing out Greece’s government,” writes Chris Miller, Yale doctoral student and a research associate at the Hoover Institution. He points to an east-west divide in addition to the north-south one. Countries in Western Europe that provide generous social programs with high ratios of debt to GDP, are generally less critical of Greece, fearing that they, too, might need bailouts someday. The former socialist countries in Eastern Europe like Poland, Estonia, Latvia and Slovakia are less wealthy than Greece and less sympathetic. Europe’s politics are becoming divided in more ways than one.

|

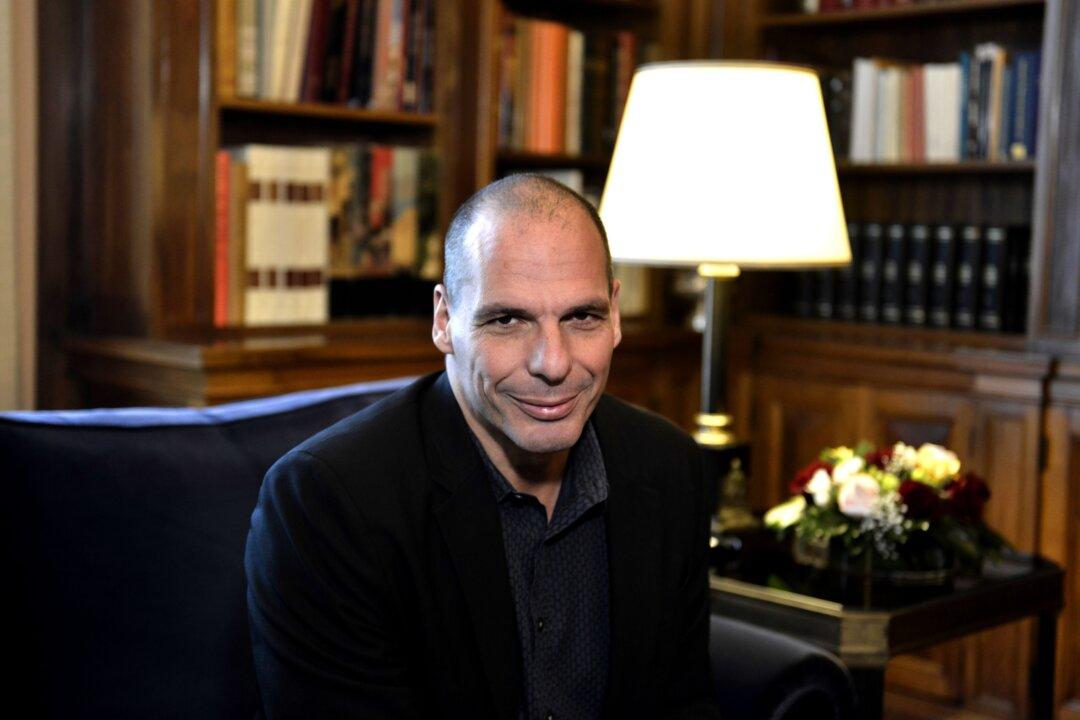

Varoufakis in Conversation With Leading Academics as Syriza Splinters and Election Beckons in Greece

Nine leading academics talk to Yanis Varoufakis, former Greek finance minister and a man who describes himself as an “accidental economist.”

|

Why Alexis Tsipras Has Called a Snap Election in Greece

Greek PM Alexis Tsipras has announced he is stepping down and has called a snap election for Sept. 20, less than a year since he took office.

|

Young Greeks Changed Their Degree Choices as the Economy Crashed

The Greek financial crisis has been one of the most severe in the developed world since 1929. Its effects on education have been real and biting.

|

Germany Profits From Greece’s Hardships

As Greeks suffer in multiple ways the effects of the economic crisis their country is going through, Germany has profited handsomely from the Greek crisis.

|

Blood From a Stone: What Greek Economic Catastrophe Looks Like on the Ground

I knew that 40 percent of Greeks now live in poverty and that half of all young people in the country are unemployed. But seeing it in person was something else entirely.

|

Effect of Greece’s Economic Crisis on People’s Health

Greece’s economic crisis that has had profound consequences on the health of the Greek people.

|

Former Central Bank Governor Warns Canada Faces More Austere Future

Canadians at every level of society will be facing financial challenges and making sacrifices, says David Dodge, former governor of the Bank of Canada.

|

Gradual Belt-Tightening Favoured Over Austerity in Fixing Canada’s Finances

Canada’s federal debt is surging toward $1 trillion.

