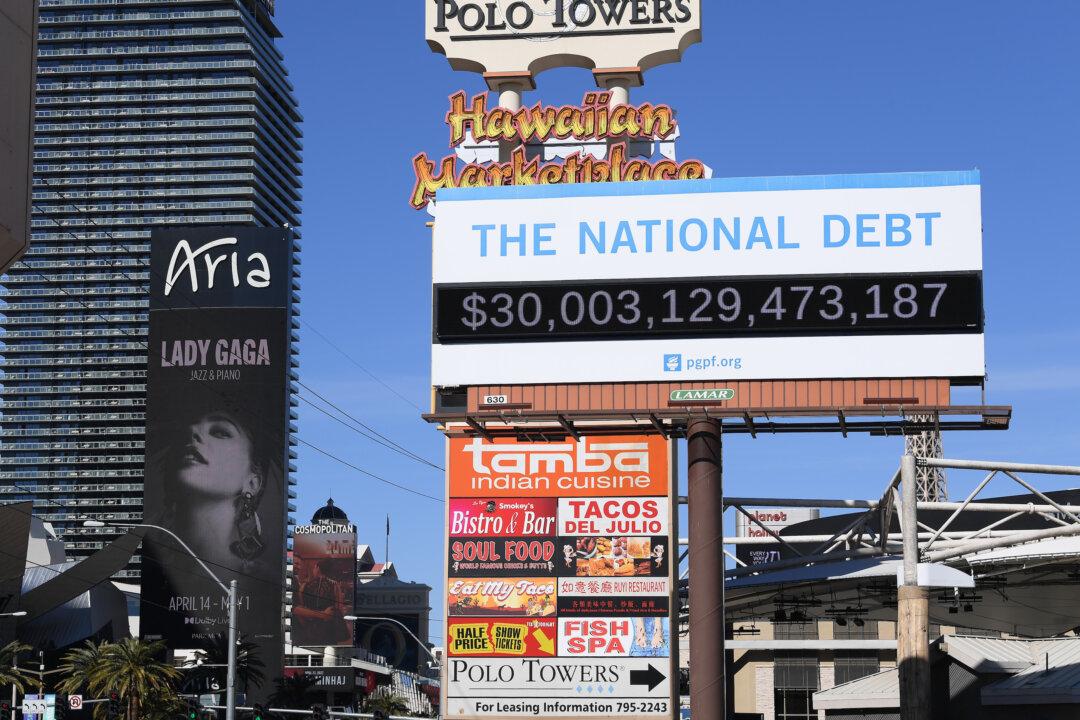

Some American institutional investors, in pushing for the highest returns, could soon find themselves hanging by their own rope while destroying the country, critics warn.

That’s because several big American money managers are investing in China through retirement funds, according to critics, who say there’s good reason for these investments to be reviewed.