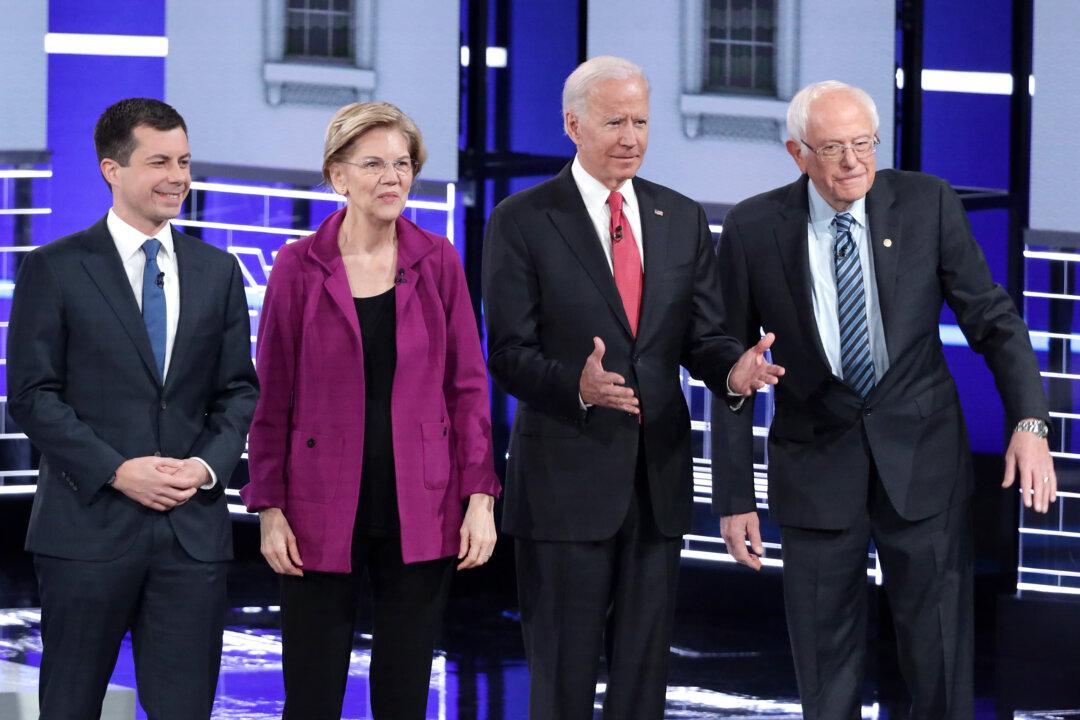

Top presidential candidates competing for the Democratic nomination, Sens. Bernie Sanders (D-Vt.) and Elizabeth Warren (D-Mass.), have been among the most critical of mammoth tech companies like Amazon, and vocal about taxing the wealthy, while at the same time being big spenders on Amazon.

According to a Bloomberg News report published Tuesday, the campaign teams for each of the two socialist-minded 2020 contenders have spent the most on Amazon. Federal campaign records analyzed by Bloomberg showed the Sanders campaign spent $233,348.51 on Amazon while the Warren campaign spent $151,240.90.