|

Africa’s Ticking Time Bomb: $35 Billion Worth of Eurobond Debt

Between 2010–2015 a dozen Sub-Saharan countries issued sovereign bonds in excess of $19.5 billion. Many of these Eurobonds will mature between 2021–2025.

|

Socialists Rain on Spain

The Socialists’ habit of running from the left and governing from the center is not a formula that will work anymore in Spain.

|

Irish Shillelagh Austerity

Whatever credibility austerity had is now lost on much of Europe.

|

Judgment Day for Austerity in Irish Election

A coalition of leftists and independents may come out on top in the Irish election.

|

Greece Approves New Austerity Bill Changing Loan Rules

Greek lawmakers on Tuesday approved legislation granting the right to sell bad business loans from local banks to overseas funds as part of a new austerity bill demanded by bailout lenders from the rest of the eurozone.

|

Angry Doctors Are Just the Latest Victims of Globalization

The current threat of a doctors’ strike is just the latest example of the unhappiness of U.K. National Health Service staff.

|

Austerity: Portugal Is on a Different Path to Greece and Spain—Here’s Why

There is an air of calm in Portugal. Like Greece and Spain, Portugal was bailed out by international creditors and underwent austerity measures that included tax hikes and salary cuts across the public sector. But the political effect of this has been starkly different.

|

Is Portugal a Poster Child for Austerity?

Austerity works. That’s the message of Pedro Passos Coelho, the Portuguese prime minister, to voters.

|

Why Leaving the Euro Is Back on the Agenda in the Greek Election

While the allure is there, a Greek exit from the European Union is unmistakably a bad idea.

|

IMF to the Aid of Ukraine: Well-Intended, but Misguided

Ukraine, battling separatists and demands for autonomy in its eastern regions, confronts a debt crisis. The International Monetary Fund approved $17.5 billion over four years and also called for another debt operation. After five months of negotiations, Ukraine received another $15.3 billion, including a 20 percent “haircut” in the $18 billion of bonds held by the private creditors. More than three quarters of the country’s 2015 external debt is privately held “Agreement may have been reached but that should not mask the fact that, like much of the IMF program, the ‘debt operation’ is misguided, a short-term fix that will prove to be costly over the longer term,” argues David R. Cameron, professor of political science and the director of Yale’s Program in European Union Studies. The structure of the deal could delay structural reforms and discourage investors. Cameron expresses doubt that Ukraine’s economy will grow at rates as predicted by the IMF and anticipates additional bailouts will be needed. He points out that the United States and the European Union have a strong geopolitical interest in Ukraine.

|

Europe’s New Economic Divide

Europe still wrestles over how to resolve the debt crisis in Greece. The managing director of the International Monetary Fund warned this month that Greece’s debt remains unsustainable, and she urged the country’s European partners to prepare to provide significant relief. “Few voters anywhere in Europe are excited about bailing out Greece’s government,” writes Chris Miller, Yale doctoral student and a research associate at the Hoover Institution. He points to an east-west divide in addition to the north-south one. Countries in Western Europe that provide generous social programs with high ratios of debt to GDP, are generally less critical of Greece, fearing that they, too, might need bailouts someday. The former socialist countries in Eastern Europe like Poland, Estonia, Latvia and Slovakia are less wealthy than Greece and less sympathetic. Europe’s politics are becoming divided in more ways than one.

|

Varoufakis in Conversation With Leading Academics as Syriza Splinters and Election Beckons in Greece

Nine leading academics talk to Yanis Varoufakis, former Greek finance minister and a man who describes himself as an “accidental economist.”

|

Why Alexis Tsipras Has Called a Snap Election in Greece

Greek PM Alexis Tsipras has announced he is stepping down and has called a snap election for Sept. 20, less than a year since he took office.

|

Young Greeks Changed Their Degree Choices as the Economy Crashed

The Greek financial crisis has been one of the most severe in the developed world since 1929. Its effects on education have been real and biting.

|

Germany Profits From Greece’s Hardships

As Greeks suffer in multiple ways the effects of the economic crisis their country is going through, Germany has profited handsomely from the Greek crisis.

|

Blood From a Stone: What Greek Economic Catastrophe Looks Like on the Ground

I knew that 40 percent of Greeks now live in poverty and that half of all young people in the country are unemployed. But seeing it in person was something else entirely.

|

Effect of Greece’s Economic Crisis on People’s Health

Greece’s economic crisis that has had profound consequences on the health of the Greek people.

|