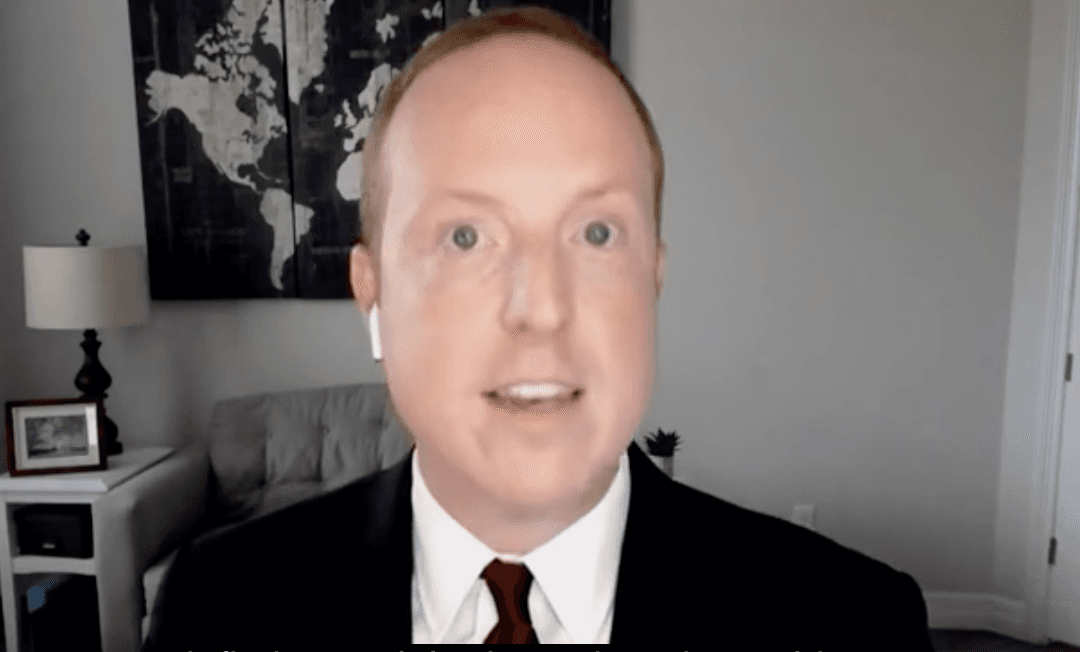

With U.S. prices higher than expected in all areas including food, shelter, and gas, the Biden administration’s student debt relief plan is really a “redistribution scheme” that will further fuel inflation, according to Vance Ginn, economist and founder of Ginn Economic Consulting.

The plan is “what I’ve really been calling a redistribution scheme from those who didn’t go to college and don’t have student loans to everyone who has student loans. Only about 33 percent of Americans have graduated with a bachelor’s degree,” Ginn said during a Sept. 14 interview with the NTD TV News Today program. “This is a huge shift in the amount of money that people are paying and ... it also fuels more inflation.”