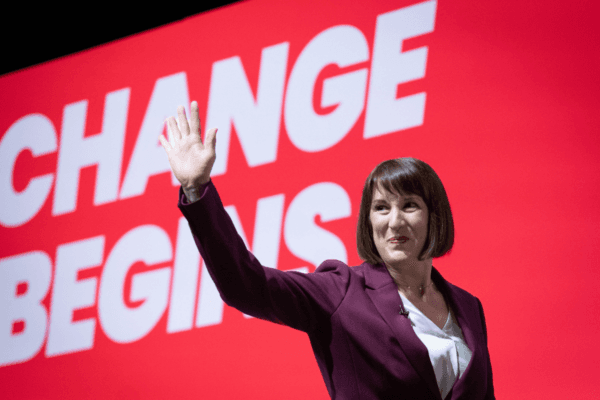

Chancellor of the Exchequer Rachel Reeves has defended her government’s “tough decisions,” like scrapping universal Winter Fuel Payments, but pledged Labour would not raise taxes on working people.

Reeves told the Labour Party Conference on Monday that her November budget would have “real ambition,” would fix the economic foundations of Britain, and would not see the return of austerity.

“We said we would not increase taxes on working people, which is why we will not increase the basic higher or additional rates of income tax, national insurance, or VAT, and we will cap corporation tax at its current level for the duration of this Parliament,” she promised.

The first Labour budget since 2009 will also see the end of non-dom tax loopholes, and the government cracking down on tax evasion and avoidance.

Winter Fuel Payments

For these reasons, she said, the government has had to introduce means testing for the winter fuel allowance, with the minister saying that now it is “only targeted to those most in need.”“I did not take those decisions lightly. I will never take the responsibilities of this office lightly,” she said.

The change is expected to bring down the numbers of those claiming from 11.4 million pensioners to 1.5 million, saving the Treasury around £1.4 billion annually.

VAT on Private School Fees

Reeves also defended ending tax breaks for private school fees, meaning that from January, VAT will be added to tuition and boarding fees and from April, independent schools will lose their eligibility for charitable rates relief under business rates.The chancellor said: “I know every parent has aspiration for their children, and I know the strain that our state schools have been under. This government will introduce VAT on private school fees to invest in our state schools.

“It is the fair choice, the responsible choice, the Labour choice, to support the 94 percent of our children in our state schools. That is the Britain we’re building. That is the Britain that I believe in.”

In its manifesto, Labour said revenue raised would be spent on improvements in the state school system, including on 6,500 new specialist teachers, 3,000 new nurseries, and mental health support in every school.

But education experts have warned that VAT charges would hurt small independent schools, in particular faith schools or those that provide special education needs and disability support.

Covid Corruption Commissioner

The chancellor also announced a block on any COVID-19-era personal protection equipment (PPE) contracts being waived or abandoned, until they have been independently assessed by a COVID corruption commissioner. According to a government statement, the commissioner will be appointed next month.Reeves said she would act on the “carnival of waste and fraud” that took place during the pandemic, with the plans set to affect £647 million of PPE contracts where contract recovery was previously earmarked to be waived.

The plans form part of her war on waste, including cutting down on the excessive use of ministerial travel by plane and helicopter. Reeves added that the new Labour government had already cancelled a £40 million contract for a VIP helicopter commissioned under her Conservative predecessors.

“I know how hard people work for their money. Taxpayers’ money should be spent with the same care with which working people spend their own money,” she said.