The stock market in continental China and Hong Kong, which plummeted for two consecutive trading days due to the failure of U.S.-China economic talks, rebounded in an abnormally short window after China’s financial commission issued a bailout signal on March 16.

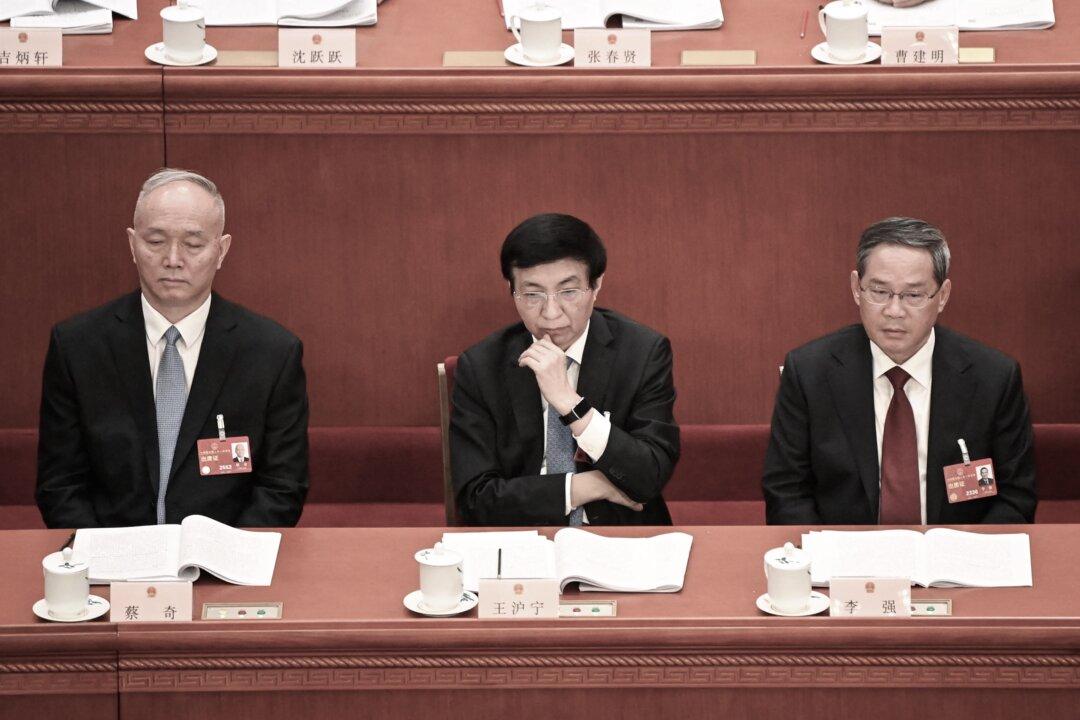

“This just goes to show that the Chinese stock market has always been a ‘policy market’, heavily influenced and manipulated by Chinese Communist Party (CCP) officials, rather than being led by market rules like a normal stock market,” political affairs commentator Lu Tianming told The Epoch Times on March 18.