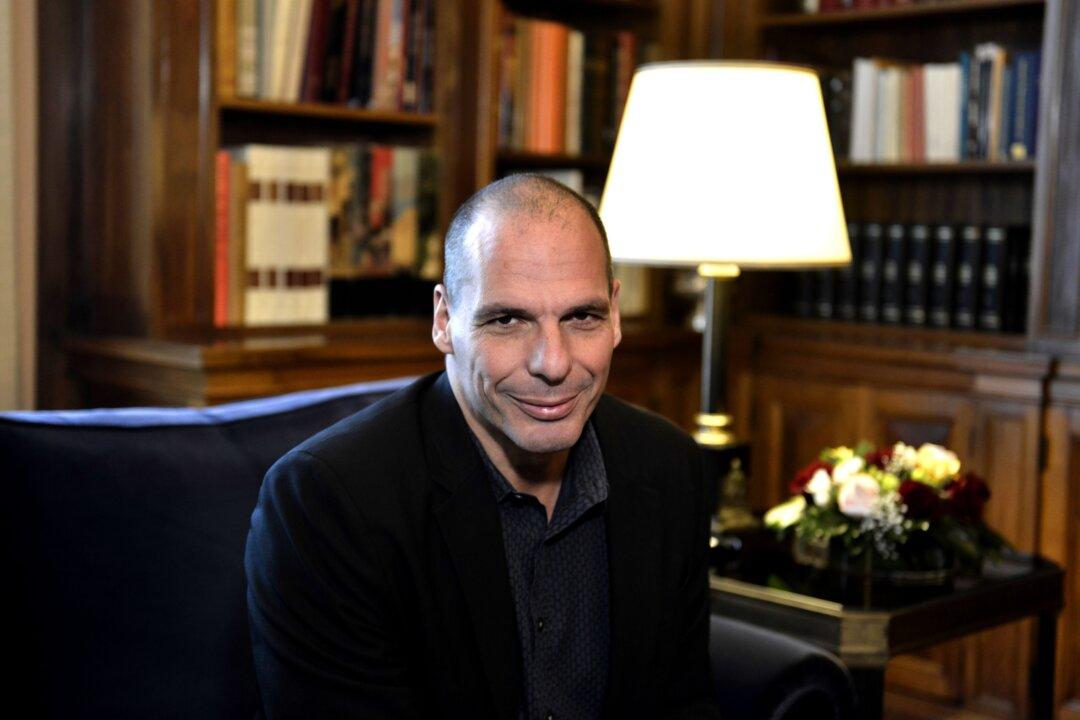

When Yanis Varoufakis was elected to parliament and then named as Greek finance minister in January, he embarked on an extraordinary seven months of negotiations with the country’s creditors and its European partners.

On July 6, Greek voters backed his hardline stance in a referendum, with a resounding 62 percent voting “No” to the European Union’s ultimatum. On that night, he resigned, after Prime Minister Alexis Tsipras, fearful of an ugly exit from the eurozone, decided to go against the popular verdict. Since then, the governing party, Syriza, has splintered and a snap election has been called. Varoufakis remains a member of parliament and a prominent voice in Greek and European politics.