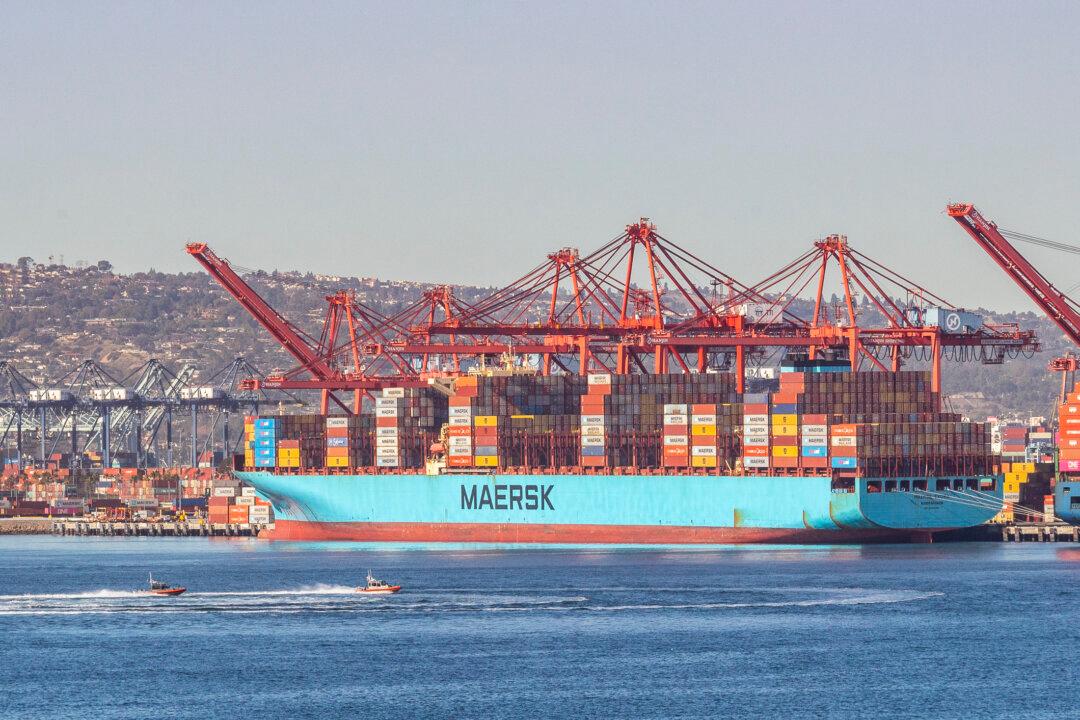

The Port of Los Angeles is watching events closely in China as container ships stack up outside Chinese ports affected by new COVID-19 outbreaks and manufacturing shutdowns.

After a year of cargo bottlenecks at the port, Executive Director Gene Seroka laid out his “wait and watch” strategy for what many industry experts say could upend the progress made on easing the supply chain.