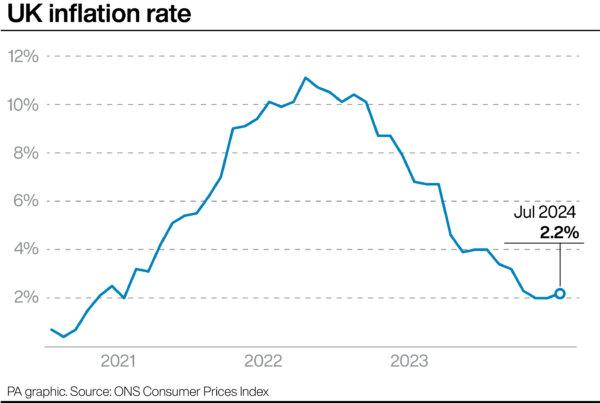

Consumer Price Index (CPI) inflation rose to 2.2 percent in July, above the Bank of England’s (BoE) 2 percent target, the first increase this year after months of decline.

The inflation figures mean that prices are rising faster than in previous months, with the main driver being a drop-off in the effect of falling energy bills.

Grant Fitzner, chief economist at the ONS, said, “Inflation ticked up a little in July as although domestic energy costs fell, they fell by less than a year ago.”

In other words, while energy bills last month still fell, they had less downward pressure on the inflation figure than in previous months.

However, inflation is still lower than during the height of the cost of living crisis in 2022 and 2023, where it peaked at 11.1 percent in October 2022. It is also below the 2.3 percent that most economists in the City of London had predicted and lower than the BoE’s forecast.

Interest Rates Cut

The recent inflation figures come after the BoE’s Monetary Policy Committee (MPC), responsible for formulating monetary policy, voted to cut interest rates to 5 percent from 5.25 percent on Aug. 1—the first interest rate cut in more than four years.The inflationary figures could influence the MPC’s decision-making in September, where most economists predict the body will hold interest rates, waiting until November before deciding on whether to cut borrowing costs further.

BoE Governor Andrew Bailey had said on August 1 that the bank should “make sure inflation stays low, and be careful not to cut interest rates too quickly or by too much.”

Families Still Struggling

In reaction to the inflation figures, Chief Secretary of the Treasury Darren Jones said that the new Labour government “is under no illusion as to the scale of the challenge we have inherited, with many families still struggling with the cost of living.”“That is why we are taking the tough decisions now to fix the foundations of our economy so we can rebuild Britain and make every part of the country better off,” Jones added.

Shadow Chancellor of the Exchequer Jeremy Hunt said the inflation figures showed more needed to be done to keep prices under control, urging the Labour administration to follow the path of the previous Conservative government.

Hunt, who served as chancellor from October 2022 until July 5 of this year, said, “In government, we took the difficult decisions to reduce inflation from 11.1 percent to the Bank of England’s target of 2 percent—paving the way for the first interest rate cut in four years.”

He then warned his successor Rachel Reeves to “not use this data as an excuse to break her promises and hike up taxes—tax rises she had planned all along.”