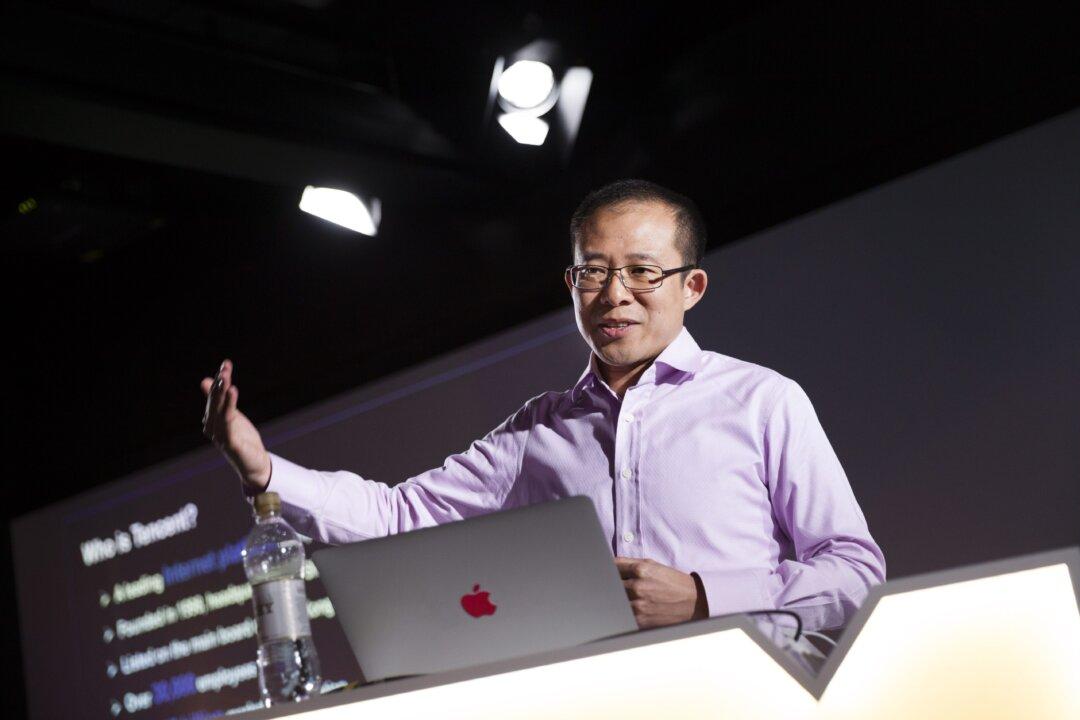

Martin Lau Chi-ping, Tencent President, recently sold 300,000 shares of his company holdings, worth $24 million. Prior to this, Lau has repeatedly reduced his Tencent shares, and this year alone cashed out approximately $57 million.

According to the Hong Kong Stock Exchange data, on June 2, Lau sold 250,000 shares of Tencent holdings at an average price of $81 per share; on June 3, at an average price of $80, he sold 50,000 shares.