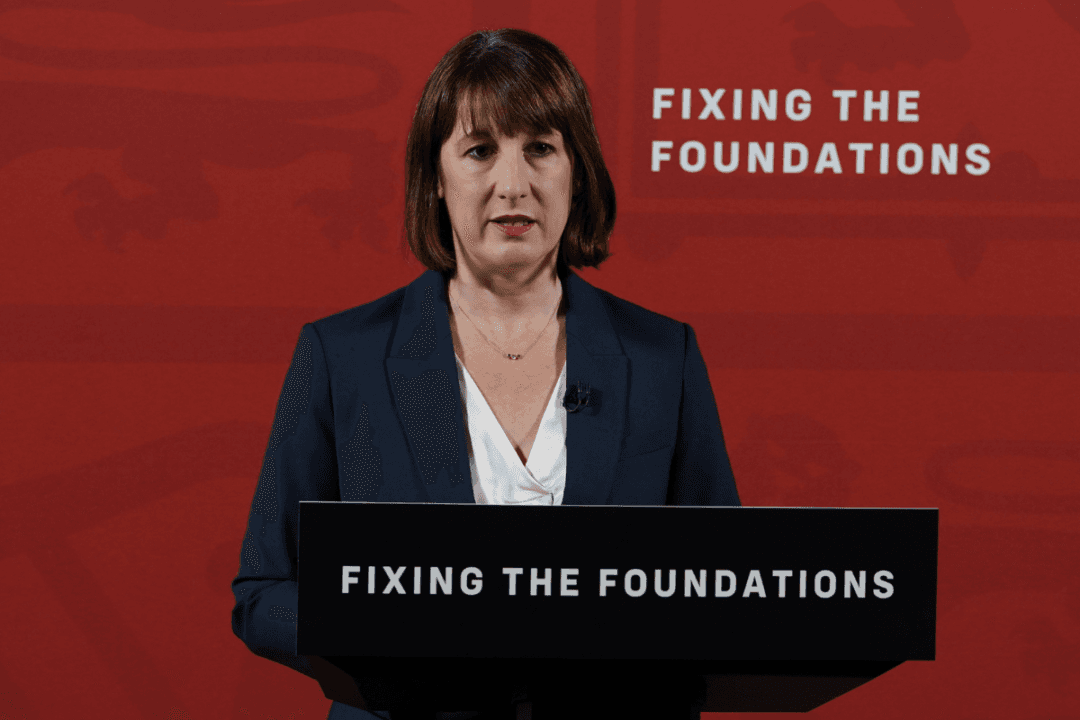

The FTSE 100 also fell and sterling weakened against the dollar and the euro, after Chancellor of the Exchequer Rachel Reeves unveiled plans that will see state spending increase by £70 billion a year, funded by increases in taxes and borrowing.

The yield—or interest rate the Exchequer pays on its debt—on a 10-year government bond hit 4.568 percent on Thursday afternoon, the highest point since August 2023. Yields on government bonds, also known as gilts, had already moved higher on Wednesday, after Reeves announced her spending and tax plans.

Kathleen Brooks, an analyst at trading firm XTB, said the higher gilt yield indicated the Budget “has not been well received” by markets.

“This is another sign that the Chancellor overestimated the market’s desire to absorb more sovereign debt issuance from the UK,” Brooks said.

Matt Britzman, an analyst at investment firm Hargreaves Lansdown, said gilt yields will be “watched closely.” Britzman added that investors are “re-assessing where UK interest rates might end up, given that the investment plan for growth is likely to add inflationary pressures into the economy.”

Stocks and Sterling Down

Negative reaction to the Budget continued, with sterling falling against the dollar to $1.2856 after 3 p.m. on Thursday—a more than two-month low. Sterling was also down against the euro by 0.8 percent to 1.185 euros.An analyst at trading firm Ballinger Group, Kyle Chapman, said that sterling’s tumble and the rise in gilt yields showed the market had decided the new Labour government had “overextended” its spending and borrowing plans.

Chris Turner, ING’s global head of markets, said that while the pound’s fall against the euro was nothing compared to its activity after former prime minister Liz Truss’s Budget—when the pound fell by 6 percent—it nonetheless showed sterling “reacting to Gilt supply risk.”

In terms of the markets, by Thursday afternoon London’s FTSE 100 was down 49.53 points, or 0.61 percent, closing at 8,110.1. The biggest fallers on the UK’s stock market index include housebuilders Persimmon, Taylor Wimpey, and Barratt Redrow, as well as hospitality company Whitbread and medical equipment manufacturer Smith & Nephew.

Susannah Streeter, head of money and markets for Hargreaves Lansdown, said that “fresh nervousness” has crept into markets about the prospects for the economy, after an initially sanguine reaction.

Warnings From Ratings Agencies

To add to the negative market reaction, top ratings agencies S&P and Moody’s gave mixed reviews of the Budget, although neither changed their ratings of the UK’s debt.S&P said on Friday that increased spending will boost growth in the short term, but it was too early to tell how much that will add to the long term.

The ratings agency added that more public service spending should “create a more business-friendly environment,” but reaping potential benefits “will also depend on whether the spending is deployed in an efficient way.”

Moody’s said Reeves’s plan to change fiscal rules to allow for more borrowing posed “an additional challenge for what are already difficult fiscal consolidation prospects.”

Calming Market Jitters

Reeves has been doing the media rounds in a bid to ease market jitters since her Budget announcement two days ago.Asked if she were worried by the market reactions, the chancellor told Channel 4 on Thursday, “Markets will move on any given day, but we have now put our public finances on a firm footing with robust fiscal rules.”

The chancellor also told Bloomberg TV that public finances were “on a stable and solid trajectory,” saying, “We have more headroom than the previous government left us, and that is important.”

However, the shadow exchequer secretary to the Treasury, Gareth Davies, told Sky News the market reaction was “embarrassing” for the chancellor.

“We have a new Labour government who promised change, who promised to stabilise markets, and what we saw yesterday was not a stable market environment,” Davies said.