Chancellor of the Exchequer Rachel Reeves may have to cut public spending or increase taxes in order to stay within the government’s fiscal rules, financial experts have said.

Yields on government bonds, which reflect the cost of government borrowing, hit their highest level in almost 17 years on Wednesday.

A potential rise in the debt interest bill could cut into the Treasury’s financial headroom. This is despite higher borrowing and a £40 billion rise in taxes to pay for the £70 billion increase in public spending.

Kallum Pickering, chief economist at brokerage Peel Hunt, said, “If bond yields rise further, Reeves may be forced to make the economically damaging decision of further increasing taxes or cutting back on planned public spending to balance the books.”

Reeves had pledged that there would only be one tax-change event a year, which is expected in the autumn.

Meanwhile, due to fiscal instability and broader global pressures, the pound weakened further on Thursday morning, dropping nearly 1 percent to just below $1.23, its lowest point since November 2023.

Record-High Long-Term Borrowing

UK government bonds, known as gilts, are bought by financial institutions in the UK and globally. Investors are promised regular interest payments, or yield, in return for lending the government their money over the bond’s lifetime.On Jan. 8, yields on the benchmark 10-year gilt climbed 12 basis points to peak at 4.81 percent, the highest since the 2008 financial crisis.

This rise in yields came as the Debt Management Office sold £4.25 billion of notes on Wednesday, after selling £2.25 billion the day before.

Kathleen Brooks, research director at online trading platform XTB, said that while still under pressure, the pace of the bond sell-off had eased on Thursday.

However, Brooks stressed that the pound’s reaction reflects ongoing concerns in the market.

“The UK’s fiscal position continues to look perilous,” she said.

Michiel Tukker, a senior European rates strategist at ING, said it could take some time for borrowing costs to lower, citing several factors including Labour’s public spending plans, sticky inflation, and supply pressures.

Markets Are ‘Orderly’

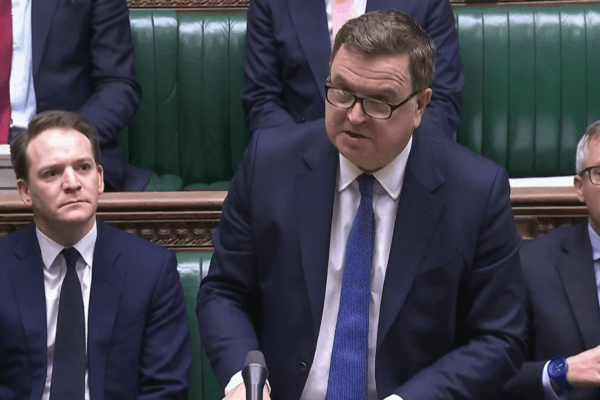

On Thursday, shadow chancellor Mel Stride raised an urgent question in the House of Commons on the growing pressure of borrowing costs.Treasury Minister Darren Jones said: “Financial market movements, including changes in government bond or gilt yields, which represent the government’s borrowing costs, are determined by a wide range of international and domestic factors.

“It is normal for the price and yields of gilts to vary when there are wider movements in global financial markets, including in response to economic data.”

“UK gilt markets continue to function in an orderly way,” Jones added.

The minister confirmed that the chancellor has commissioned the Office of Budget Responsibility to conduct an updated economic and fiscal forecast for March 26, which will incorporate the latest data.

Fiscal Rules ‘Non-Negotiable’

Stride responded by remarking: “Despite what [Jones] says about international factors, the premium on our borrowing costs compared to German bonds recently hit its highest level since 1990.“With these rising costs, regrettably, the government may now be on course to breach their fiscal rules, and the chancellor has committed to no further tax rises.”

Stride then asked whether the chancellor will stand by her commitment not to increase taxes “even further,” and “if so, does this mean that the public should expect cuts to public service spending?”

Jones said that these rules are “non-negotiable,” adding that “public services have to live within their means.”