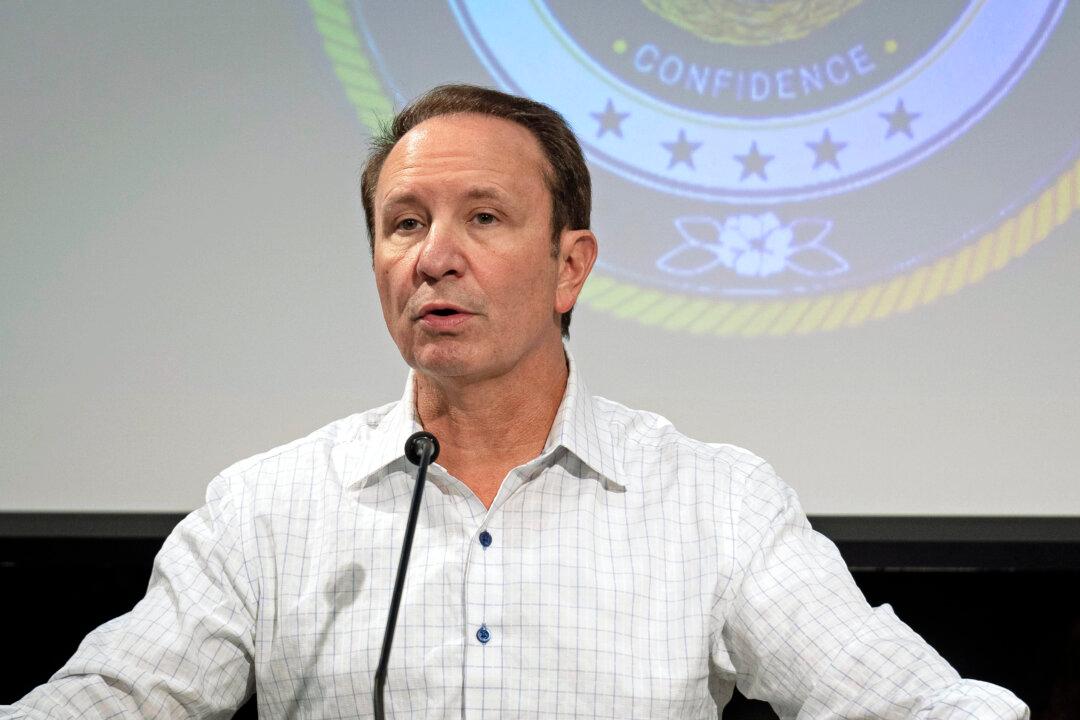

Louisiana Governor Jeff Landry signed into law a series of tax reforms on Dec. 5, reducing income tax rates for businesses and individuals while increasing the state sales tax rate.

At the center of Landry’s tax reforms is a measure the governor says will provide $1.3 billion in income tax cuts for Louisiana residents as well as nearly triple the standard individual deduction and double deductions for older adults.