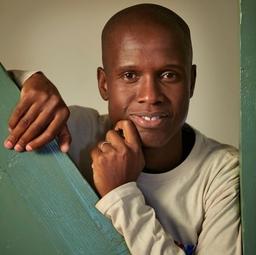

MUTARE, Zimbabwe—A Zimbabwean legislator is taking on Chinese companies that he says aren’t adhering to local laws and are abusing workers in the African nation.

China’s investments in the country should be reviewed, as they are skewed in favor of the Chinese, Temba Mliswa, an independent member of Parliament for Zimbabwe’s Norton Constituency, told The Epoch Times.