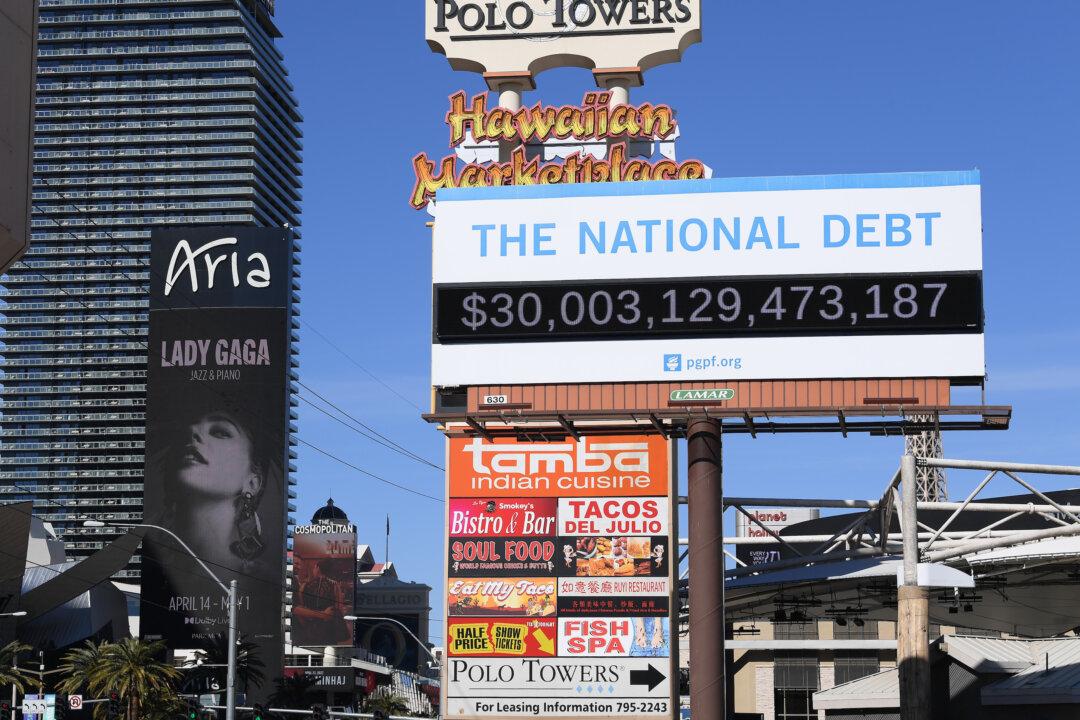

The Biden administration has recently bypassed Congress in raising taxes on multinational corporations, according to a Washington-based think tank.

The tax increase came recently through action by the U.S. Treasury and the IRS in establishing new foreign tax credit (FTC) rules, according to the Tax Foundation. A paper published by the think tank, “A Regulatory Tax Hike on U.S. Multinationals,” explains the changes in tax credits for multinational companies that reduce deductions and credits.