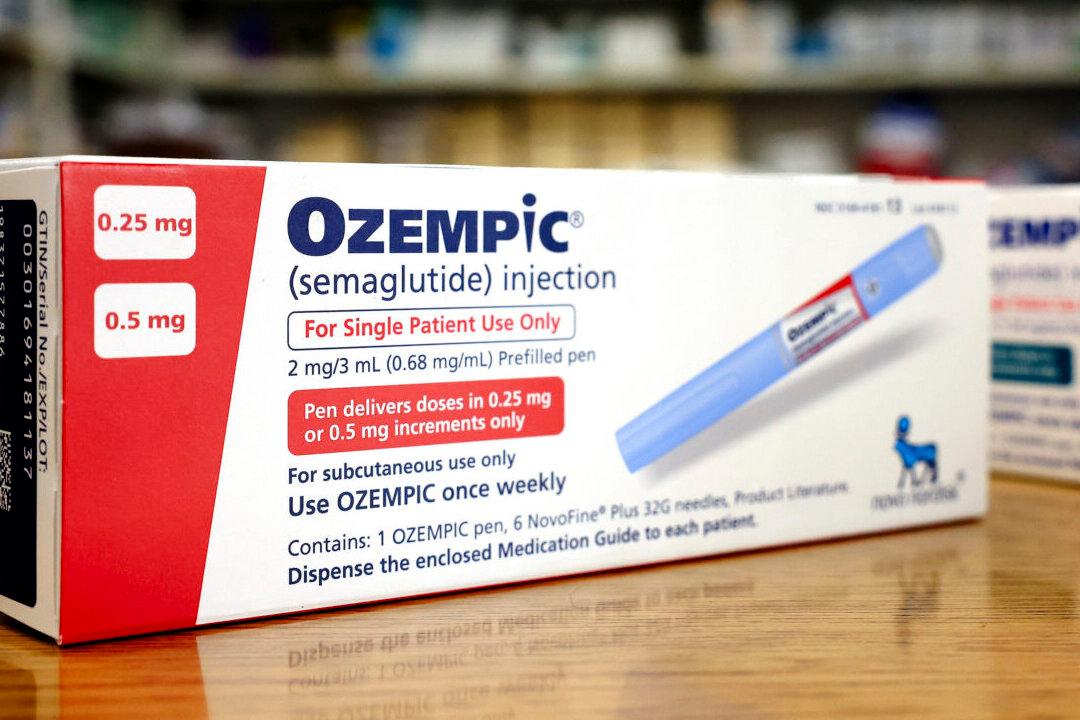

Oklahoma’s attorney general has filed a lawsuit against major diabetic drug manufacturers and pharmacy benefit managers (PBM) for what he describes as “an unfair and deceptive” practices in insulin pricing.

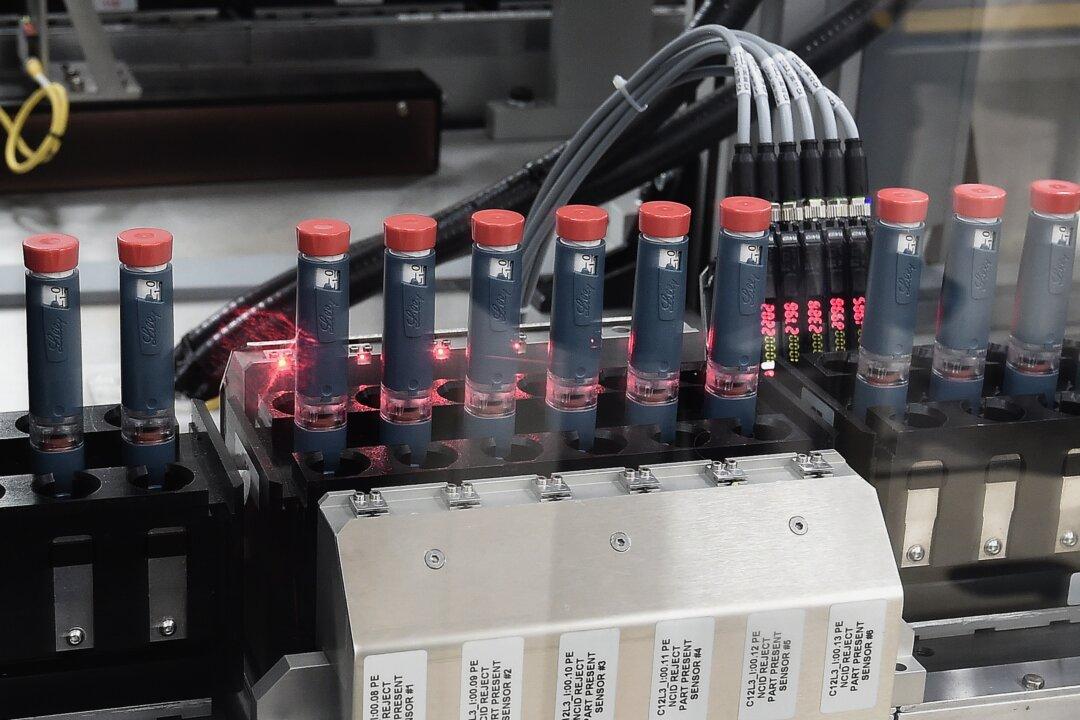

The petition, filed in Cleveland County District Court by Oklahoma Attorney General Gentner Drummond on May 14, accuses drug manufacturers of significantly and consistently raising the prices of their diabetes medications over the past 15 years, even though the costs of producing the much-needed drugs have decreased and the characteristics of the medications have remained unchanged. Mr. Drummond alleges that this insulin pricing scheme violates the Oklahoma Consumer Protection Act.