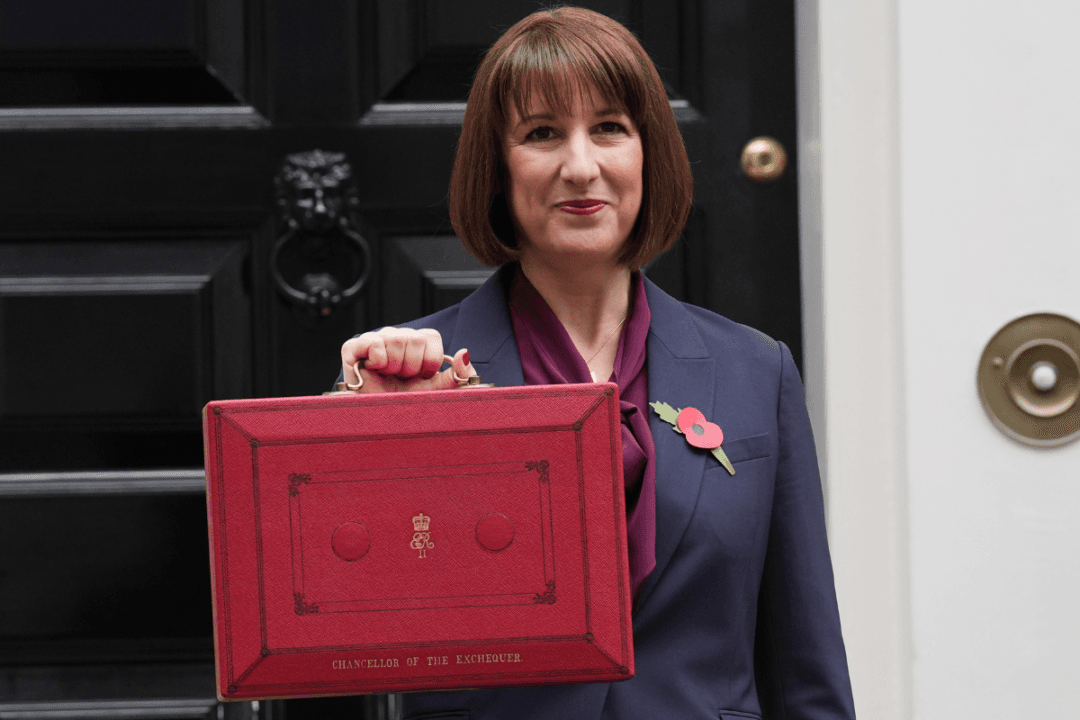

Chancellor of the Exchequer Rachel Reeves has announced £40 billion a year in extra taxes as she increased borrowing and spending to “fix the NHS and rebuild Britain.”

Public spending will increase by around £70 billion annually over the next five years and borrowing will increase by an average of £32.3 billion a year.

Reeves said after delivering her Budget to a packed House of Commons: “The choices I have made today are the right choices to restore stability to our public finances, to protect working people, to fix our NHS, and to rebuild Britain.

Employer NI Contribution Hike

The chancellor confirmed there would be no change to “working people’s payslips,” with no increase in income tax, employee national insurance (NI), and VAT.However, fears that employers’ NI could increase were borne out, with the chancellor confirming a 1.2 percent increase to 15 percent from April 2025, with the threshold for paying it falling from £9,100 to £5,000 per year.

Reeves said this would raise £25 billion per year until the end of the forecast period.

Experts have warned that staff may still risk bearing the brunt of this increase, with employers looking to keep costs low and remain competitive.

Benoit Hudon, chief executive of consultancy Mercer UK, said the rise will “make each UK recruit more costly, potentially stifling hiring, limiting pay rises, or possibly even leading to a reduction in benefits and pensions.”

Capital Gains, Inheritance Tax

Reeves announced other major changes which would increase tax revenue, including increasing the rates of capital gains tax, with the lower rate rising from 10 percent to 18 percent and the higher rate from 20 percent to 24 percent.Sarah Coles, head of personal finance at investment firm Hargreaves Lansdown, said the increase “makes investment less attractive for newcomers” and that there was a danger this could drive investor behaviour, with people choosing to “hoard” assets rather than cashing them in and paying the higher taxes.

‘Sin’ Taxes

The government also increased oft-called “sin taxes” on smoking, drinking, and consuming sugary drinks.A flat rate duty on vaping liquid will also be introduced from October 2026 and the soft drinks industry levy will increase to account for inflation.

Good News for Drivers

There was good news for drivers. The chancellor froze fuel duty for one year and extended the temporary 5p cut to March, 22, 2026.However, public transportation users will see higher prices, with train fares in England increasing by up to 4.6 percent next year and the price of most railcards rising by £5.

Big Spending in Public Services

On public services, Reeves said there would be “no return to austerity,” announcing a £22.6 billion increase in the day-to-day health care budget as well as a £3.1 billion increase in the capital budget for the NHS.Education will also see increases in spending, with the chancellor announcing £1.4 billion to rebuild schools and £2.1 billion for maintenance. The core schools budget will also rise by £2.3 billion, with an extra £1 billion funding increase in special education needs provision.

Broken Promises

Former prime minister and Leader of the Opposition Rishi Sunak criticised the Labour government for borrowing and spending “far beyond” what they had promised to the country.Delivering his final speech from the dispatch box before the Conservatives choose a new leader, Sunak said of the new Labour government: “They’re taxing your job, they’re taxing your business, they’re taxing your home, they’re taxing your savings.

“I said it during the election campaign: ‘You name it, they will tax it.’ And that is exactly what they have done.”

“It’s broken promise after broken promise, and working people paying the price,” he added.