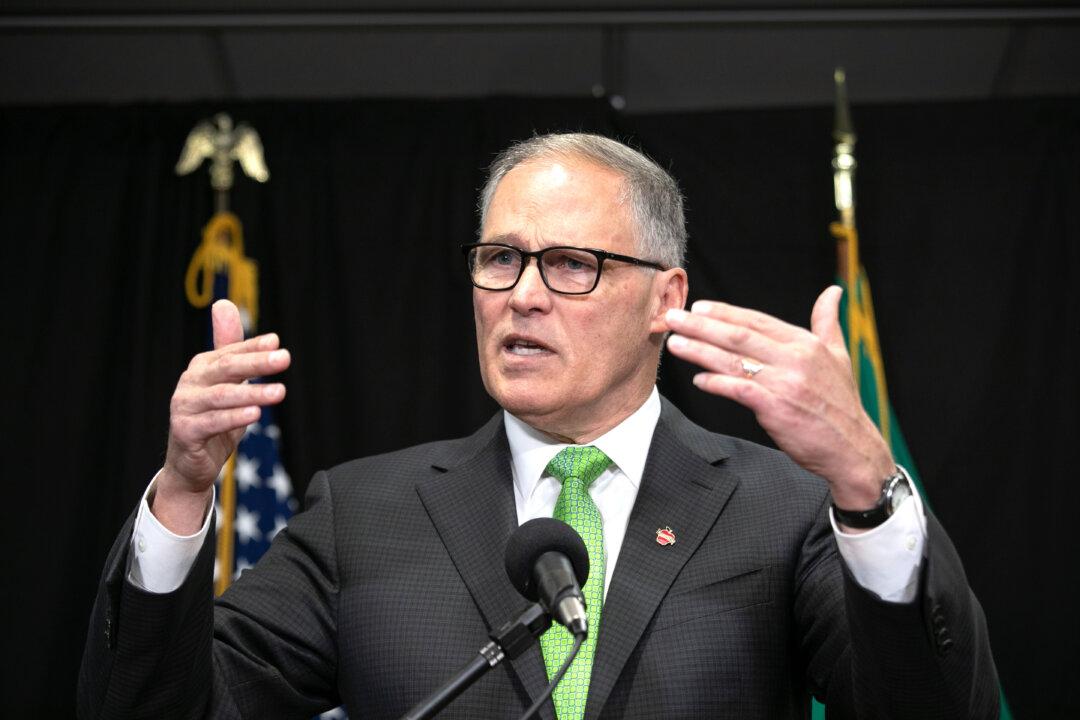

A good-government group is suing Washington state after Gov. Jay Inslee signed a controversial capital gains tax into law that it says violates the U.S. and state constitutions.

The lawsuit comes as President Joe Biden pushes for big increases in federal capital gains tax rates.